As a seasoned researcher with extensive experience in the cryptocurrency market, I’m eagerly anticipating the debut of Ethereum Exchange-Traded Funds (ETFs) set to begin trading on July 23. Based on my analysis and knowledge gained from monitoring the crypto space, I believe that the initial inflows to these ETFs will significantly impact Ethereum’s (ETH) price.

Ethereum-linked Exchange-Traded Funds (ETFs) are slated for launch on July 23, marking the implementation of the SEC’s rule modification from around two months prior.

Based on a Kaiko report, the early investments into these Exchange-Traded Funds (ETFs) could influence Ethereum’s (ETH) price. The outcome, be it a rise or fall, remains uncertain at this point.

“Will Cai, the head of indices at Kaiko, commented on the lackluster response to the introduction of futures-based Ethereum exchange-traded funds (ETFs) in the US towards the end of last year. There is great anticipation surrounding the upcoming launch of spot Ethereum ETFs, with expectations of swift asset accumulation. While it may take several months for a clear demand pattern to emerge, Ethereum’s price could be influenced by the initial inflows during the early days.”

On July 23rd, several Ethereum exchange-traded funds (ETFs) from BlackRock, Fidelity, Bitwise, VanEck, 21Shares, Invesco, Franklin Templeton, and Grayscale are set to become available for trading.

Today, it is anticipated that the Ethereum ETF applications will be approved by the Securities and Exchange Commission (SEC), leading to their commencement of trading tomorrow. Consequently, SEC’s website should display several filings today indicating the “effectiveness” of their prospectuses, usually around or after market hours. The following are the contenders for these ETFs:

— James Seyffart (@JSeyff) July 22, 2024

The large inflow of funds might lead to a significant increase in ETH‘s value, despite the tepid response to Ethereum-based ETFs using futures last year. There is growing optimism regarding the collection of assets in spot ETFs and its potential impact on ETH’s pricing.

In May, Ethereum prices experienced a notable surge due to the approval of spot Ethereum Exchange-Traded Funds (ETFs). However, since then, the price has been decreasing. Currently, Ethereum hovers around $3,500, encountering a significant resistance level in its path.

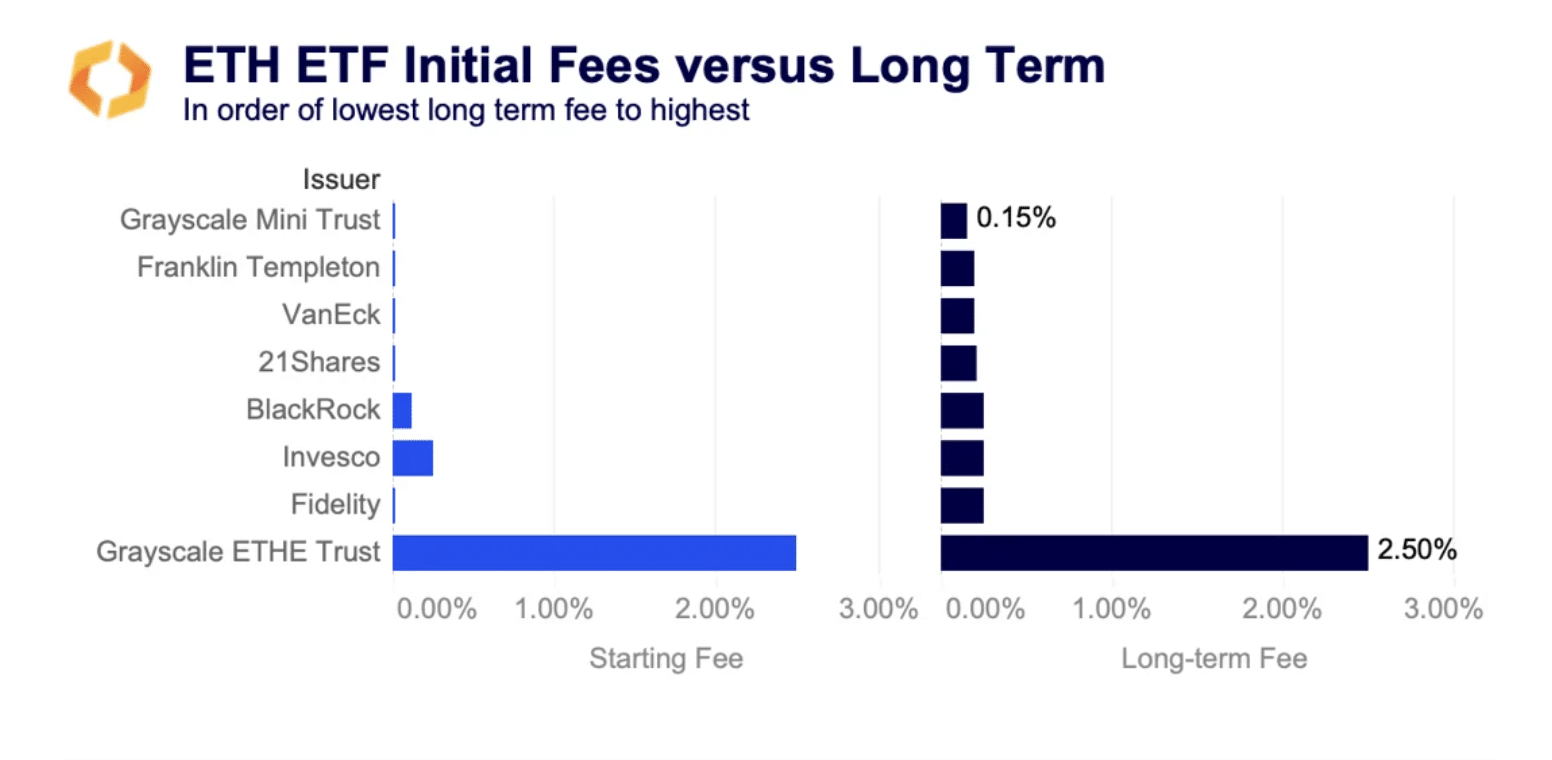

Grayscale’s ETH ETF fees

Prominent cryptocurrency investor Grayscale has announced plans to transform its ETHE trust into an exchange-traded fund (ETF) in spot form and establish a mini seeded trust with an initial capital of $1 billion derived from the original fund. Despite maintaining a 2.5% fee, which is higher than industry standards.

Many issuers provide fee concessions to entice investors, some waiving charges for a period of six months to a year or until assets under management reach between $500 million and $2.5 billion. This fee reduction trend signifies intense competition within the Exchange-Traded Fund (ETF) market, prompting ARK Invest to withdraw from the ETH ETF development race.

Grayscale’s approach with their Bitcoin (BTC) ETF mirrors how they kept charging higher fees even amidst intense competition and market downturns.

Based on Kaiko’s analysis, Grayscale’s choice to maintain high fees could potentially result in ETF redemptions, triggering price declines akin to GBTC’s post-conversion pattern.

In simpler terms, the difference between the discounted price of ETHE (ETHEREUM Trust) and its net asset value has decreased lately, suggesting that investors are keen on purchasing ETHE at a discount in order to reap profits by converting and redeeming it at its net asset value.

ETH ETF volatility

Over the last several weeks, implied volatility for Ethereum has risen significantly. This increase can be attributed to two major events: the failed assassination attempt on former President Donald Trump and President Joe Biden’s decision not to seek re-election. These developments have caused apprehension among traders in light of the upcoming Ethereum Exchange Traded Fund (ETF) launch.

Based on Kaiko’s findings, the volatility of contracts set to expire in late July increased from 59% to 67%. This surge suggests that the market is closely watching and potentially reacting strongly to the initial inflows of data.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-07-22 22:34