In summary, the Bitcoin mining ecosystem is undergoing significant changes post-halving. Miners are adapting to the pressures brought about by halving by diversifying their operations and exploring new revenue streams. The introduction of spot Bitcoin ETFs is expected to provide a stabilizing effect on the market and potentially attract institutional investors, leading to better prices and profit margins for miners. Additionally, innovative solutions like the Runes protocol have offered temporary relief in the form of increased transaction volume and fees. Looking ahead, experts predict continued growth for Bitcoin, with some forecasting prices reaching $100,000 by 2025. However, challenges such as macroeconomic factors and regulatory environments will need to be addressed for the mining ecosystem to thrive in the long term.

After the halving event, Bitcoin (BTC) miners encounter financial pressures due to decreased rewards and escalating operational costs. Can miners adapt through inventive approaches and evolving market conditions to maintain profitability?

An integral part of Bitcoin’s design is the halving event, which happens roughly every four years. This process decreases the compensation given to miners for creating new blocks in the blockchain. In April 2024, the most recent halving occurred, lowering the reward from 6.25 Bitcoins to 3.125 Bitcoins per block.

As a Bitcoin analyst, I’d describe it this way: This significant event directly influences Bitcoin’s inherent deflationary characteristics by affecting the generation of new coins. Rippling effects extend to the Bitcoin mining sector and the larger cryptocurrency market, presenting both complex challenges and enticing opportunities.

This article will examine the post-halving world and how the Bitcoin mining sector can adapt.

Table of Contents

Squeeze on miners: understanding the challenges

Reduced rewards

One consequence of the halving was a decrease in miner profits due to reduced block rewards. The halving event itself led to this outcome by causing miners to earn fewer coins as a result.

As a financial analyst, I’d like to point out that at the current moment, each Bitcoin block reward is valued approximately at $215,000, given a Bitcoin price of around $68,800 per coin. In contrast, historically, Bitcoin had primarily traded near $60,000, implying a typical block reward was worth less than $200,000.

As a cryptocurrency analyst, I’d rephrase it this way: In an interview with crypto.news, Manthan Dave, co-founder of Ripple-supported crypto custody firm Palisade, shared his concern that decreased rewards might lead smaller and less profitable mining operations to shut down or merge with larger ones.

According to him, this situation might result in a more concentrated Bitcoin network with a smaller number of larger players controlling its operations.

As a crypto investor, I’m feeling the pinch following the halving. Smaller and less productive mining operations might find it hard to keep up, leading to their eventual shutdown. The industry is expected to undergo consolidation, which could raise concerns regarding centralization in the market.

Manthan Dave, Palisade co-founder

Bitcoin price dynamics: impact on the mining ecosystem

After the halving event, miners required Bitcoin prices to stay elevated in order for the potential profits to cover the substantial energy expenses linked with mining. Consequently, fresh miners could be enticed to join the network, while current miners might be inspired to increase their operations and improve energy efficiency.

Alternatively, if Bitcoin prices were to decrease significantly, miners might find themselves incurring losses. This could lead to less productive miners exiting the market, resulting in a transformation within the Bitcoin mining industry.

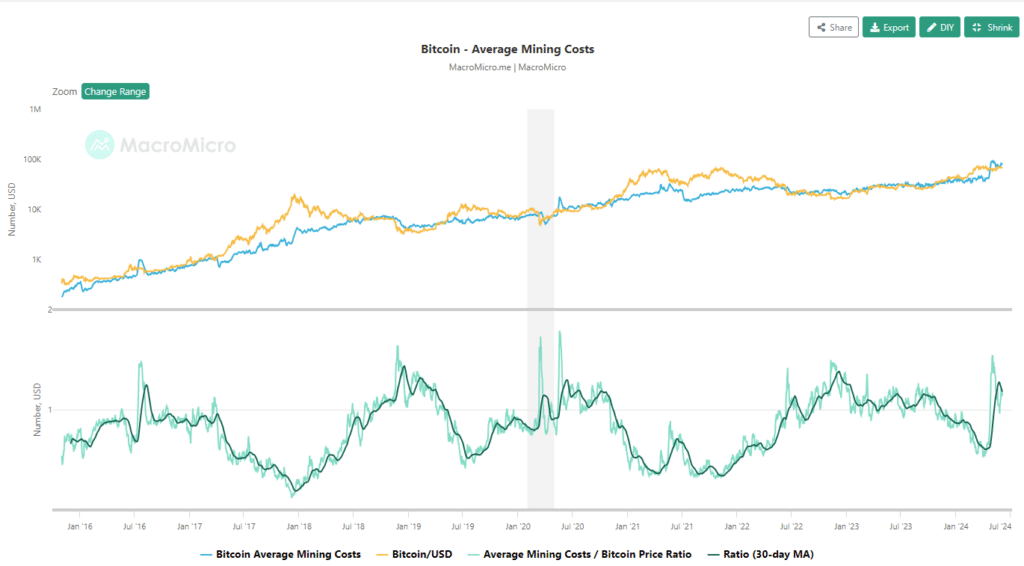

As a market analyst, I’ve reviewed the most recent data from MacroMicro, and their findings paint an intriguing picture of the mining landscape. The average cost to mine a single Bitcoin, according to their figures, was approximately $78,115 as of June 3. This cost stands in contrast to the current market price for Bitcoin, which was around $68,804 during the same period.

The ratio of average Bitcoin mining costs to Bitcoin price was approximately 1.14, potentially making it a challenging situation for numerous Bitcoin mining businesses.

As a researcher studying the cryptocurrency mining industry, I’ve come across some intriguing findings from a recent CoinShare survey. It appears that less profitable mining machines are predicted to be decommissioned due to their inefficiency. Moreover, miners are planning to move their operations to areas offering cheaper electricity costs in order to maintain profitability.

A Bloomberg article published on February 7th revealed that approximately 21 Bitcoin miners have reached agreements with the Ethiopian government to establish their mining operations in Ethiopia.

Increased competition

After a halving event occurs, the mining competition becomes more rigorous as we all strive for a decreased reward pool. Miners who can operate more efficiently, tap into cheaper energy resources, or benefit from larger economies of scale will gain an edge in this competitive landscape.

As a researcher studying the mining industry, I would phrase it this way: The intensified competition in the mining sector might compel less productive miners to enhance their operations or consider leaving the market due to the financial strain caused by inefficiency.

Manthan Dave holds the opinion that Bitcoin miners facing heightened competition may not necessarily abandon the industry. Instead, he suggests that these miners could shift their resources towards mining and creating other digital currencies.

As a crypto investor, I’ve observed that miners leaving the Bitcoin network due to rising costs aren’t deserting crypto entirely. Instead, they might repurpose their hardware for mining other cryptocurrencies or invest in staking.

Network hashrate and mining difficulty adjustment

As a network analyst, I can explain that when mining profits decrease, certain mining operations may be compelled to close or adjust their methods. This situation inevitably influences Bitcoin’s network hashrate, which represents the collective computational power required for Bitcoin transaction processing and mining.

As a Bitcoin analyst, I’ve observed that when the price of Bitcoin climbs up, mining becomes a financially attractive proposition for more participants due to increased profitability. This influx of miners contributes to an overall increase in computational power or hashrate. On the other hand, if the price takes a downturn and the hashrate starts to wane, it signals that mining is no longer profitable for many miners. In response, they shut down their equipment, leading to a decrease in computational power or hashrate.

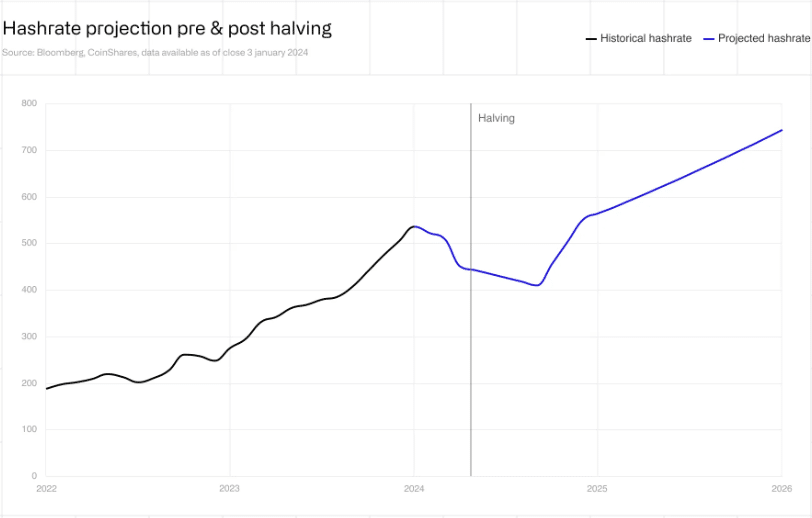

Based on data from Blockchain.com, the current hashrate stands at 612.99 Exahashes per second (EH/s). This figure falls short of the seven-day moving average peak hit in April, 2024, which was recorded at 629.75 EH/s.

The CoinShare report previously mentioned anticipates that Bitcoin’s hashrate will hit approximately 700 Exahashes per second by the year 2025.

The Bitcoin mining process includes an automatic mechanism for adjusting difficulty levels. This feature responds to current conditions by either increasing or decreasing the complexity of the mathematical puzzles miners must solve to earn new coins.

Approximately every two weeks, this adjustment is made to keep the mining process consistent with a target block time of around ten minutes. The adjustment is calculated based on the time it took to mine the last 2016 blocks.

Possible remedies

Jurisdictional arbitrage

As a crypto investor, I’ve come across the concept of jurisdictional arbitrage, which is an intriguing strategy for miners looking to maximize their operations. Simply put, this approach involves leveraging the differences in regulations, laws, and costs between various countries or regions to gain an edge in mining activities. By carefully selecting locations with favorable conditions, miners can minimize expenses while ensuring compliance with local rules. This tactic could potentially lead to increased profitability and competitiveness within the industry.

Manthan Dave, co-founder of Palisade, points out that jurisdictional arbitrage is a potential major advantage for newcomers looking to enter the Bitcoin mining industry due to the substantial challenges and high financial requirements associated with launching mining operations.

“Newcomers find jurisdictional arbitrage an effective tool, given the challenges and high capital requirements to enter the industry,” Dave noted. “Clear regulatory frameworks in locales with affordable electricity expenses can pave the way for fledgling businesses to establish mining operations.”

In different parts of the world, there is a diverse range of regulatory guidelines and financial incentives that can impact miners’ decisions about where to establish their businesses. For example, nations boasting affordable electricity rates and supportive regulatory frameworks are likely to draw significant interest from cryptocurrency miners following the halving event.

Clear regulations offer a substantial benefit by minimizing uncertainties and enabling miners to make informed, long-term investment decisions.

In recent times, there’s been a significant increase in mining activities in areas such as Texas, Kazakhstan, and Ethiopia. The primary reasons behind this trend include the availability of affordable electricity and favorable regulatory environments for mining operations in these locations.

As an industry analyst, I would rephrase that statement as follows: Expecting stringent regulations and elevated energy costs in certain regions, industry observers anticipate that miners will be compelled to move, thereby altering the geographical distribution of mining powerhouses.

Diversification and adaptation

Analysts anticipate that miners will place greater emphasis on diversification as they confront the challenges brought about by a reduction in the price of halving.

As a researcher studying the strategies of cryptocurrency miners, I have observed that they adopt various approaches to expand their business and increase revenues. Some miners diversify their operations by venturing into other cryptocurrencies. Others explore alternative revenue streams, such as providing cloud mining services or utilizing the excess heat generated during mining for industrial purposes. These innovative practices not only help miners optimize their resources but also contribute to the overall growth and sustainability of the cryptocurrency industry.

Some miners, like Texas-based Lancium, have expanded their operations to include renewable energy initiatives. They now utilize surplus energy to mine Bitcoin instead of wasting it.

Some companies, such as Bitfarms, are pursuing a vertically integrated approach, managing operations from the manufacturing of mining hardware all the way to establishing their own power plants.

first, to boost profits, and second, to increase the durability and adaptability of mining operations.

Spot Bitcoin ETFs: a game-changer in market dynamics

As a market analyst, I believe the arrival of spot Bitcoin Exchange-Traded Funds (ETFs) is a game-changer that could significantly impact the Bitcoin market. These new investment vehicles offer an alternative way for participants to gain exposure to Bitcoin and have already drawn in institutional investors. With their entry into the market, we may see a more stabilizing effect on Bitcoin’s price volatility.

Bitcoin ETFs labeled as “Spot” versions offer a significant shift in the Bitcoin investment landscape. They simplify the process for institutions and individual investors to acquire and maintain long-term Bitcoin holdings without the complications of managing private keys. Consequently, this increased demand from buyers, instigated by the ETFs, can offset the selling pressure from miners. Ultimately, this balanced market dynamic fosters a more stable and optimistic Bitcoin price trend.

Manthan Dave, Palisade co-founder

As a researcher studying the impact of Exchange-Traded Funds (ETFs) on the cryptocurrency market, I believe that one potential benefit is the reduction of market volatility. The enhanced accessibility and recognition of ETFs could lead to more stability in crypto prices. This, in turn, may result in improved profit margins for miners due to better pricing.

Experts propose that ETF approval could boost investor confidence in Bitcoin, leading to larger investments and increased market stability. Consequently, this infusion of institutional funds would benefit not only investors but also Bitcoin miners by ensuring sufficient liquidity.

As a crypto investor, I’ve been following Manthan Dave’s insights on the market closely. He recently pointed out that in the long run, the introduction of crypto Exchange-Traded Funds (ETFs) could boost confidence in the crypto space and decrease overall market volatility. He specifically mentioned the potential launch of an Ethereum ETF, which could attract significant new investment due to Ethereum’s more eco-friendly energy consumption compared to Bitcoin. However, he also warned that this development might lead some investors to shift their funds from Bitcoin ETFs as they look to diversify their portfolios.

Runes to the rescue?

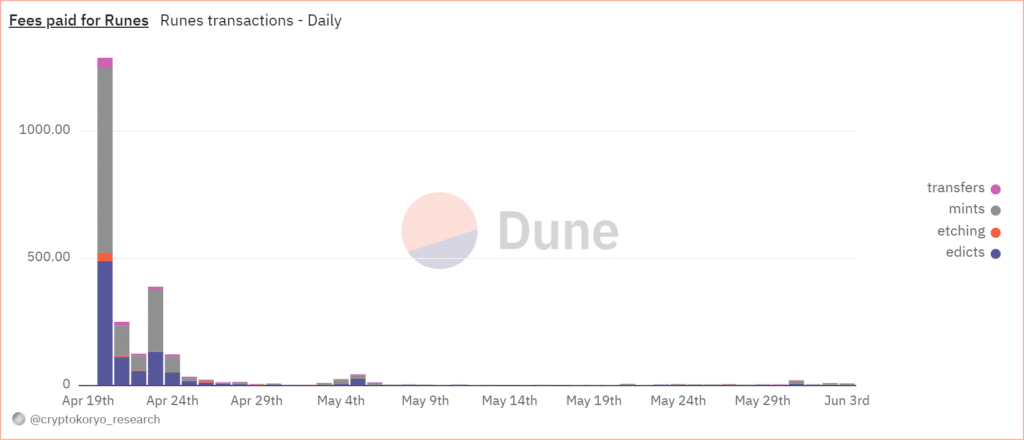

An intriguing development for Bitcoin miners following the halving has been the debut of the Runes protocol on the Bitcoin network. Launched during the fourth Bitcoin halving, this new protocol enables the creation of fungible tokens on the Bitcoin platform more efficiently than BRC-20 by optimizing block space usage.

Miners of Bitcoin (BTC) experienced a fortunate turn of events due to the heightened transaction activity from Runes. In the initial two weeks post-Runes’ debut, miners successfully earned a total fee income of 2,253 BTC.

Approximately 80% of the transactions on the Bitcoin network, according to Dune Analytics data from that period, involved Runes rather than bitcoin itself, which accounted for only about 20% of the total transactions.

As a researcher studying the trends in cryptocurrency transactions, I’ve observed an intriguing pattern with Runes. The surge in transaction volume led to higher network fees, which ultimately benefited miners financially. However, recent data from Dune Analytics paints a different picture. Instead of continuing to rise, the number of Runes transactions has been on a downward trend.

Forecasting the future: Bitcoin’s trajectory

After a Bitcoin halving event, anticipating its price direction entails examining multiple market indicators and influencing elements. Bitcoin’s history shows that its value tends to surge after such occurrences due to fewer new coins being mined and heightened investor interest.

Despite the complexities of the present situation with its economic conditions and shifting regulations, Bitcoin’s prospects continue to be debated among industry professionals.

As a analyst, I anticipate that the industry will persistently expand due to heightened acceptance and technological progressions. However, it’s crucial not to overlook the potential risks such as stricter regulations and market oversaturation.

Despite this, the prospect for Bitcoin and its mining community looks positive in the long run. Experts such as Manthan Dave predict that the price of Bitcoin could reach around $100,000 by 2025.

Based on current trends, it’s probable that Bitcoin will flirt with the $100,000 mark before the year is over, according to the Palisade co-founder’s forecast.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-06-04 22:51