Well, well, well! It appears that JuCoin has decided to throw its hat into the ring with a rather splendid launch of its inaugural USDT fixed-income product. One can hardly keep a straight face as they join the ever-growing parade of trading platforms offering tiered-yield and flexible staking solutions for those lucky USDT holders. 🎩

On this fine day, May 26, 2025, our friends at JuCoin, hailing from the sunny shores of Singapore, have officially unveiled their first Tether (USDT) fixed-income product, complete with a tiered APY that would make even the most stoic investor raise an eyebrow. The offering boasts six delightful terms—7, 15, 30, 45, 60, and 90 days—catering to the whims and fancies of various investor preferences. Talk about a buffet of options! 🍽️

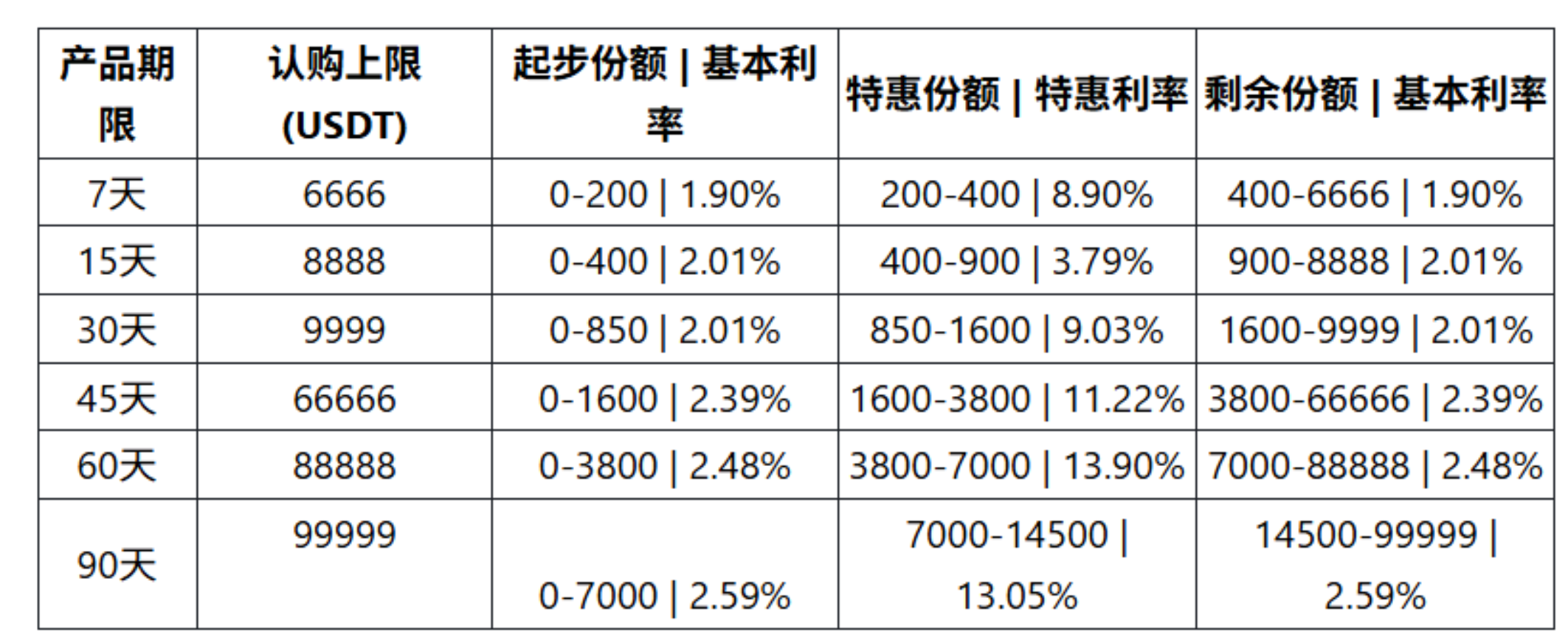

Now, let’s not get too bogged down in the details, but JuCoin has employed a rather clever “ladder interest rate” model. This means that yields are tiered based on investment amounts, which is just a fancy way of saying that the more you invest, the more you earn—up to a point, of course! Each product has a base quota with a standard interest rate, followed by a preferential tier that offers a higher rate. Any amount exceeding this tier reverts to the base rate, like a well-behaved dog returning to its master. Earnings are calculated daily and distributed automatically upon product maturity. How civilized! 🐶

For instance, if one were to invest a charming sum of 4,000 USDT in the 45-day product, the breakdown would be as follows: the first 1,600 USDT earns a base APY of 2.39%, the next 2,200 USDT qualifies for a higher APY of 11.22%, and the remaining 200 USDT returns to the base rate. The blended annualized return in this case would be approximately 7.25%. It’s like a financial puzzle, and who doesn’t love a good puzzle? 🧩

With this new offering, JuCoin is not alone in this grand adventure. They join a growing number of trading platforms already offering similar products. For example, Bybit is also in the game, offering USDT-based options with tiered yields across various durations. Current rates include 2.70% for 14 days, 3.20% for 30 days, and 4.00% for 90 days for both fixed-term and flexible deposits. Among the big players, we have KuCoin, Binance, Kraken, and MEXC, all offering USDT staking across fixed and flexible terms with a range of APYs. It’s a veritable smorgasbord of financial opportunities! 🍭

Now, let’s clarify a few things, shall we? In fixed-term staking, users commit their USDT for a set period in exchange for a predetermined APY, and they cannot withdraw until the term ends. The platform pools these locked funds and typically lends them out to institutional borrowers or uses them in liquidity-providing and yield-farming strategies, generating steady interest that’s shared with holders at maturity. Quite the industrious little setup, if I do say so! 🏦

On the other hand, flexible-term staking allows users to deposit and redeem their USDT at any time. Rates are usually lower and can fluctuate based on demand, but they offer the convenience of instant access to locked capital. It’s like having your cake and eating it too—if only life were always this simple! 🎂

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Hero Tale best builds – One for melee, one for ranged characters

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

2025-05-26 14:39