As a seasoned crypto investor with years of market navigation under my belt, I find myself keeping a keen eye on the ebb and flow of the digital currency landscape. This week, three coins have caught my attention: JUP, OCEAN, and ATOM.

Over the weekend, I noticed a significant dip in the crypto market as we closed below the $2 trillion mark for the first time in a month, shedding an additional $150 billion to settle at a global market cap of $1.92 trillion.

This week, keep an eye on some top-tier cryptocurrencies that have shown substantial price fluctuations recently:

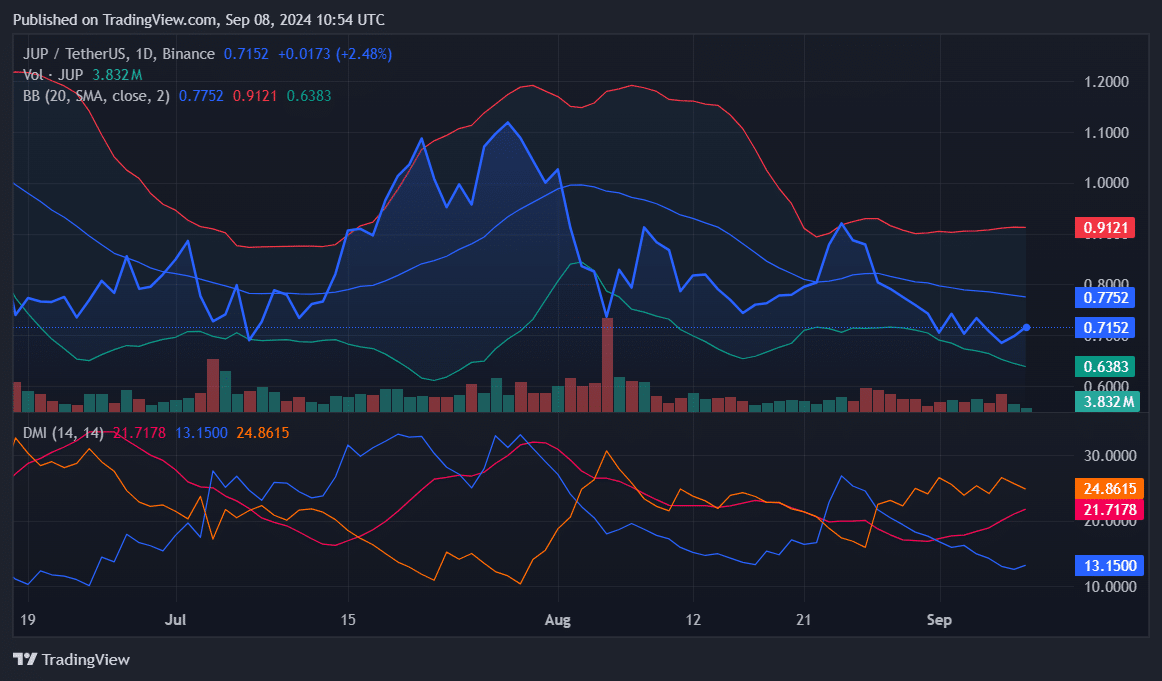

JUP battles at $0.70

Last week, the price of Jupiter (JUP) fluctuated between increases and decreases as it struggled around the $0.70 mark. Yet, a bearish trend dominated due to market instability, causing a 6% decline over the week and ending at $0.6979.

At present, the trading range for JUP lies within its Lower and Middle Bollinger Bands. The current price hovers slightly above the Lower Band at approximately $0.6383, offering underlying support. Despite this, it falls short of the 20-day moving average ($0.7752), suggesting potential resistance from above.

On the Daily Moving Average Indicator (DMI), the Plus DI at 13.15 indicates a slight buying pressure, whereas the Minus DI at 24.86 suggests more prominent selling pressure.

Nonetheless, the +DI appears to be rising as Jupiter begins the new week bullish, with the -DI dropping. This suggests a potential shift toward buyers. The ADX at 21.71 shows a moderately strong trend but still lacks clear directional conviction.

This week, it’s important for investors to keep an eye out for a strong move either above the median line (indicating a bullish trend) or below the bottom line (signaling a bearish trend), as these actions could provide clearer signals about the market’s momentum.

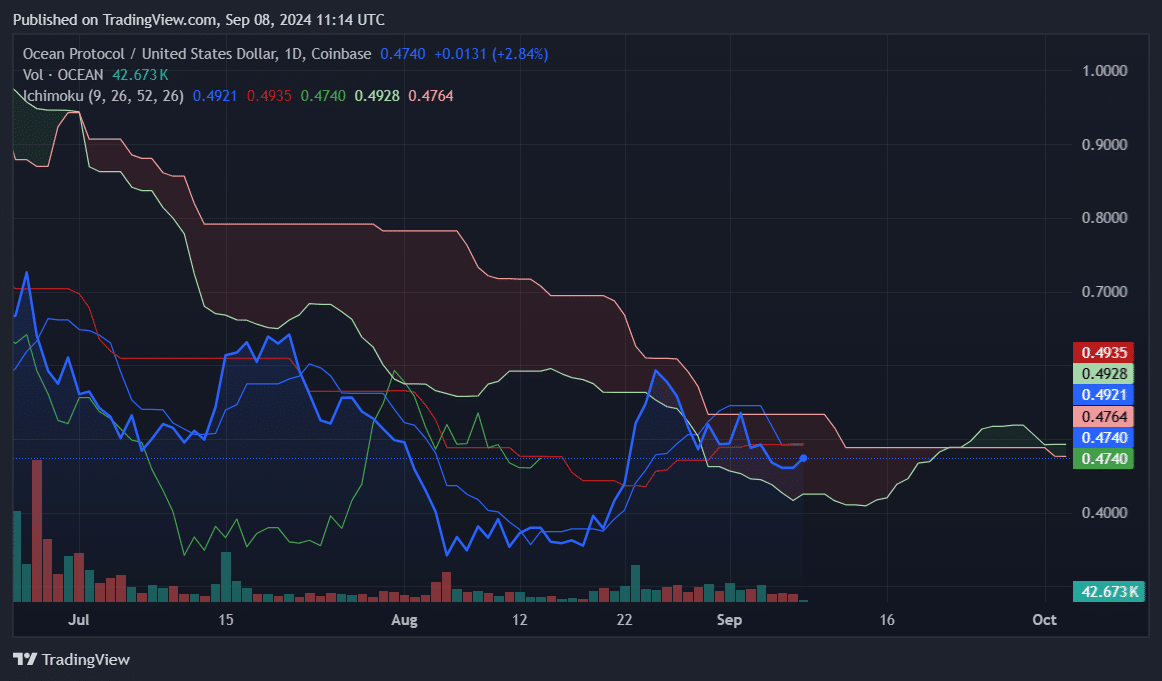

OCEAN faces volatility

Last week was quite tumultuous for Ocean Protocol (OCEAN). After experiencing a surge of 9% on September 1 and 2, it swiftly changed direction, shedding those gains in a steep 8.82% descent on September 3. This downward trend persisted, resulting in the token closing the week at $0.4609, marking a weekly decline of 6.1%.

At present, OCEAN’s price is lower than its Ichimoku Cloud, with $0.4935 acting as a significant resistance point (Senkou Span B). The cloud’s bearish formation implies ongoing downward movement. Yet, it’s worth noting that OCEAN is close to both the Kijun-Sen ($0.4921) and Tenkan-Sen ($0.4740), suggesting a possible period of stabilization or sideways movement.

To start off the week, OCEAN is displaying a positive trend. If the cost manages to surpass the cloud, it could aim for higher altitudes. Notably, $0.4935 serves as significant resistance.

A break below the Kijun-Sen could signal further declines toward $0.46.

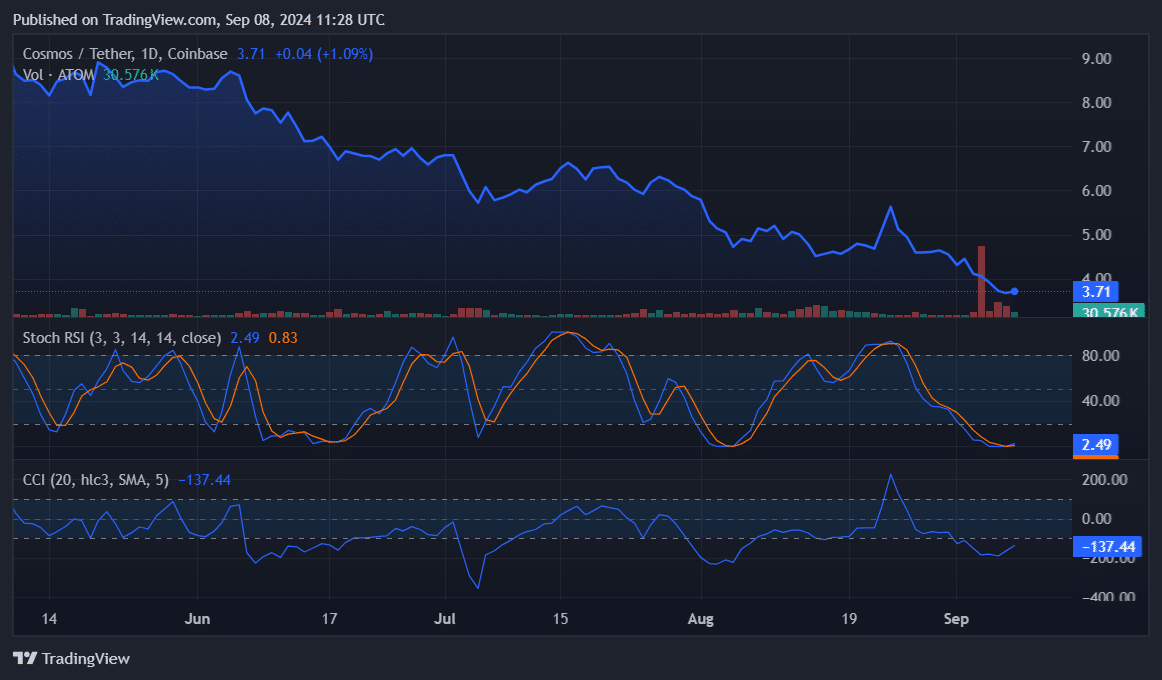

ATOM collapses 18%

Last week saw a challenging period for Cosmos (ATOM), as it plummeted by 18.8%, ending the week at $3.67. A continuous downward pressure, or bearish trend, was responsible for keeping the price levels suppressed.

In simple terms, the Stochastic RSI’s K line stands at 2.49, while its D line has dipped to 0.83. This suggests that ATOM is heavily oversold, and if purchasers enter the market, a recovery might occur. However, it’s important to note that the current momentum remains negative (bearish).

In simpler terms, when we see a Composite Chaikin Indicator (CCI) value of -137.44, it underscores an oversold market condition. Values below -100 indicate intense selling activity. However, this heavy selling could potentially signal a shift in trend if the market strength begins to wane, suggesting a possible reversal might be on the horizon.

In the upcoming week, ATOM might endeavor to settle down, yet indications of being oversold imply a possible brief surge. Should negative sentiments continue, ATOM may challenge its lower support near $3.50.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Gold Rate Forecast

- Every Upcoming Zac Efron Movie And TV Show

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Silver Rate Forecast

- USD CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- EUR USD PREDICTION

2024-09-08 18:34