As a long-time resident and business operator in South Korea, I have witnessed firsthand the resilience and innovation of this remarkable nation. However, recent events have left me deeply concerned about its economic future. The rapid devaluation of the Korean Won and the unattractiveness of domestic assets are signs that something must change.

The Chief Executive Officer of CryptoQuant issues a caution about potential economic upheaval and advocates for changes in the monetary strategies of South Korea’s government.

On December 19th, Ki Young Ju, CEO and founder of CryptoQuant, voiced significant worries about the current state of South Korea’s economy in a recent post. He criticized the country’s economic strategies, emphasizing the escalating value of the South Korean Won and the lack of appeal of domestic assets as his main points of concern.

Ju stated that, when it comes to domestic investments like the Korean Won, they are currently unappealing, as he pointed out the limited success of the government’s efforts to maintain stability in the currency.

Ju noted that despite the government’s attempts to maintain stability in the currency, these efforts have largely fallen short due to the current state of the economy. He underscored that this predicament is exacerbated by the swift increase in the currency value, leading to economic volatility.

Ju additionally noted that the value of USDT on Upbit, a significant South Korean exchange, had matched the IMF rate, which could potentially signal trouble for the South Korean economy, particularly in regards to cryptocurrencies.

As a crypto investor, I find it crucial to consider the International Monetary Fund (IMF) rate when evaluating a digital coin’s worth compared to others, as it provides a universally recognized benchmark based on international financial norms.

The South Korean Won (KRW) is rapidly weakening compared to the U.S. dollar, as the worth of USDT, a stablecoin pegged to the U.S. dollar, matches the International Monetary Fund’s (IMF) rate on platforms such as Upbit. Given that investors can employ USDT or other similar assets as a safeguard against the unpredictability of the domestic currency, this equivalence between USDT and IMF rate could be indicative of diminishing trust in South Korea’s economy.

This situation could be seen as a signal by South Korea that they might be experiencing capital outflow, which occurs when businesses and investors move their funds overseas to protect them from currency depreciation or inflation. If fewer individuals choose to keep the South Korean Won, this trend may exacerbate instability within the local banking system and potentially weaken the country’s economy as a whole.

Additionally, these developments could potentially influence foreign investments and trade with other nations, possibly diminishing South Korea’s attractiveness to overseas investors. Jus’ remarks underscore growing concerns about the administration’s handling of the crisis and its ability to prevent funds from leaving the country.

CryptoQuant’s CEO expressed disagreement with the government’s approach to the issue, suggesting they create a welcoming environment to keep wealth within the country rather than focusing on retention. Ju advocated for less regulatory burden and more attractive incentives to persuade investors to stay in South Korea, emphasizing that the government should not cling tightly to capital that is moving abroad voluntarily.

Ju, who’s run his company in South Korea for seven years, has grown increasingly discontent with the government. He stated, “I’ve tolerated this situation while conducting business domestically for 7 years, but now I’m considering leaving Korea. It’s incredibly frustrating.” His comments, which call for change to prevent capital outflow, reveal a profound concern about South Korea’s economic prospects.

In December 2024, South Korea experienced significant political turbulence due to President Yoon Suk Yeol’s controversial decision to impose martial law, which was later rescinded. This action led to his impeachment by the National Assembly. A trial ensued before the Constitutional Court to decide if he should remain in office.

In simple terms, the recent political turmoil in South Korea has significantly affected its financial sector. The stock market there has been experiencing fluctuations, while the value of the South Korean currency (won) has decreased mainly due to foreign investors liquidating their domestic stocks.

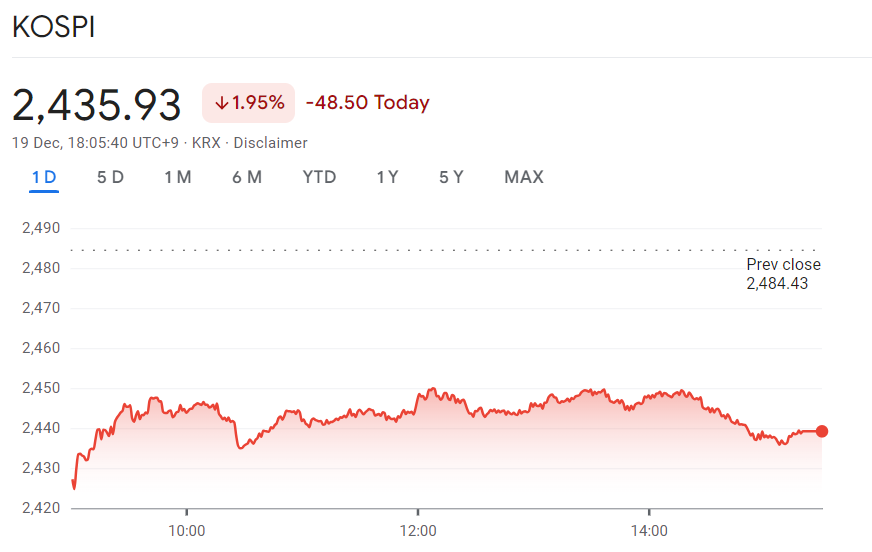

For example, the KOSPI index, the benchmark stock index of South Korea that tracks the performance of businesses listed on the Korea Stock Exchange, fell 2.5% from Dec. 3, the day martial law was declared, and since then it has shown bearish momentum and now trading at 2,435.93 as of Dec. 19.

Additionally, Samsung Electronics, a major tech company based in South Korea and a global leader in technology, experienced a 9.3% decrease in its stock price, now valued at approximately 53,100 KRW. Meanwhile, the South Korean won has also weakened, reaching a 15-month low against the US dollar, with an exchange rate of around 1,448.9 to 1 USD.

To reduce the potential dangers arising from the present political and financial climate, many businesses and private entities are contemplating transferring their resources to foreign countries due to increasing worries about financial security.

The future impact of the government’s actions on South Korea’s financial institutions remains uncertain, and there’s speculation that businesses such as CryptoQuant might need to move elsewhere to ensure their longevity in a more consistent environment, given the country’s current political and economic instability.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

- All New and Upcoming Characters in Zenless Zone Zero Explained

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-12-19 16:09