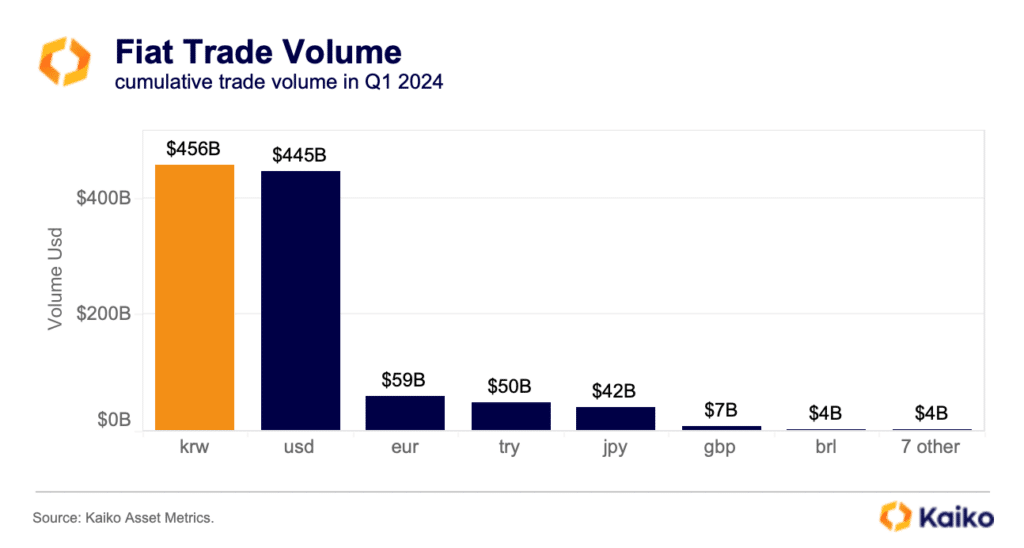

During the first quarter of 2024, the cryptocurrency markets in South Korea experienced their greatest trading activity in more than two years. The Korean Won (KRW) surpassed the US Dollar (USD) as the currency with the highest cumulative trade volume, according to Kaiko’s data.

In the beginning of March, trading activity in South Korean cryptocurrency markets reached a peak not seen since late 2019, fueled by a more favorable economic situation and intensified competition amongst domestic exchanges, as indicated by data from the blockchain analysis company, Kaiko.

Although Upbit has held a strong position in the South Korean cryptocurrency market for the past three years, accounting for an average market share of 82%, new developments seem to be introducing more competition. Toward the end of 2023, Bithumb and Korbit initiated zero-fee campaigns.

In contrast to Korbit’s market share, which remained stagnant at roughly 1% in 2024, Bithumb underwent remarkable expansion. Following the introduction of its zero-fee policy in October 2023, Bithumb witnessed a threefold increase in market share. However, Kaiko’s analysts pointed out that despite this surge in trading volume, Bithumb suffered a steep revenue loss of approximately 60% in 2023, compelling the exchange to abandon its zero-fee strategy.

A notable drop in income might have led the exchange to end their zero-fee promotion on February 5th, only five months following its start.

Kaiko

In the beginning of April, Kaiko reports a small drop in KRW trading volumes. However, the market mood in the Asia-Pacific area might improve due to the recent green light given for Bitcoin and Ethereum spot ETFs in Hong Kong.

According to crypto.news’ previous article, HashKey and Bosera International have received conditional approval from Hong Kong’s Securities and Futures Commission for two Bitcoin ETFs. This development is significant for Asian investors, as it could lead to the listing of these ETFs on the Hong Kong Stock Exchange within approximately two weeks.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-16 15:10