As a crypto investor with some experience under my belt, I’m always keeping an eye on developments within the DeFi space, particularly projects that have shown promise. Lido DAO (LDO) is one such project that has caught my attention recently.

As a crypto investor, I’ve noticed an exciting development in the Lido DAO (LDO) ecosystem. The recent publication of the Validator and Node Operator Metrics (VaNOM) report for Q1 2024 has sparked a significant increase in the token price.

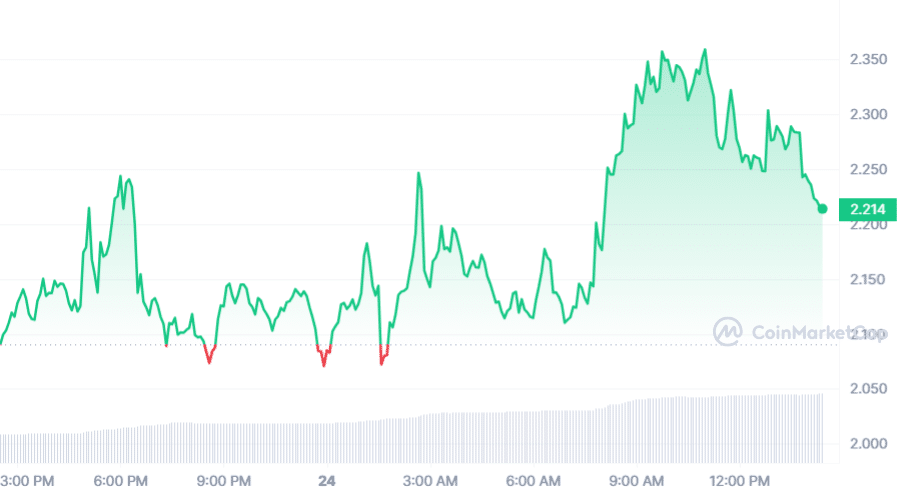

Currently, LDO is priced at $2.35 during this writing, signifying a 10% surge in value over the past 24 hours. Its market capitalization surpassed $2 billion, while its trading volume for the previous 24 hours amounted to $474 million, marking a significant jump of 148%.

The VaNOM report, released on May 23rd, brought attention to a notable change in the client base composition, most notably at the execution stage. Notably, the client Geth’s usage rate saw a substantial decrease, dropping from a dominant 96% in 2022 to 46%, and further declining to 67% during the last quarter of 2023.

Lido Validator and Node Operator Statistics: Quarter 1, 2024 📊

Here’s a summary or read further for details on significant changes.

In brief:

– The adoption of the supermajority client (Geth) decreases to 46% from 67% in Q4, 2023.

– Public cloud usage among validators experiences a rise.For more information, please refer to the complete report below or continue reading.

— Lido (@LidoFinance) May 23, 2024

The report revealed a decrease in the usage of public clouds from 46% to 40%, implying a shift towards more diverse technologies and reduced dependence on particular platforms such as Geth and public clouds.

The report did not specify the reasons for these changes.

As a researcher looking into the events surrounding LDO‘s price surge on May 21, I’ve discovered that a security breach at Numic, one of Lido DAO’s Node Operators, might have contributed to the significant price increase. This incident was identified on May 14 and involved unauthorized access to a developer machine used by Numic in their collaboration with Lido within the Ethereum protocol.

On May 14th, it was brought to the attention of Lido DAO community members that a security issue had occurred involving one of the active Node Operators on the Lido platform on Ethereum network (Numic). The problem has since been addressed and no validator functions have been impacted, and there has been no financial loss. Only the affected operator was impacted.

— Lido (@LidoFinance) May 21, 2024

As a crypto investor, I’ve heard rumors about the possibility of the mainnet validators’ encrypted key material backups being compromised. However, I want to reassure you that based on current information, there’s been no definitive evidence suggesting tampering or malicious use of these backups.

Numic acted swiftly, resetting all deposit keys to zero and eliminating any suspicious keys. This measure protected the system from routing deposits to potentially compromised validators.

As a researcher, I’d like to share that Lido DAO members played a pivotal part in collaborating with Numic during an exhaustive probe into the security incident. Our collective efforts led to the implementation of protective measures that maintained the uninterrupted functioning of validator operations. Fortunately, no financial repercussions ensued from this event.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-05-24 14:07