As a seasoned researcher with over two decades of experience in the crypto market, I find myself intrigued by Terra Luna Classic’s (LUNC) recent surge. Having witnessed numerous crypto winters and summers, I must admit that the resilience of this coin is quite remarkable.

The price of Terra Luna Classic has been steadily increasing since its low point in August, and experts believe there’s even more potential for growth ahead.

This week, Terra Luna Classic (LUNC) – the surviving piece of the fallen Terra system – reached a high of $0.000129, which is its peak level since March of this year.

Crypto experts think there’s still potential for this digital token to increase further, particularly if the cryptocurrency market rally builds up steam.

In a recent post, Miles Deutscher, a popular analyst on X, noted that he was long LUNA and LUNC. He cited reasons such as LUNC’s continued listing on Binance, strong bullish charts, and its meme appeal.

I find it hard to believe I’m expressing this, but here goes: I can hardly contain my excitement…I’ve been yearning for LUNC and LUNA! 😂

— Miles Deutscher (@milesdeutscher) November 23, 2024

A possible way to rephrase the given sentence could be: One possible factor fueling the growth of Terra Luna Classic is the continuous token destruction, which decreases the total supply and potentially raises the value of the surviving tokens. As per LUNC Metrics, approximately 1.34 billion tokens were incinerated in the last week.

Approximately 390 billion tokens have been destroyed within the network, reducing the total number of circulating tokens to approximately 6.51 trillion. Notably, a substantial token burn took place earlier this month when Terraform Labs incinerated 251 billion tokens as part of a bankruptcy stipulation.

The proportion of LUNC tokens being staked has climbed up from its 2022 minimum levels, nearing 16%. This suggests that a significant number of investors are choosing to hold on to the token for a prolonged period.

LUNC price chart points to more gains

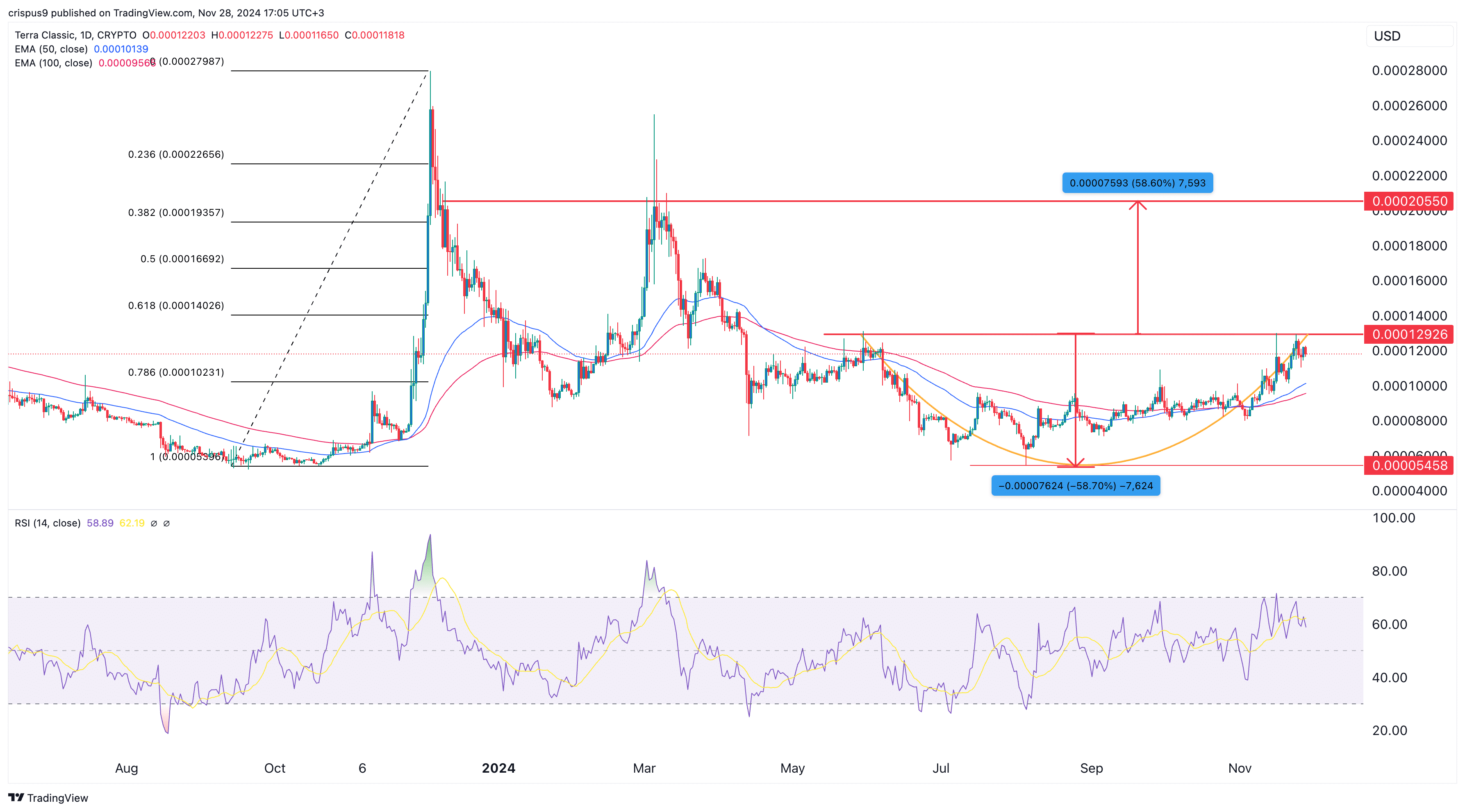

As an analyst, I’ve observed a gradual upward trajectory in Terra Luna Classic over the past few months following its bottoming at approximately $0.000054. This coin has developed what’s known as a ‘cup and handle’ pattern, with the peak of the cup at around $0.000129 – a technical configuration that often signals a bullish continuation.

As an analyst, I project that given the depth of the cup, the coin could potentially reach a price of around $0.0002055 – this represents a roughly 75% increase from its current value. Notably, this target is slightly above the 38.2% Fibonacci Retracement level at $0.00020.

As a crypto investor, I’m observing a positive trend with LUNC as it surpasses both the 50-day and 100-day moving averages, which is an encouraging sign for a bull run. Moreover, the Relative Strength Index (RSI) is on the rise, suggesting that the bullish momentum remains robust. However, should LUNC drop below the 100-day moving average at $0.000095, it may signal a shift in the bullish perspective.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2024-11-28 17:32