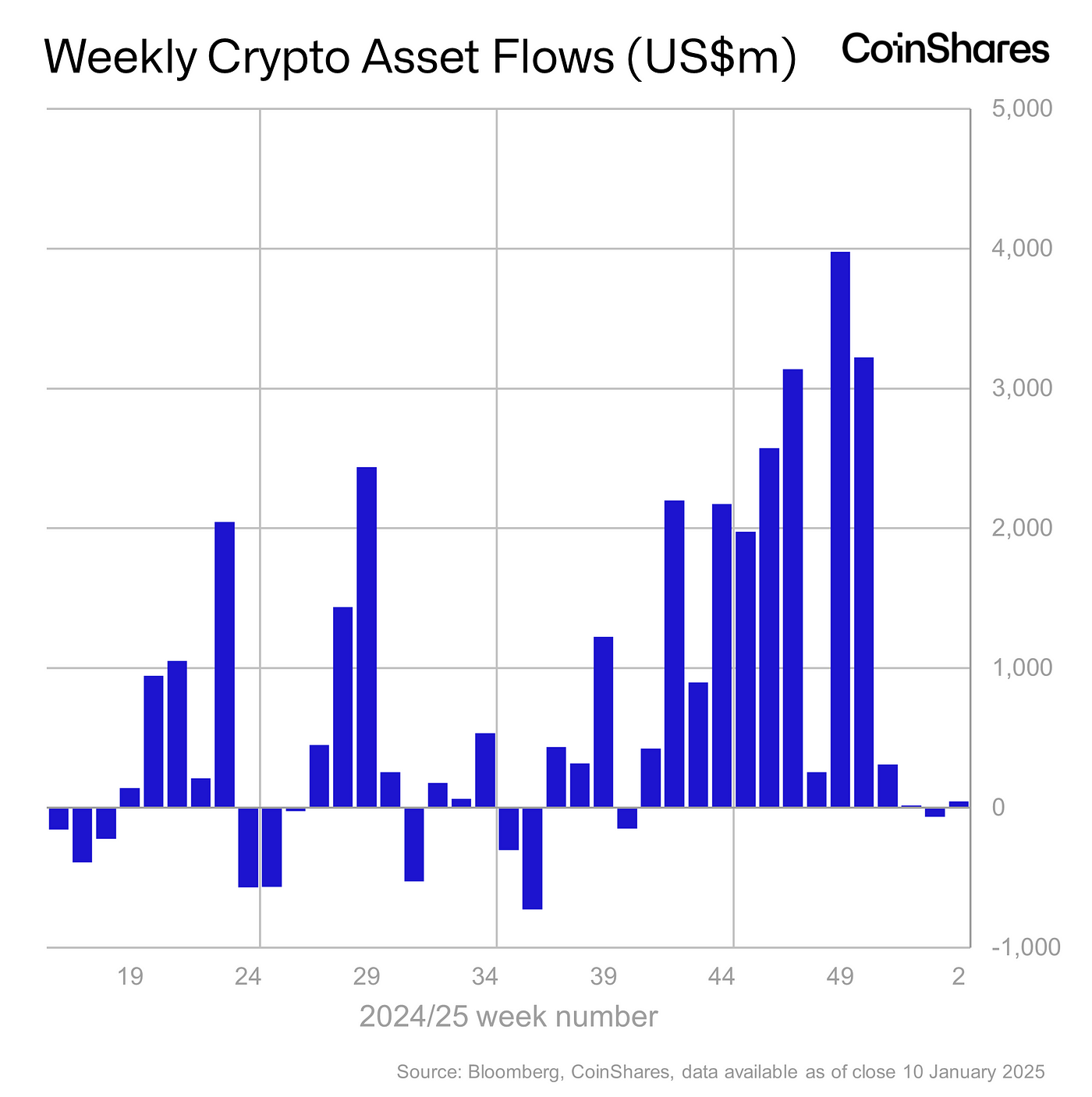

Last week saw significant changes in cryptocurrency movements due to macroeconomic indicators, as reported by CoinShares. These shifts resulted in a net outflow of approximately $940 million, effectively erasing initial inflows that had been observed earlier.

According to a report published on January 13th by James Butterfill, the head of research at CoinShares, digital asset investment products experienced approximately $48 million in new investments this week. However, this inflow was largely offset by outflows totaling nearly $940 million, as fresh economic data and hawkish Federal Reserve minutes caused unease among investors.

Bitcoin (BTC) initially saw inflows worth approximately $214 million, but towards the end of the week, it experienced the most significant outflows among digital assets. However, Butterfill points out that despite these outflows, BTC has been the top-performing asset with a total inflow of about $799 million this year.

Last week presented a tough stretch for Ethereum (ETH), with approximately $256 million being withdrawn, according to Butterfill’s analysis. This outflow, however, seems more closely tied to the broader tech market downturn rather than problems unique to Ethereum. In stark contrast, Solana (SOL) demonstrated strength and drew in around $15 million during this period.

XRP (XRP) saw an inflow of approximately $41 million, primarily due to “political and legal considerations,” according to Butterfill’s statement. This increase in inflows indicates a surge in optimism among investors, as they anticipate developments by the SEC before the January 15th appeal deadline.

Despite a general weakness in their price performance, several alternative cryptocurrencies (altcoins) experienced inflows of funds. For example, Aave (AAVE), Stellar (XLM), and Polkadot (DOT) were particularly notable, receiving approximately $2.9 million, $2.7 million, and $1.6 million respectively. Butterfill remarks that the recent data suggests the post-U.S. election period of optimism has ended, and now macroeconomic indicators are once again playing a significant role in shaping asset prices.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-01-13 15:20