As a seasoned crypto investor with a knack for spotting trends, I find myself intrigued by the recent surge of MKR. Having weathered multiple market cycles, I’ve learned to read between the lines and decipher the subtle signs that the market presents.

The former token of the Sky ecosystem, known as Maker, is showing signs of increasing value as its holders get ready to cash out their gains.

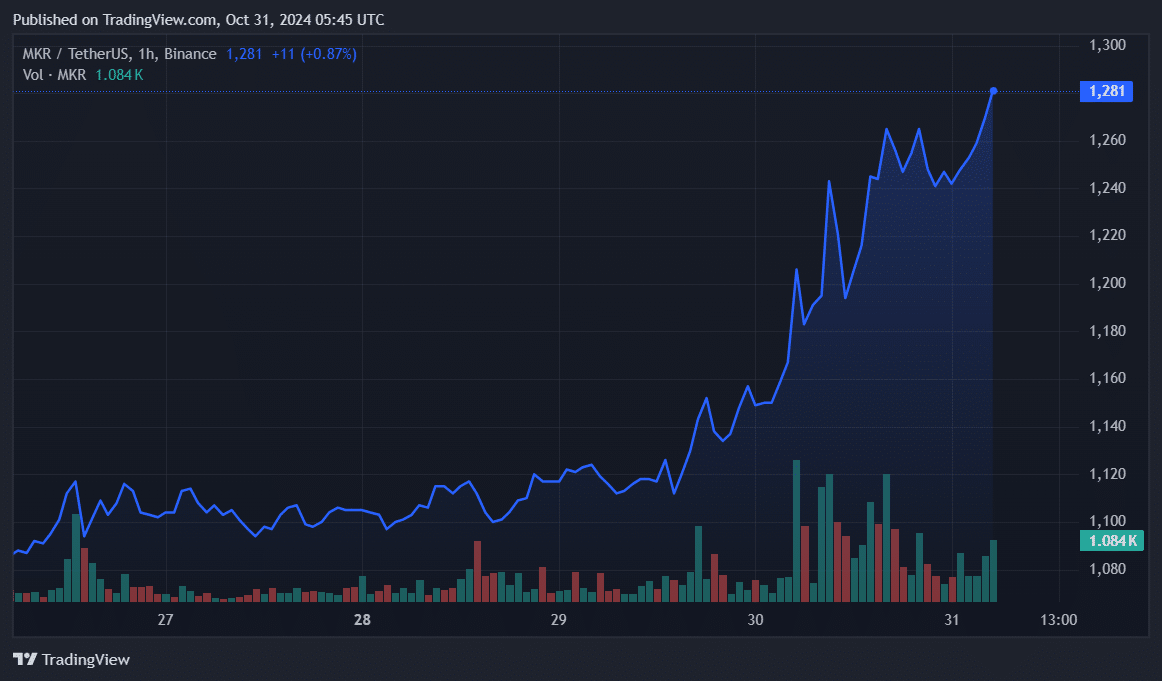

Maker (MKR) is up 11% in the past 24 hours and is trading at an intraday high of $1,280 at the time of writing. The asset’s market cap has surpassed the $1.1 billion mark, making it the 64th-largest cryptocurrency.

Each day, MKR’s training expenditure has grown by a substantial 120%, now amounting to $150 million. However, even with these advancements, Maker is currently 80% lower than its peak of $6,339, which was reached on May 4, 2021.

Its high trading volume shows increased interest in the token. However, the sudden surge could trigger a price correction due to the greedy market conditions.

50% MKR holders in profit

Based on information from IntoTheBlock, approximately half (50%) of MKR holders, representing about 47,560 accounts, are currently experiencing profits. Nearly 5% of these investors are just shy of breaking even, and the rest, or around 45%, consisting of 43,700 addresses, have yet to see a return on their initial investment.

Additionally, we’ve seen a significant increase in the number of Maker daily active addresses reporting profits. Over the past week, this figure climbed from just seven to 48.

Despite the number being significantly smaller compared to the overall MKR holders, it’s important to consider that a large portion of profits might influence the asset’s value since more than 81% of the token supply is stored in the wallets of these ‘whales’.

Significantly, the buildup of large holdings has decreased since October 26, a period when MKR was trading under $1,100, according to ITB’s data.

According to data from ITB, the number of whale transactions involving at least $100,000 worth of MKR has increased significantly, moving up from 14 to 38 over the past three days. In just the last seven days, over $72 million in such large-scale transactions have been documented.

Over the last week, there’s been a growing trend in the incoming MKR exchanges. In fact, Maker reported a single-day exchange net inflow of approximately $4.27 million on October 30th.

In simpler terms, the financial system known as Sky, previously called Maker, has been grappling with an identity dilemma following its rebranding. Rune Christensen, a co-founder of Maker, suggested a return to its original name. The supply of USDS (a replacement for DAI), reached one billion tokens within just two weeks.

The rebranding decision is likely to be announced in mid-November.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-31 10:08