In the grand theater of financial folly, the cryptocurrency prices have once again resumed their descent into the abyss, following a rather theatrical gathering at the White House, where President Donald Trump entertained the titans of industry. One can only wonder if they discussed the art of losing money as a new form of performance art.

Bitcoin (BTC), once soaring high at a dizzying $93,000, has now plummeted to a mere $86,000. Meanwhile, the altcoins—those fickle friends like Ethereum (ETH), Solana (SOL), and Ripple (XRP)—have also decided to join the downward spiral, each falling by over 1%. Ah, the predictions of crypto.news were spot on, as if they had a crystal ball or perhaps just a good sense of humor.

Nasdaq 100 index crashes below 200-day moving average

As the U.S. stock market dances to the tune of despair, Bitcoin and its altcoin companions may continue their tragic waltz downward. The Nasdaq 100 index, that illustrious tracker of the tech giants, is on the brink of a technical correction, where an asset drops by 10% from its local peak. A double-top pattern has emerged at $22,137, and it has now slipped below the neckline at $20,565. Truly, a double top is the harbinger of doom in the world of technical analysis.

To add insult to injury, the Nasdaq 100 has also tumbled below the 200-day moving average, signaling a downtrend that may linger like an unwelcome guest. The narrowing spread between the 200- and 50-day moving averages threatens the formation of a death cross—how poetic!

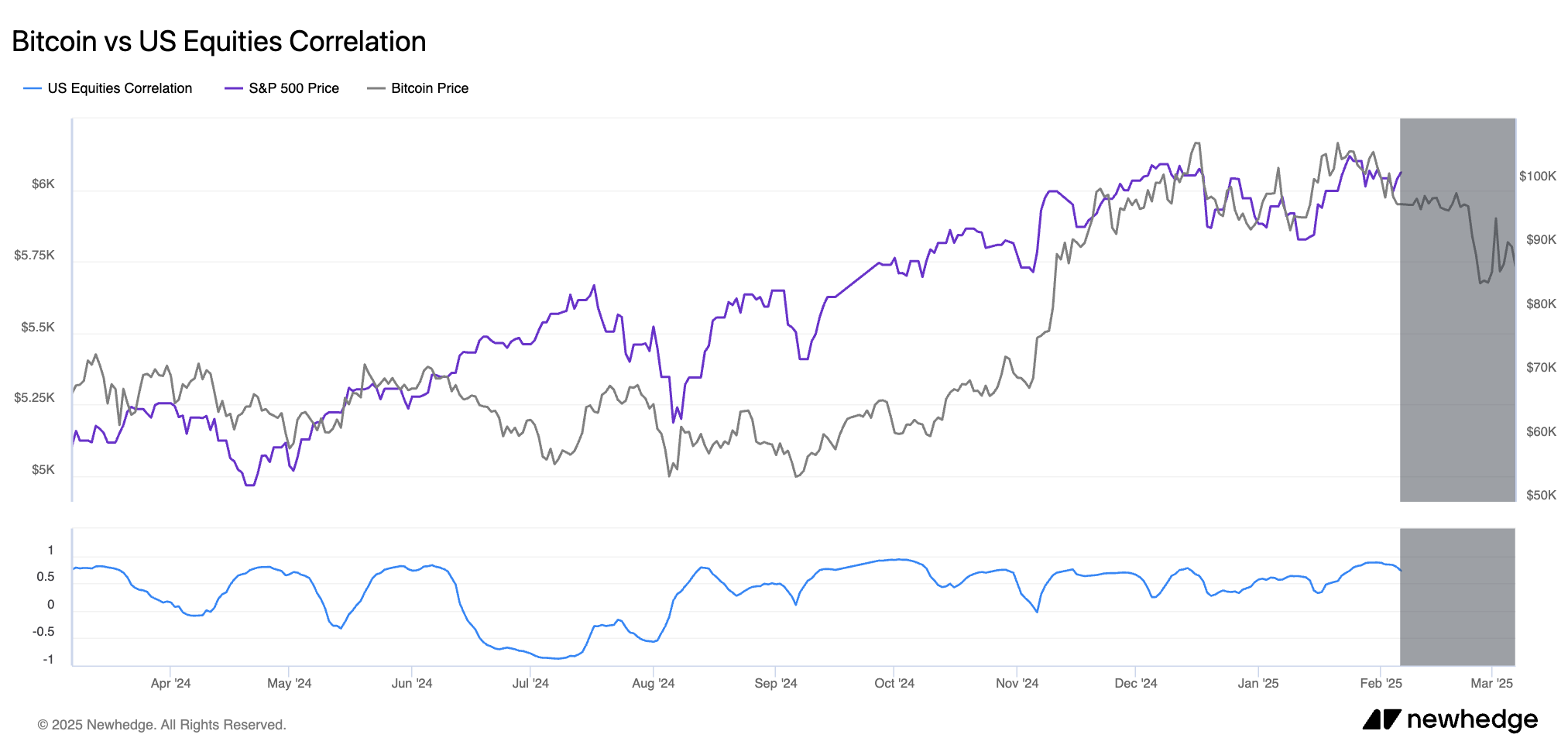

Other U.S. stock indices, such as the S&P 500 and the Dow Jones, have also joined the pity party, with the S&P 500 dropping by 6.3% from its peak this year. It seems that U.S. equities and cryptocurrencies share a close bond, both characterized as risk assets, much like a couple that thrives on drama.

In recent weeks, cryptocurrency and stock prices have retreated, driven by the specter of stagflation haunting the U.S. economy. Flash economic data suggests that the U.S. may be teetering on the edge of negative growth this quarter, all thanks to the uncertainties surrounding Trump’s tariffs. Meanwhile, inflation, already a troublesome beast, could rear its ugly head as companies raise prices to counteract the tariff impact. What a delightful mess!

Impact on Bitcoin, Ethereum, and XRP

As the U.S. stock market continues its downward spiral, Bitcoin, Ethereum, and XRP prices may follow suit, as the technical indicators suggest. XRP has already formed a head and shoulders pattern, and unless it rises above the right shoulder at $3, it may face a bearish breakdown. How fitting for a cryptocurrency that once promised the moon!

Bitcoin, too, is at risk of further decline after forming a double-top pattern at $108,400. It has dipped slightly below the neckline at $89,165 and is on the verge of losing the 200-day moving average once more. The specter of a drop to the key support level at $73,550 looms large, the highest point in 2024. What a rollercoaster ride!

Ethereum, meanwhile, hovers precariously above the key support level at $2,000, the neckline of the triple-top pattern at $3,000. As previously noted, this pattern hints at a potential ETH price crash to $1,500 and below. Buckle up, folks; it’s going to be a bumpy ride!

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- The 15 Highest-Grossing Movies Of 2024

2025-03-08 20:28