What to know:

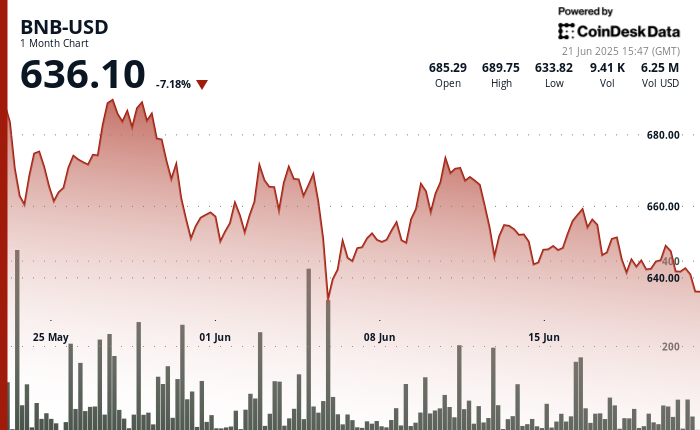

- Alas, dear BNB! Cast from its former heights to $635, all in anticipation of the fabled Maxwell hard fork—and, as the world so often supplies, a generous sprinkling of Middle Eastern discord.

- Activity upon the BNB Chain has ballooned: where once a modest eight million transactions sufficed, now it heaves beneath the weight of 17.6 million since mid-May. (Even the postman’s horse would request hazard pay!)

- Our embattled hero BNB now trades between tight sentinels: a lonesome support at $638, resistance standing aloof at $644.5–$645. Neither party invites strangers in for tea.

Like a melancholic estate owner watching storms gather above his lands, BNB, too, has bowed to the tempests of fate, slipping to $635. Traders, bracing for the Maxwell hard fork, peer nervously at telegrams from both blockchain and battlefield (one full of acronyms, the other of pointed threats—truly, who can say which is graver?).

The BNB Chain itself—restless as a Moscow market—has teemed with transaction swarms, swelling from eight to seventeen million with the indifference of a bureaucrat stamping passports. DeFiLlama (ever the bearer of grim news) confirms this escalation.

The Maxwell fork is scheduled (on June 30, if the fates do not intervene, which one suspects they might just for the sheer drama). Block times—like the interval between Dostoevsky chapters—will be halved; improvements promised, throughput bolstered, user spirits presumably lifted for a moment before the next headline arrives.

Investors, meanwhile, study the world’s headlines with the strained patience of Turgenev’s Ivan Sergeyevich: crude prices have leapt over 10% in a mere week, speculators casting lots on whether the United States will leap into the boiling cauldron of Israel and Iran.

Should Iran’s oil find itself blockaded or the Strait of Hormuz closed—Reuters whispers such things—oil could soar to $130, and some anxious economist from Oxford is stricken enough to predict 6% inflation and the untimely demise of cherished rate cuts. (On Wall Street, handkerchiefs are waved with appropriate drama.)

Faced with all this, risk assets like BNB are regarded as one might regard playing chess during a thunderstorm: daring, perhaps, but not strictly wise.

Technical Analysis Overview

BNB—like a sheepdog unwilling to leave its narrow lane—remains penned in between $635 and $646. Support at $638 receives occasional visitors (volumes spiking like aunties at a wedding), but resistance at $644.5–$645 remains unyielding, manned by sellers with all the hospitality of a Petersburg landlord in February.

Brief excitement: a volume surge of 4,222.99 tokens coincided with a sudden drop to $638 (perhaps a fleeting romance?), but alas—that support was punctured as weekend lethargy set in and volumes subsided. As with so many Russian summers, glory fades too soon.

So traders wait, watchers all, wondering just who will blink first—Maxwell, the market, or the world itself. One thing’s for certain: BNB’s journey, like that of all Russian heroes, remains gloriously unpredictable.

🚀📉💸

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Every Upcoming Zac Efron Movie And TV Show

- PUBG Mobile heads back to Riyadh for EWC 2025

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Gods & Demons codes (January 2025)

- USD CNY PREDICTION

2025-06-21 19:28