As a seasoned investor with over two decades of experience in traditional finance and cryptocurrencies alike, I must admit that I find the recent developments surrounding Bonk quite intriguing. The idea of a meme coin like Bonk entering the ETF space is something I never thought I’d see during my career.

The suggested BONK ETP, which might be the first meme coin exchange-traded product, could serve as a link connecting cryptocurrency investors with the financial world of Wall Street.

Table of Contents

Bonk eyes Wall Street

The popular meme cryptocurrency, BONK, constructed on the Solana network (Solana), has revealed intentions to debut an Exchange-Traded Product within the U.S. territory.

At Solana’s Breakpoint conference held on September 20th and 21st, it was announced by one of Bonk’s main developers that they are collaborating with Osprey Funds, a well-known New York company specializing in integrating cryptocurrencies into conventional financial markets.

Just like other cryptocurrency Exchange-Traded Products (ETPs), this action seeks to simplify the process for both conventional and institutional investors to invest in cryptocurrencies. An ETP serves as a stand-in for the price of the underlying asset, such as BONK, and can be bought and sold on traditional stock exchanges. This eliminates the intricacies associated with managing crypto wallets and trading on specific crypto exchanges.

As per the recent declaration, the ETP (Exchange Traded Product) is set to receive initial financing from Bonk DAO and key collaborators. This product will be accessible to both individual and institutional investors. At this moment, an official date for its launch remains undetermined.

If it proves successful, this will mark the inaugural instance of a meme coin penetrating the Exchange-Traded Product (ETP) sector – a significant move for a cryptocurrency asset class frequently perceived as highly speculative, with a reputation for being short-lived and lacking in seriousness.

Is a Bonk ETF a done deal?

Although Bonk has unveiled intentions to introduce an Exchange Traded Product (ETP) in the United States, it’s crucial to remember that this doesn’t automatically mean the product will be authorized for trading immediately – or even at all.

Making the announcement marks only the beginning of what might turn out to be a lengthy and unpredictable process. Obtaining approval from the United States Securities and Exchange Commission is still a significant challenge that we must overcome.

Historically, the Securities and Exchange Commission (SEC) has shown reluctance in endorsing Exchange-Traded Products (ETPs) associated with the leading digital currencies. This hesitation arises from apprehensions about potential market manipulation, extreme price fluctuations, and insufficient investor safeguards.

For Bonk’s ETP to get approved, the SEC would likely need to evaluate several things:

- Market transparency: The SEC would want to ensure that the markets where Bonk tokens are traded are stable, transparent, and resistant to manipulation. Meme coins like Bonk are usually considered especially volatile and speculative, which could raise concerns.

- Investor protection: The SEC’s main job is to protect investors. It would be looking at whether retail and institutional investors have enough information to understand the risks of investing in an ETP with Bonk as the underlying asset. Since meme coins can swing wildly in price, this could be a sticking point.

- Market impact: The SEC would also consider whether introducing a Bonk ETP could disrupt financial markets or create unforeseen risks. It would closely evaluate how an ETP for a meme coin might behave differently from one for more established assets like Bitcoin or traditional stocks.

While Osprey Funds, which is handling the Bonk ETP, has experience with other crypto financial products, including Bitcoin ETFs, that still doesn’t guarantee success.

Even ETP applications for the most well-known cryptocurrencies have faced delays and rejections from the SEC. For example, spot Bitcoin ETFs took years to get approved, and many applications were rejected before the first one was launched in January 2024.

Essentially, the SEC has the power to either endorse, deny, or postpone the approval of the ETP. They might do so if they perceive the potential risks as excessive or if they believe the product falls short of their set criteria.

Bonk’s price action remains flat

Over the weekend, a significant revelation about the debut of the initial meme-based ETP sparked quite a bit of excitement. However, this news didn’t cause a significant change in BONK‘s current market value.

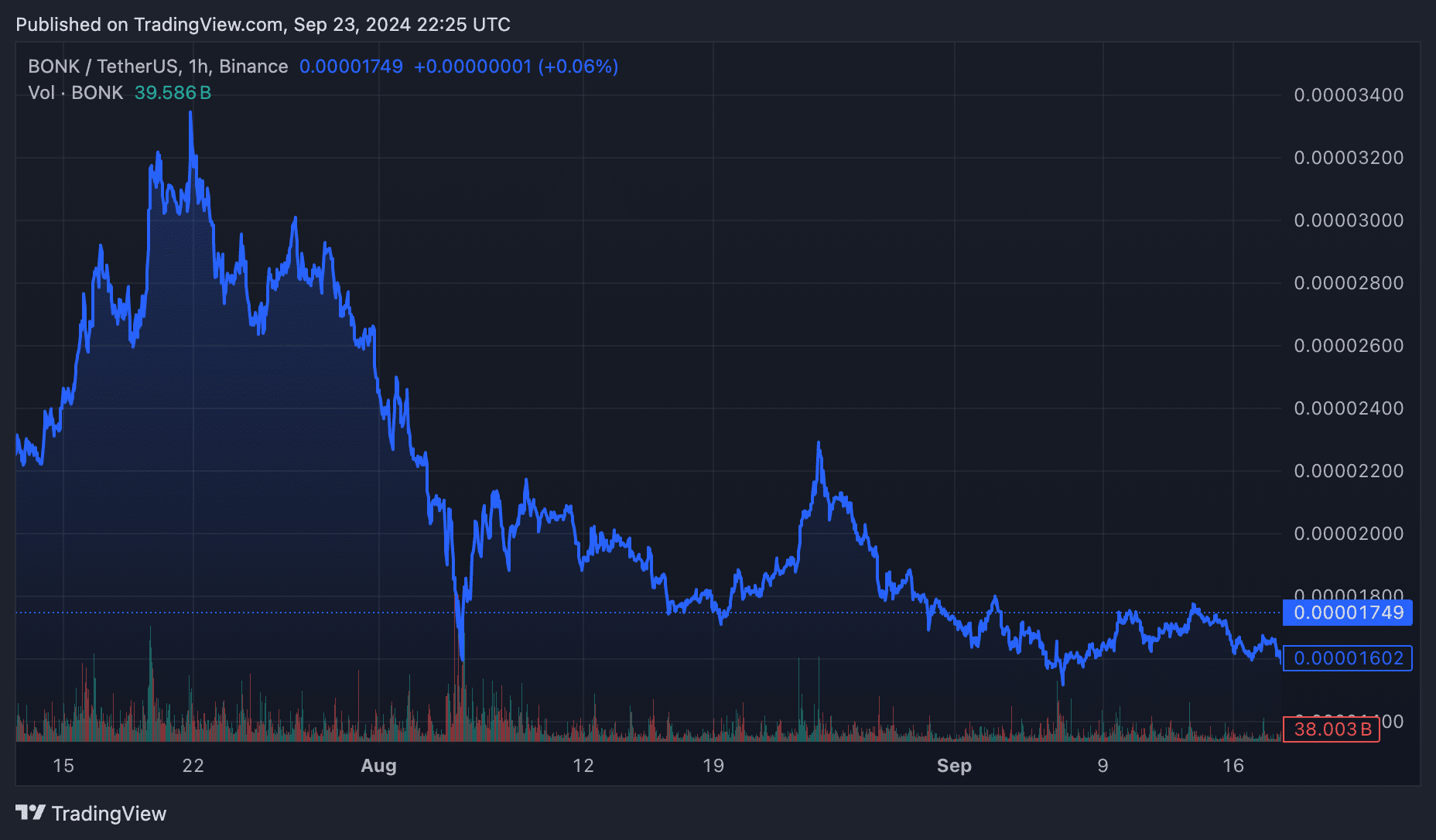

On September 23rd, the price of BONK stands at $0.0000175, marking a 4.3% growth in the last 24 hours and a more significant 8% surge over the previous week. This price hike seems to align with a broader upward trend among meme coins during the past seven days.

Contrary to its rival meme coins, BONK has been moving horizontally lately. On the other hand, Shiba Inu (SHIB) has experienced a stronger price surge, jumping approximately 11% in the last week, currently trading at $0.0000145.

In a similar fashion, PEPE has surpassed BONK by recording gains exceeding 13% during the current week. Conversely, Dogwifhat (WIF) has stood out as the leading meme coin, witnessing a rise of approximately 18% over the past seven days and is currently being traded at $1.75.

Investors who are well-known for diving into extremely risky cryptocurrencies seem to be giving their attention to digital tokens such as SHIB, PEPE, and WIF lately, due to their more dynamic market behavior over the past few days.

As a researcher, I’ve observed that compared to well-known meme coins like Shiba Inu (SHIB) and Pepe the Frog (PEPE), Bonk seems to be less prominent in the crypto landscape. This could potentially indicate that it’s being overshadowed by more established players in the meme coin market.

Currently, the trading activity of BONK is rather quiet. Its price is moving within a fairly narrow band, having dropped from its peak in July and August. Whether this pattern persists or attracts more investor attention as the ETP’s regulatory filing progresses remains to be determined.

Social media’s mixed reactions

The announcement that Bonk is launching an ETP has sparked varied reactions across social media, split between excitement and skepticism.

For certain individuals, this action is seen as a significant advancement. One user of X even described it as “crazy” in a positive sense, emphasizing the potential for Bonk to pioneer the entry of meme coins into the Exchange Traded Fund (ETF) market.

While some believe that traditional financial products based on meme coins are necessary for the industry’s progress, others express reservations. One such individual voiced worry that these efforts might even erode crypto’s credibility. From their point of view, the drive to legitimize meme coins for mainstream finance may primarily serve to artificially inflate the asset’s value for existing holders rather than delivering genuine benefits to the broader cryptocurrency sector.

In my opinion, this appears to be the natural progression towards legitimizing cryptocurrency. Investors, seeking to expand their buyer base and increase their wealth, will likely pursue avenues aimed at validating crypto, making it more attractive to potential investors. However, it’s important to note that this could potentially impact the credibility of cryptocurrencies.

— Enryu (@0xEnryu) September 21, 2024

There’s a concern that such actions might divert attention from crypto’s original purpose, which was to provide decentralized solutions to the conventional, intermediary-based financial system. This could potentially result in speculative market fluctuations rather than fulfilling its intended goals.

Some individuals have voiced a more skeptical perspective, implying that digital currencies such as Bonk might be seeking “additional ways out for market liquidity,” given the increasing rivalry among meme coins.

Since Tron has predominantly assumed the main meme #rugfactory function on Solana, it is necessary for its memes to seek out alternate sources of exit liquidity.

— Ajki (@ajki76) September 21, 2024

Over the next few months, we’ll see if this Exchange-Traded Product (ETP) delivers tangible benefits or if it merely stokes the speculative flames commonly found in meme coins.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-09-24 02:04