As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I must say these recent developments have me a bit concerned, especially when it comes to meme coins. The sell-off continues unabated, with even the biggest names like Brett and Dogwifhat taking a hit.

On Monday, the values of cryptocurrencies persisted in a downward slope, a pattern that has been observed for nearly two weeks straight.

Meme coins sell-off continues

As a market analyst, I’ve observed that the cumulative market capitalization of all meme coins monitored by CoinGecko currently surpasses $38 billion. However, this figure is significantly lower compared to its year-to-date peak, which stood at over $68 billion.

Examining their graphs more closely reveals a strong relationship between them. Each asset, as you’ll notice, has experienced a decline over the last five days, with all of them dipping by more than half from their peak value this year.

-

Bitcoin (BTC) was stuck below $60,000 while most meme coins continued their steep downfall.

Dogwifhat (WIF) token has dropped for five consecutive days and is down by over 51% from its highest point this year.

Similarly, Brett (BRETT), the biggest meme coin in the Base Blockchain, has retreated for five days, is down by 60% from its all-time year. Long-term holders have lost over $1 billion as its market cap has dropped from over $1.89 billion to $794 million.

Bonk (BONK), the first Solana (SOL) meme coin was also one of the worst-performing cryptocurrencies on Aug. 17 as it has retreated by 63% from its March highs.

Pepe (PEPE) has also moved to $0.0000071 after falling for several straight days.

Additionally, technicals suggest that these tokens have more room to go down.

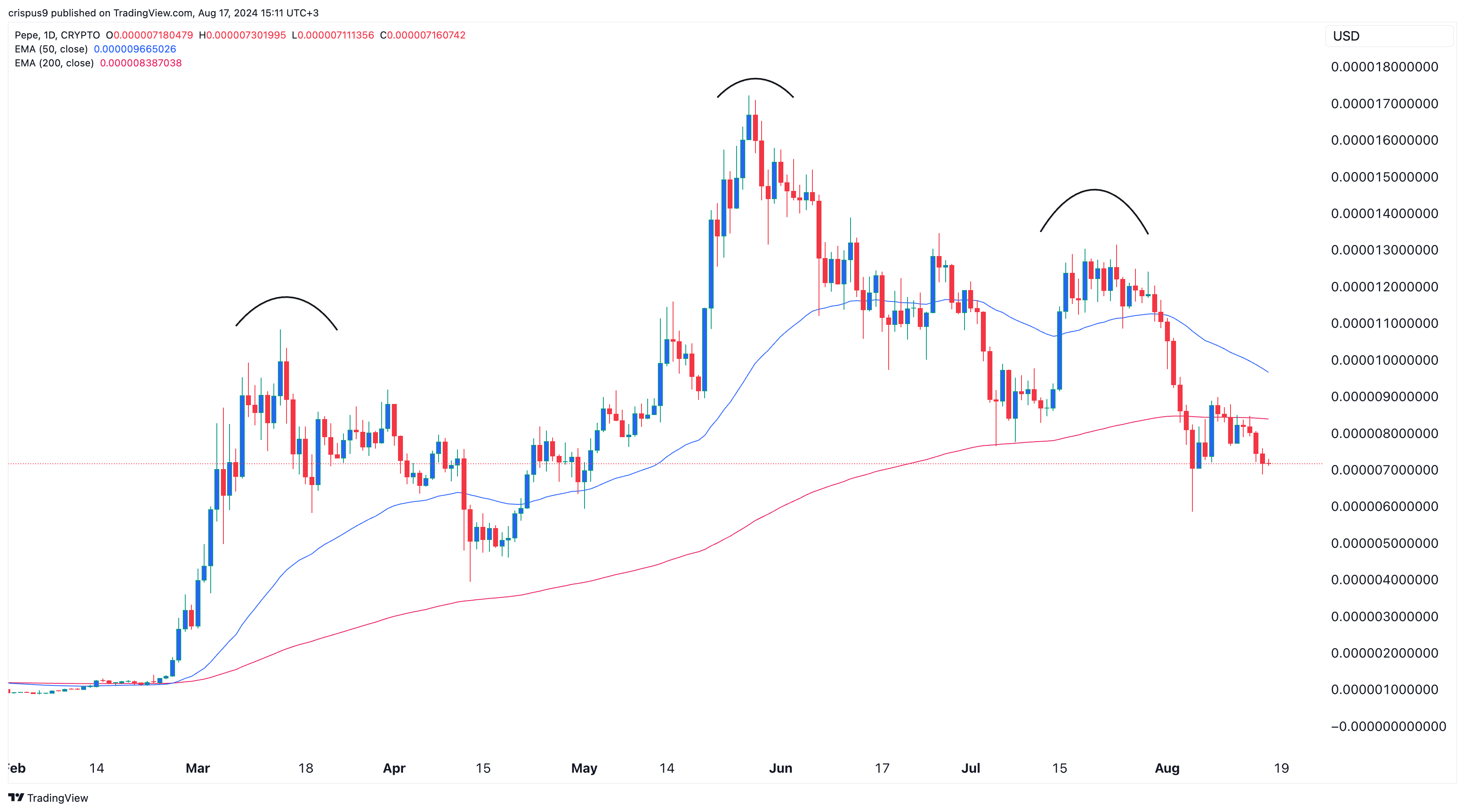

Pepe death cross and head and shoulders pattern

On July 31st, the meme coin Pepe saw a drop and fell below its 50-day moving average. Then, on August 11th, it dipped even further beneath the 200-day Exponential Moving Average (EMA). If this downward trend persists, there’s a possibility that Pepe may develop what’s known as a “death cross,” which is typically followed by increased upward movement.

As a researcher, I’ve noticed that the price action of Pepe resembles a classic head and shoulders pattern, which is often associated with a potential downtrend in financial markets.

The main driving factor for these meme cryptocurrencies is Bitcoin, which has failed to break through $60,000 this week and shows signs of a potential downturn. If Bitcoin continues to decline, it’s likely that meme coins will follow suit, aiming to reach their lowest points from August.

Historically, meme coins often display dramatic movements that mirror Bitcoin’s trends. To illustrate, Pepe skyrocketed more than 1,500% between January and March as Bitcoin increased by over 80% within the same timeframe. However, since then, Pepe has dropped more than 50%, while Bitcoin has only decreased by 20% compared to the same period.

Investors often switch to meme coins such as Pepe, Doge, Bonk, and Brett when Bitcoin increases in value due to their lower cost compared to Bitcoin.

Rather than investing in Bitcoin, priced at nearly $60,000, many traders prefer to buy tokens such as Pepe, which are available for just 0.0000071 USD. The rationale behind this is that these lesser-known tokens may offer a greater likelihood of doubling in value compared to Bitcoin.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Black Myth: Wukong minimum & recommended system requirements for PC

2024-08-17 19:56