As a seasoned crypto investor with a keen interest in the decentralized finance (DeFi) sector, I find the recent surge in the total value locked (TVL) of real-world asset (RWA) protocols quite intriguing. According to Messari’s report, the RWA market has grown by nearly 60% between February and April, reaching close to $8 billion. This growth is primarily driven by investors seeking high-yield opportunities in lending within this sector.

As a crypto investor, I’ve noticed an intriguing development based on a recent finding from Messari, a reputable research firm in the cryptocurrency space. Specifically, they reported that the total value locked within real-world asset protocols experienced a significant surge between February and April – approaching a 60% increase.

Based on the data in the report, the real-world asset market held approximately $8 billion worth of assets as of April 26. The industry’s recovery is attributed to surging demand for investment opportunities offering attractive returns, primarily within the lending sector.

As an analyst, I’ve reviewed the document outlining the Total Value Locked (TVL), which encompasses securities, commodities, real estate tokenization protocols, bond-backed stablecoins, among other assets. Notably absent from this definition are fiat-backed stablecoins like Tether (USDT) and Circle (USDC).

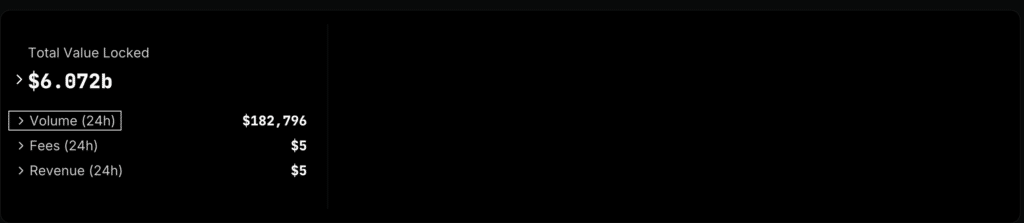

According to DefiLama’s on-chain analytics, the total value locked in decentralized finance (DeFi) currently stands at approximately $6.07 billion. This represents a substantial increase of around 700% since the beginning of the year. Amongst the leading players in this sector, Etherna holds the top spot with a market capitalization of roughly $2.32 billion.

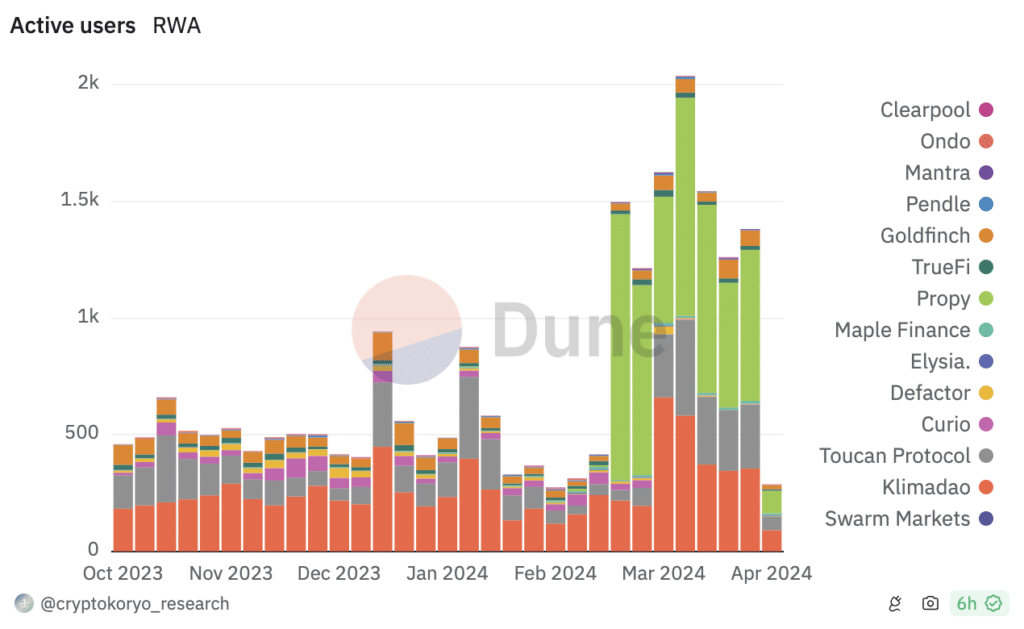

Starting from February 2024, there has been a significant rise in the number of active users employing RWA (Rapid Withdrawal and Access) protocols. According to Dune Analytics’ recent data, this figure surpassed 2,000 by early April. Notably, projects like Toucan and KlimaDAO, alongside real estate tokenization platform Propy, have been the primary contributors to this influx.

As a crypto investor, I’ve taken note of K33 Research’s recent report indicating an escalating trend in the RWA tokenization narrative within the cryptocurrency space. This development has piqued my interest and may warrant further exploration, especially since Chainlink’s native token, LINK, could potentially benefit from this growing hype.

David Zimmerman’s report reveals that RWA faces numerous challenges preventing it from fully realizing its capabilities. Yet, an intriguing story surrounding RWA could ignite a separate crypto market surge prior to significant real-world application by RWA.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-05-01 17:44