As a seasoned researcher who has closely followed the crypto market for years, I must say that December 30th is shaping up to be an exciting and potentially game-changing day for the European crypto industry. The long-awaited MiCA regulation promises to bring clarity and consistency to the industry across the trading bloc, a move that is desperately needed given the fragmented nature of existing regulations in member states.

The MiCA regulation will provide European cryptocurrency companies with definitive guidelines to navigate by, yet it might pose a challenge to the global supremacy currently held by the largest issuer of stablecoins.

December 30 is shaping up to be a big day in the crypto calendar.

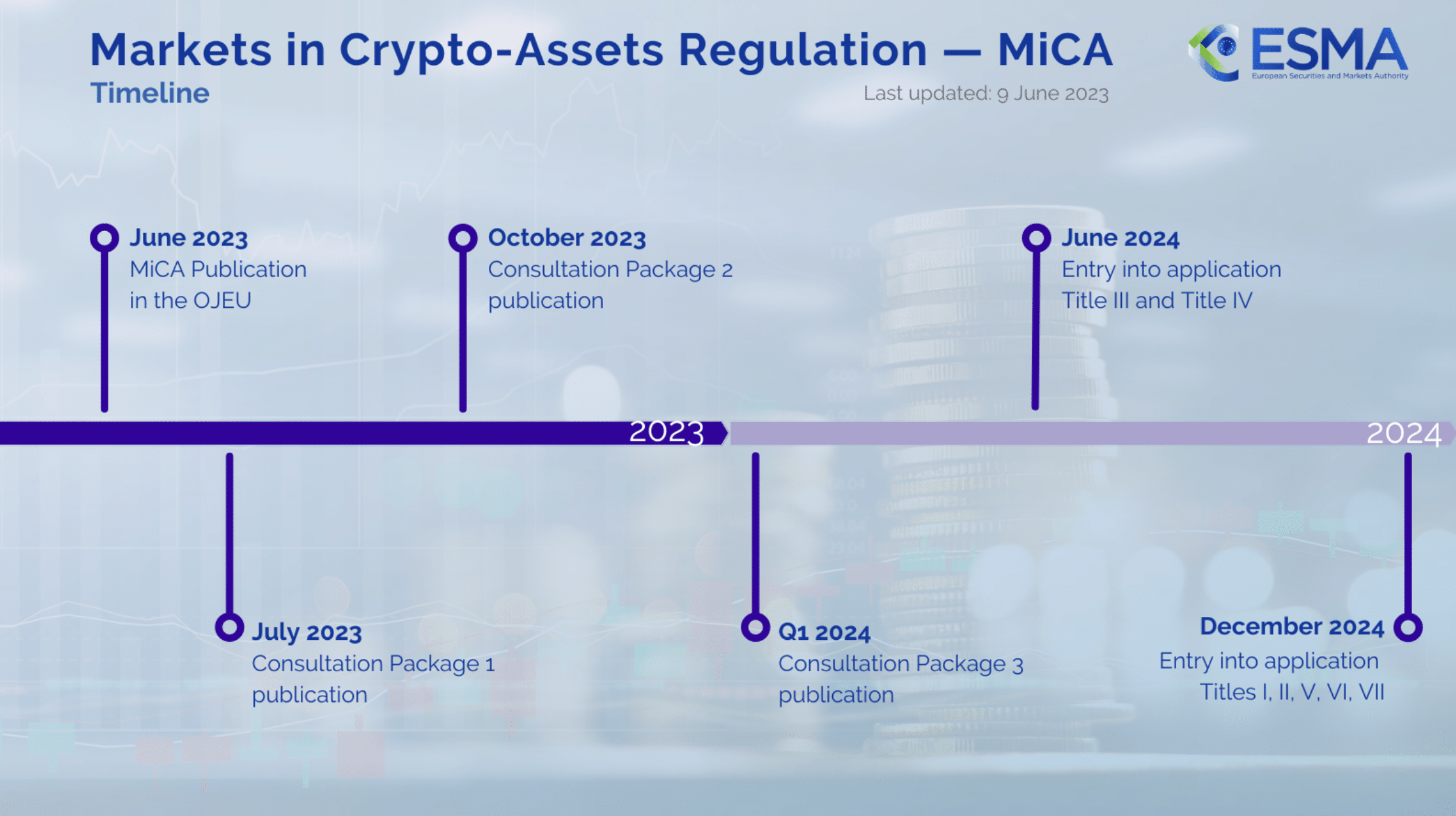

It’s at this point that the European Union’s eagerly anticipated Markets in Crypto-Assets Regulation (MiCA) is expected to be enacted.

A key objective is to establish uniform guidelines for the trade sector within the economic union, simultaneously ensuring stronger consumer safeguards.

Politicians’ recent statements suggest they aim to bring an end to the lawless era often associated with cryptocurrency, a development that has been met with approval from businesses within the industry who have sought consistent regulations for quite some time.

Previously, cryptocurrencies have frequently fallen under the purview of older securities regulations, some of which date back several decades.

In a different approach, the MiCA regulation modifies existing laws to address emerging digital assets like stablecoins, which are linked to the value of traditional currencies.

These specific rules could create a strong ripple effect within the industry, possibly challenging the supremacy of the globe’s leading stablecoin publisher.

Currently, Tether (USDT) significantly outperforms other competitors in terms of market capitalization, standing at approximately $119.7 million. This figure is nearly four times greater than the next largest contender, USD Coin (USDC).

However, Tether is encountering an issue: At present, they don’t have the e-money license needed to function within the European Union, and there’s uncertainty about whether their digital assets adhere to the guidelines set by MiCA (Markets in Crypto-Assets).

Simultaneously, Circle – the organization that handles both USDC and EURC (euro-centric stablecoins) – successfully met regulatory requirements following the acquisition of a license in France.

For Tether, the challenge lies in meeting compliance requirements which could significantly increase the amount of reserves kept in conventional bank accounts instead of U.S. Treasuries. This shift might diminish the company’s profit margins due to reduced investment opportunities in government securities.

In July, it was disclosed that the company’s combined direct and indirect holdings in Treasuries amounted to a staggering $97.6 billion. This figure surpasses that of significant economies such as Germany and Australia. Consequently, this massive exposure resulted in an astounding net profit of $5.2 billion from January through June.

By the end of this year on December 30th, Coinbase has previously announced they will remove non-compliant stablecoins from their European platforms, potentially dealing a significant setback to Tether if they don’t sort out their required documentation.

But this is just one facet of how Europe’s crypto industry is evolving as MiCA looms.

The winners and losers of MiCA

Marina Markezic serves as both co-founder and executive director of the European Crypto Initiative, an organization dedicated to amplifying industry voices within Brussels. In an interview with crypto.news, she expressed that MiCA (Markets in Crypto Assets) represents a significant leap forward for the trading bloc, positioning it advantageously against other global markets.

In the European Union, a thriving cryptocurrency sector exists, comprised of robust, expanding companies catering to EU residents for quite some time. Unlike other markets, the crypto industry in the EU doesn’t have a single definition due to differing regulations among member states. Before MiCA, there was no common interpretation of what constitutes a cryptoasset, and even less consensus about what a cryptoasset service is or how it should be regulated.

Markzic clarified that there’s a growing tendency towards consolidation within the crypto industry due to recent regulations. This consolidation isn’t just visible through significant acquisitions like Robinhood buying Bitstamp, but it also means that numerous businesses working in this field are becoming more similar as they face extensive legal obligations and stringent requirements.

Just as anticipated when we initially reviewed the preliminary version of MiCA in 2020, it appears that the established and major players will reap the greatest advantages from MiCA, while smaller entities may struggle excessively under its requirements. This strain could potentially disrupt their operations and compel them to significantly revise their services or even their entire business model.

The European Crypto Initiative thinks it’s essential to have more detailed explanations about certain MiCA regulations, as there are still uncertainties regarding the obligations of stablecoin issuers and trading platforms.

Additionally, there’s a great deal of ambiguity concerning the fundamentals, like what specific actions fall under MiCA regulation. For instance, initiatives providing services in a decentralized way, without any third parties involved.

Nevertheless, Markezic asserts that the EU is pioneering a novel path in cryptocurrency, demonstrating less stagnation compared to the situation across the Atlantic where the Securities and Exchange Commission faces criticism for its “enforcement-based regulation” strategy.

At present, the European Union (EU) offers a greater degree of regulatory transparency regarding cryptocurrencies compared to several other regions, notably including the United States. The ongoing debate over whether digital assets like Ethereum and Bitcoin will be classified as securities illustrates this discrepancy — in the EU, such questions are addressed through the Markets in Crypto-Assets (MiCA) regulation.

Markets expert, Markezic, points out that discussions revolving around tokenizing real-world assets are currently a focal point in the European Union. This emerging technology, when combined with stablecoins, represents some of the strongest applications of cryptocurrency within the region.

Indeed, it’s possible that Tether, Circle, and similar entities might face competition from a unified central bank digital currency across the EU. At this stage, Brussels is considering whether to introduce such a currency, but like in other regions, there are concerns about its potential impact on consumer privacy and its potential use for surveillance purposes.

As an analyst, I find myself grappling with the contentious nature of the digital euro discussion, which seems to be stalled due to its political complexity. However, one thing that is clear is that blockchain technology will not be incorporated in the development and implementation of this project. This revelation has noticeably diminished enthusiasm towards it within the crypto industry, as they had been anticipating a potential integration of their preferred technology.

Over the next two-and-a-half months, the pace is going to pick up significantly as cryptocurrency firms gear up for MiCA implementation. Since the EU houses approximately 450 million residents, this regulation will leave a lasting impression on investors across various countries such as Croatia, Cyprus, Spain, Sweden, Germany, and Greece.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-10-17 14:07