As an analyst with over two decades of experience in the financial industry, I must admit that MicroStrategy’s relentless Bitcoin buying strategy under Michael Saylor leaves me both impressed and intrigued. Having seen numerous market trends come and go, I can say with confidence that this is one of the most audacious moves I’ve ever witnessed in corporate finance.

Software developer MicroStrategy, under the leadership of Michael Saylor’s ambitious Bitcoin acquisition approach, has boosted its Bitcoin reserves significantly, now owning more than 331,200 Bitcoins.

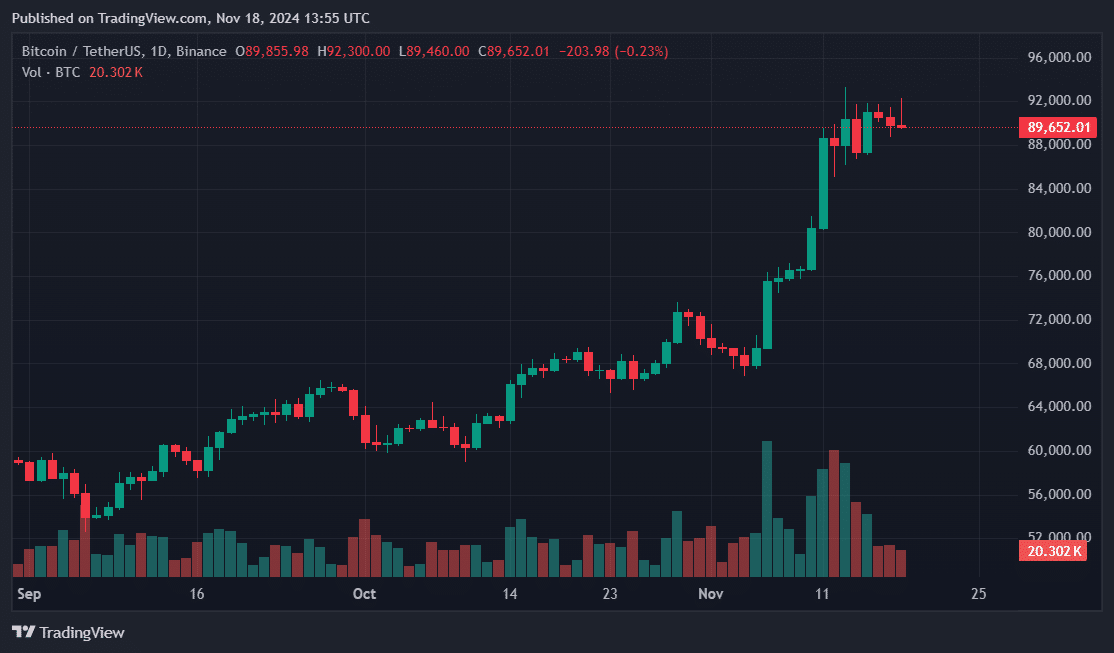

As per the recently released documents, MicroStrategy just purchased a whopping $4.6 billion worth of Bitcoin (BTC). This new acquisition more than doubles their previously disclosed purchase from last week. The company obtained 51,780 BTC at an average price of approximately $88,627 per coin, as reported by the company’s executive chairman and founder, Michael Saylor.

MicroStrategy recently purchased approximately 51,780 Bitcoins for around $4.6 billion, which equates to approximately $88,627 per Bitcoin. This acquisition has resulted in a quarter-to-date (QTD) Bitcoin Yield of 20.4% and a year-to-date (YTD) yield of 41.8%. As of November 17, 2024, we hold about 331,200 Bitcoins that were acquired for around $16.5 billion, with each Bitcoin costing approximately $49,874. The ticker symbol for MicroStrategy is $MSTR.

— Michael Saylor⚡️ (@saylor) November 18, 2024

On November 18th, MicroStrategy’s average purchase price for Bitcoin was only around 4% lower than its record high of $93,477. To date, this firm has invested a total of approximately $16.5 billion in Bitcoin, and as a result, it now possesses over $13 billion in potential profits from its cryptocurrency holdings.

In 2020, after the worldwide pandemic, Saylor initially outlined his Bitcoin acquisition plan. Since that time, MicroStrategy has grown to be the biggest corporate owner of BTC, accumulating approximately $30 billion worth of the cryptocurrency.

Mastercard’s Bitcoin strategy now includes one of Wall Street’s most daring capital-gathering plans: Saylor intends to collect $42 billion over the next three years to acquire more Bitcoin. The company has already leveraged loans, debt, and stock sales to finance what could potentially be an unending cycle of Bitcoin purchases.

Over a span of four uninterrupted years, Saylor’s MicroStrategy outshone most private organizations and some countries, such as the United States, due to persistent acquisitions. Increasingly, other businesses are embracing this idea, integrating Bitcoin into their financial records and investment portfolios.

In May, Semler Scientific revealed their Bitcoin Treasury plan. Last week, artificial intelligence pioneer Genius Group made its initial Bitcoin purchase, and Thumzup Media Corp followed suit in November. Metaplanet from Tokyo currently holds more than 1,000 Bitcoins and has declared intentions to further expand its Bitcoin holdings.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- The 15 Highest-Grossing Movies Of 2024

2024-11-18 17:13