As a seasoned crypto investor with over two decades of market experience under my belt, I find MicroStrategy’s (MSTR) performance in the third quarter to be nothing short of remarkable. The company’s strategic approach towards Bitcoin and its aggressive buying spree have set it apart from other players in the game, attracting heavyweight institutional investors like Vanguard, Morgan Stanley, and Capital International Investors.

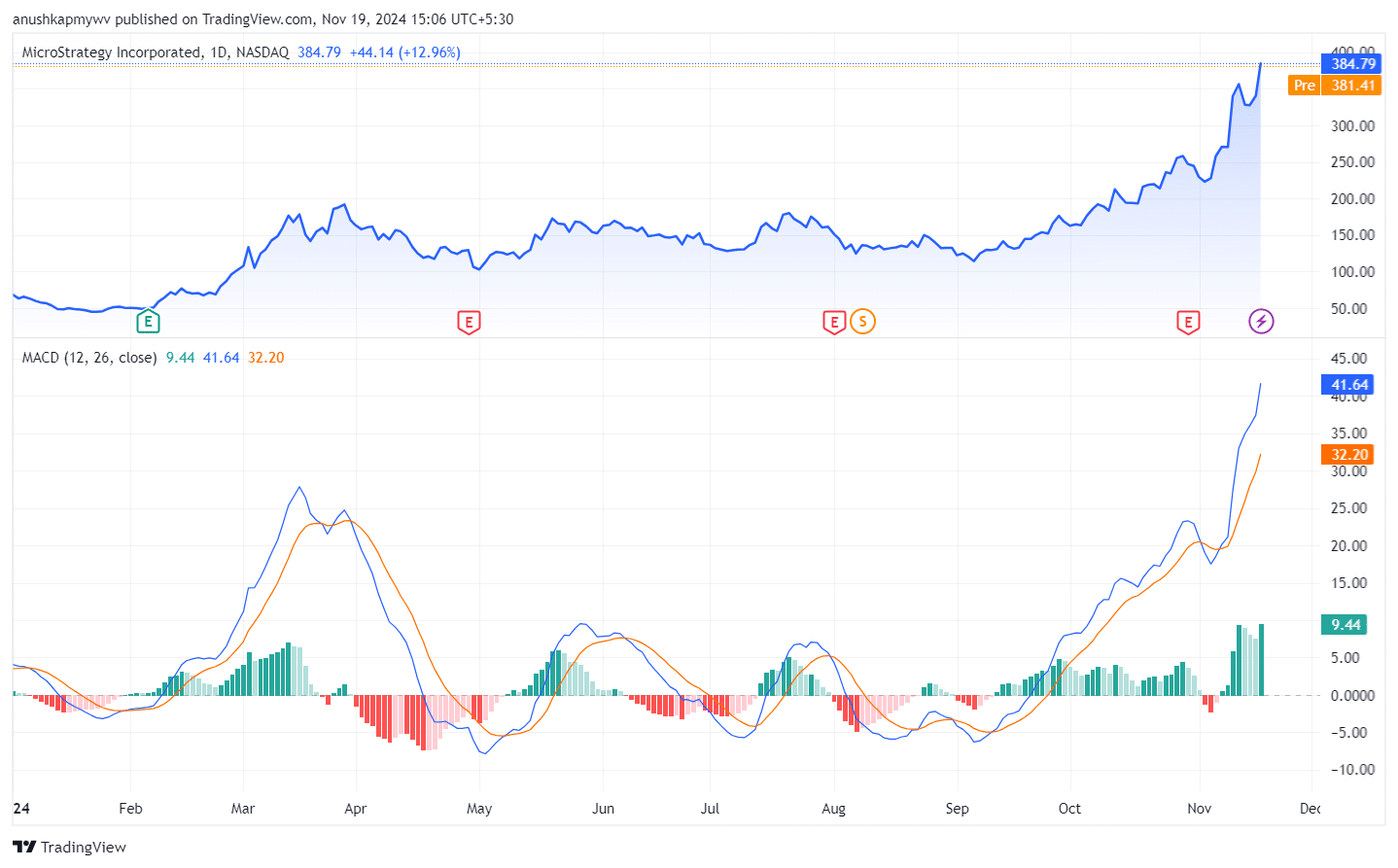

In simple terms, shares of MicroStrategy (symbol MSTR) have surged by an impressive 450% so far this year, outperforming Bitcoin‘s increase of 110% during the same timeframe. This remarkable growth has captured the interest of prominent Wall Street investors such as Vanguard, Morgan Stanley, and Capital International Investors.

MicroStrategy, currently holding the most Bitcoin among corporations globally, owns approximately 331,200 Bitcoins, valued at around $29.7 billion. This follows a substantial purchase of $4.6 billion on Monday, setting a new record for the largest one-day acquisition in their history.

The latest 13F report submitted by MicroStrategy to the Securities and Exchange Commission shows an increase in institutional investors, rising from 667 to 738. These investors now collectively hold a value of $15.3 billion as of September’s end.

In Q3, both Vanguard Group and Capital International Investors significantly boosted their holdings of MSTR by approximately purchasing 16 million shares each, representing a 10-fold increase compared to the previous quarter. Similarly, Morgan Stanley increased its investment with the acquisition of 8 million shares, marking a five-fold rise from the prior quarter. Goldman Sachs and Bank of America followed suit by adding 696,000 and 766,000 shares respectively, extending their substantial buys made throughout the last year. Notably, State Street and Susquehanna International Group, a global quantitative trading firm, jointly bought 5.3 million shares.

Despite the recent investments being a minor part of these companies’ overall portfolios, an increase in investment in MSTR indicates rising faith in MicroStrategy’s position within the cryptocurrency market. In the most recent trading, MSTR closed at $384 per share, resulting in a market capitalization of approximately $78 billion, a jump of 12.96%. Meanwhile, Microsoft saw a minimal increase of 0.18%, Tesla stocks climbed by 5.62%, and Nvidia experienced a decline of 1.29%. Given its Bitcoin-centric approach, MicroStrategy currently outshines the others in this context.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-11-19 15:09