Ah, greetings, crypto-cognoscenti and dabblers alike! Here’s your US Morning Crypto News, fresh as a daisy and twice as puzzling. ☕️

Fetch yourself a cuppa and peer into the curious case of Bitcoin (BTC), the digital dodo trying to convince us it’s anything more than a high-stakes gamble. Once heralded as that trusty umbrella in the rainstorm of inflation, it now scuttles nervously, thanks partly to institutional puppeteers twisting the strings.

The $555 Million Bitcoin Blitzkrieg: Will Michael Saylor’s Strategy Launch BTC Beyond $90,000?

Picture Michael Saylor, Strategy’s dashing chairman (formerly called MicroStrategy but no longer quite as restrained), swiping his corporate Amex for a cool 6,556 shiny Bitcoin tokens, worth around $555.8 million. This cerebral splurge has puffed up Strategy’s Bitcoin yield to a sprightly 12.1% so far in 2025. Bravo, old sport!

“MSTR has bagged 6,556 BTC at the princely sum of roughly $84,785 per coin, racking a YTD 12.1% yield for 2025. Donning his monocle of numbers, Saylor notes that as of April 20th, Strategy cradles a hoard of 538,200 Bitcoins, amassed at an average price near $67,766. Quite the digital nest egg,” Saylor chirped with all the modesty of a cat with cream.

The company gauges glory through the Bitcoin Yield YTD—basically how much their holdings per share have ballooned since the first daring purchase in August 2020. A pinnacle of financial acumen, or perhaps digital bravado, depending on your inclination.

This blitzkrieg of Bitcoin buying dovetails nicely with a bullish mood in the market, where Bitcoin tiptoes nearer to the tantalizing $90,000 mark, leaving investors either bated or baffled. The plot thickens.

Although Bitcoin’s price clocked a gentle 3% jog in the past day—a veritable moonwalk compared to its usual trapeze act—it remains twitchy as a cat in a room full of rocking chairs, especially when economic news flashes like a fire alarm.

Our roving reporter nudged Innokenty Isers, the chief honcho of Paybis, who offered insights about this grand rollercoaster. “Tech stocks dominate the scene, and so when trade policies and government tomfoolery waltz into Nasdaq’s dance floor, the effect ripples across markets like a bothersome but inevitable sneeze,” he mused.

“Post-presidential inauguration, Bitcoin’s rep has shifted. Once, it was ‘Daddy, can I be your inflation shield?’ Now, it’s more like, ‘Sure, come dance with me—but only if you like a bit of risk,’” said Isers, with a twinkle that suggested he’d seen one too many charts upside down.

Shrinking Like Your Last Good Idea at a Cocktail Party

Meanwhile, in the realm of equities, Strategy has experienced a curious twist. Saylor reveals that by Q1 2025, over 13,000 institutions and 814,000 retail folks had made MSTR their financial pen pal. Meanwhile, a whopping 55 million indirect investors peek at MSTR through ETFs, pensions, and mutual-fund-shaped kaleidoscopes.

“Yes, 55 million indirect voyeurs,” Saylor confided, because who doesn’t like to peek at something that might go up—or plunge spectacularly?

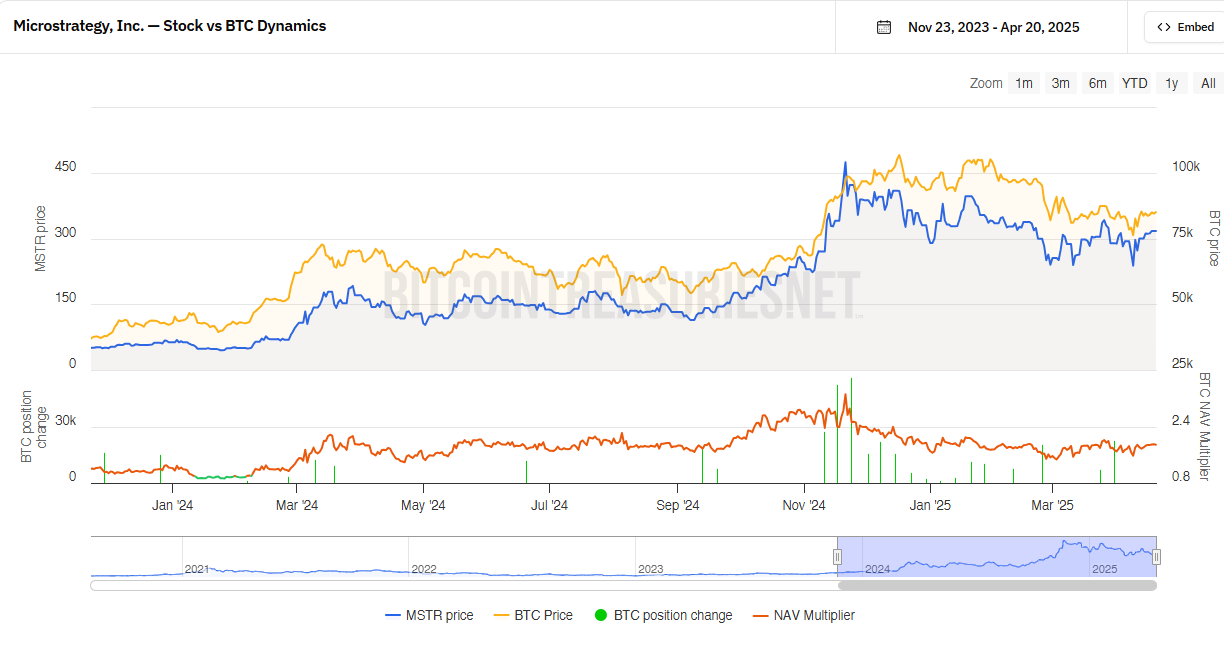

Data from Bitcointreasuries.net narrates a tale of a shrinking premium: investors used to pay extra just for the glamour of Bitcoin exposure. Now, the price gap between MSTR shares and their Bitcoin treasures has narrowed, as if reality itself tossed a wet blanket over the party.

Back in 2024, investor enthusiasm was as bubbly as summer lemonade, willing to pay a pretty penny extra for the MSTR ticket. Those heady days appear to have tempered into the prudence of a vintage wine tasting.

“Now, your government buying MSTR? I’d say it’s like trying to sweet-talk a predatory cat—not impossible, but tricky. Plus, good luck finding institutions ready to part with their Bitcoin treasures en masse,” an analyst quipped, presumably while lighting a cigar.

The shrinking NAV multiplier hints the market is pivoting away from wild Bitcoin frenzy towards sober valuation of MicroStrategy’s actual bricks and mortar—albeit digital ones.

Chart of the Day: When Bitcoin Sneeze, MSTR Catches a Cold

This charming chart reveals the intimate dance betwixt Strategy’s stock price (in dashing blue) and Bitcoin’s gyrations (fiery orange). When Bitcoin perks up, MicroStrategy pirouettes not just in step but with extra flair and flair alone.

Yet, the narrowing of the NAV multiplier means the stock prefers the company of Bitcoin’s true valuation, rather than an overexcited tailspin of speculation. This maturing fondness is perhaps the most grown-up thing the crypto-world has seen in some time.

Crypto Equities Pre-Market: The Usual Suspects, Plus One or Two Curveballs

Company At the Close of April 17 Pre-Market Overview Strategy (MSTR) $317.20 $323.49 (+1.98%) Coinbase Global (COIN) $175.03 $175.85 (+0.46%) Galaxy Digital Holdings (GLXY.TO) $15.36 $15.12 (-1.41%) MARA Holdings (MARA) $12.66 $12.83 (+1.34%) Riot Platforms (RIOT) $6.49 $6.52 (+0.54%) Core Scientific (CORZ) $6.61 $6.59 (-0.27%)

Read More

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2025-04-21 17:26