As a seasoned researcher who has witnessed the highs and lows of the cryptocurrency market for over a decade, I find myself both disheartened and amused by the latest news from Mt. Gox. The fact that this bankrupt exchange continues to delay the repayment of its creditors is not only frustrating but also baffling given the billions of dollars worth of Bitcoin they still hold.

The struggling cryptocurrency platform, Mt. Gox, has delayed yet again the date when it will pay back its creditors. This means that some of those affected by its downfall will have to wait until the following year before they can receive their money.

As a researcher, I’ve recently uncovered that while the majority of creditors have successfully received their initial and early payments, there are still some outstanding cases. These instances involve either incomplete procedures or various issues that have arisen. Consequently, the repayment deadline has been extended from October 31, 2024, to October 31, 2025, to ensure all parties can meet their obligations effectively.

To meet the goal of paying back the creditors involved in the rehabilitation process as much as practically possible, the Rehabilitation Trustee has requested and received court approval to move the repayment deadline from October 31, 2024 (Japan Standard Time) to October 31, 2025 (Japan Standard Time).

Table of Contents

Market remains calm after news from Mt. Gox

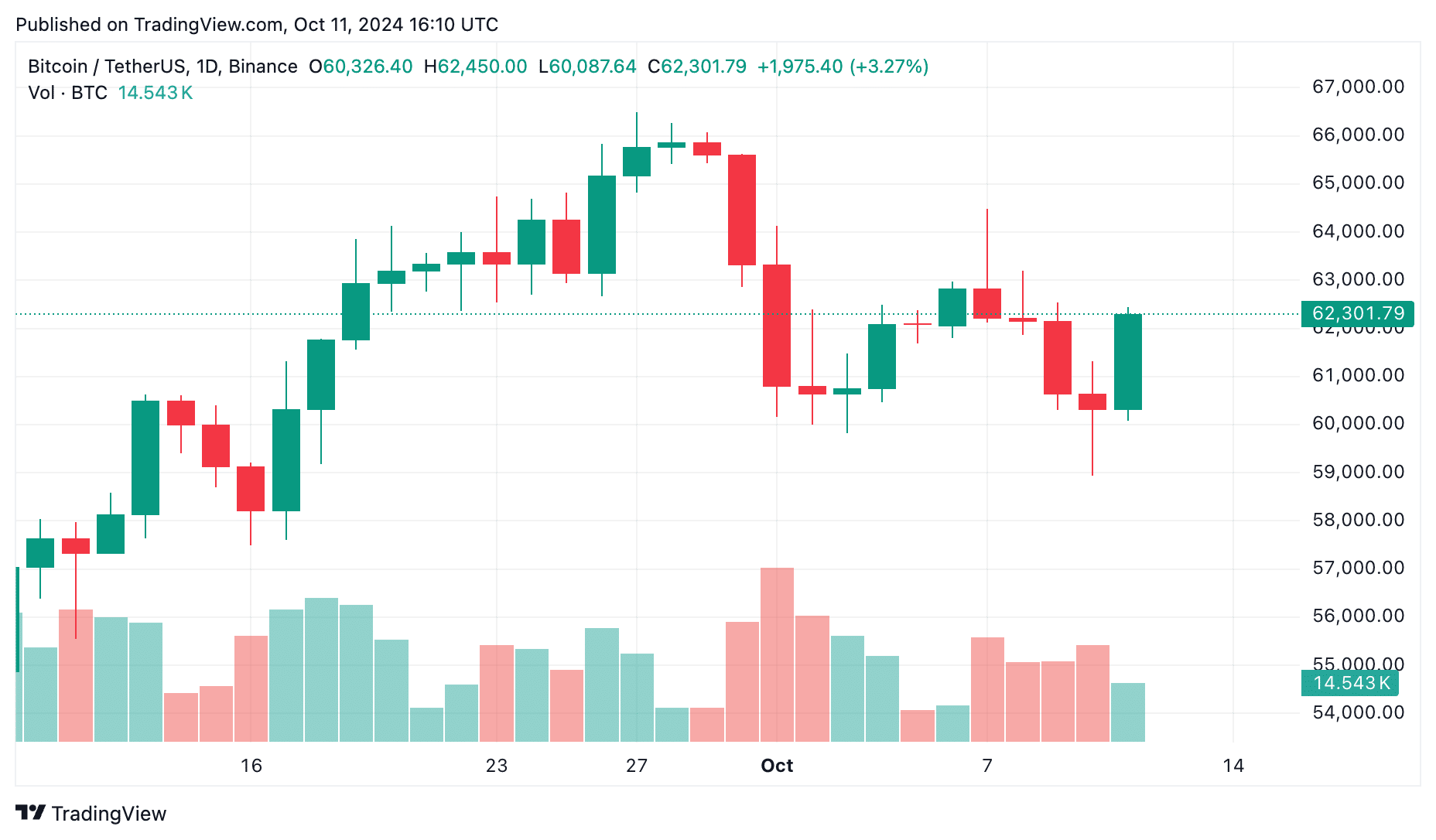

Currently, Bitcoin (BTC) hovers near $61,000, experiencing minimal growth of approximately 0.9% over the past day. The recent news from Mt. Gox seems to have had little impact on the market so far.

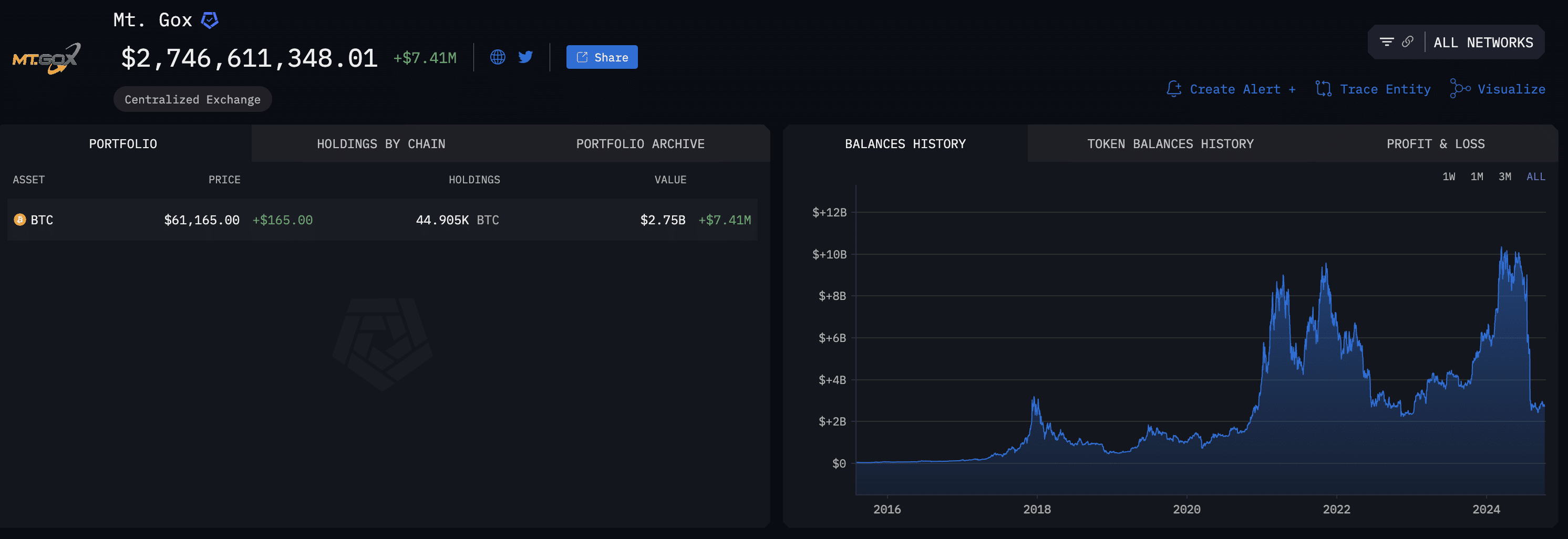

As reported by Arkham, the digital wallet associated with Mt. Gox is presently storing about 44,905 Bitcoins, which amounts to over $2.7 billion in value.

In the past, this exchange has shifted its Bitcoin holdings, such as transferring $8.7 billion worth on May 28 in anticipation for the first creditor payments. By the end of July, Mt. Gox moved an additional 37,477 BTC, valued at $2.5 billion, and reported that about 60% of creditor payouts had been processed.

New growth driver for October or disappointment?

As an analyst, I’ve noticed that within the cryptocurrency community, there’s been ongoing apprehension regarding potential payment issues from exchanges, which some fear could lead to a significant drop in Bitcoin’s value and trigger a cascade of sell-offs across the crypto market.

It’s not unusual to hear that Mt. Gox payment delays have been extended. In fact, such deadlines are often pushed back by crypto exchange creditors, and this recent announcement of another delay didn’t spark much excitement within the community.

“Till now, Uptober is looking like Rektober.”

Wise Advice

According to Eljaboom, the recent news regarding Mt. Gox serves as an additional catalyst for the expansion of the cryptocurrency market. In his viewpoint, a mix of elements such as the backing of U.S. presidential candidate Donald Trump and worldwide interest rate reductions contribute to market growth and create a positive momentum in the market.

Mt. Gox’s repayment schedule has been delayed:

— Elja (@Eljaboom) October 10, 2024

Why haven’t Mt. Gox clients been able to get their money for 10 years?

In recent times, the cryptocurrency market has seen numerous ups and downs and shifts, with one of its most significant events being the Mt. Gox exchange incident. This online trading platform was established in 2010 and at a certain point, it held the distinction of being the world’s largest for bitcoin transactions.

In 2014, it filed for bankruptcy, resulting in the loss of over 850,000 customer Bitcoin worth around $450 million. Since then, efforts to repay investors have persisted, but recent news about payment delays has once again sparked interest among investors and experts.

The bankruptcy of Mt. Gox sparked numerous intricate legal disputes, leading creditors and investors into prolonged court battles that lasted for several years. Since the processes to establish ownership over cryptocurrency assets don’t always align with conventional laws, it introduced further complications.

Tracking down and dispensing assets necessitates determining ownership, a process that requires care and time. Cryptocurrencies can be spread across multiple addresses and wallets, making the return of funds more challenging. Furthermore, ensuring the safety and transparency of transactions on a platform demands significant technical expertise, and developers must create and test this infrastructure. On the other hand, some investors might find comfort in delays in payouts.

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2024-10-11 19:26