As a seasoned analyst with over two decades of experience in the tech and finance industries, I find myself intrigued by the recent developments surrounding Near Protocol (NEAR). My years spent navigating the tumultuous waters of blockchain technology have taught me to always keep an eye on significant updates like the Nightshade 2.0 launch and upcoming events such as Nvidia’s earnings report.

Over the past two days, I’ve noticed a pullback in my crypto investments, possibly due to the recent launch of Nightshade 2.0 on the mainnet and the anticipation among traders for Nvidia’s upcoming earnings report.

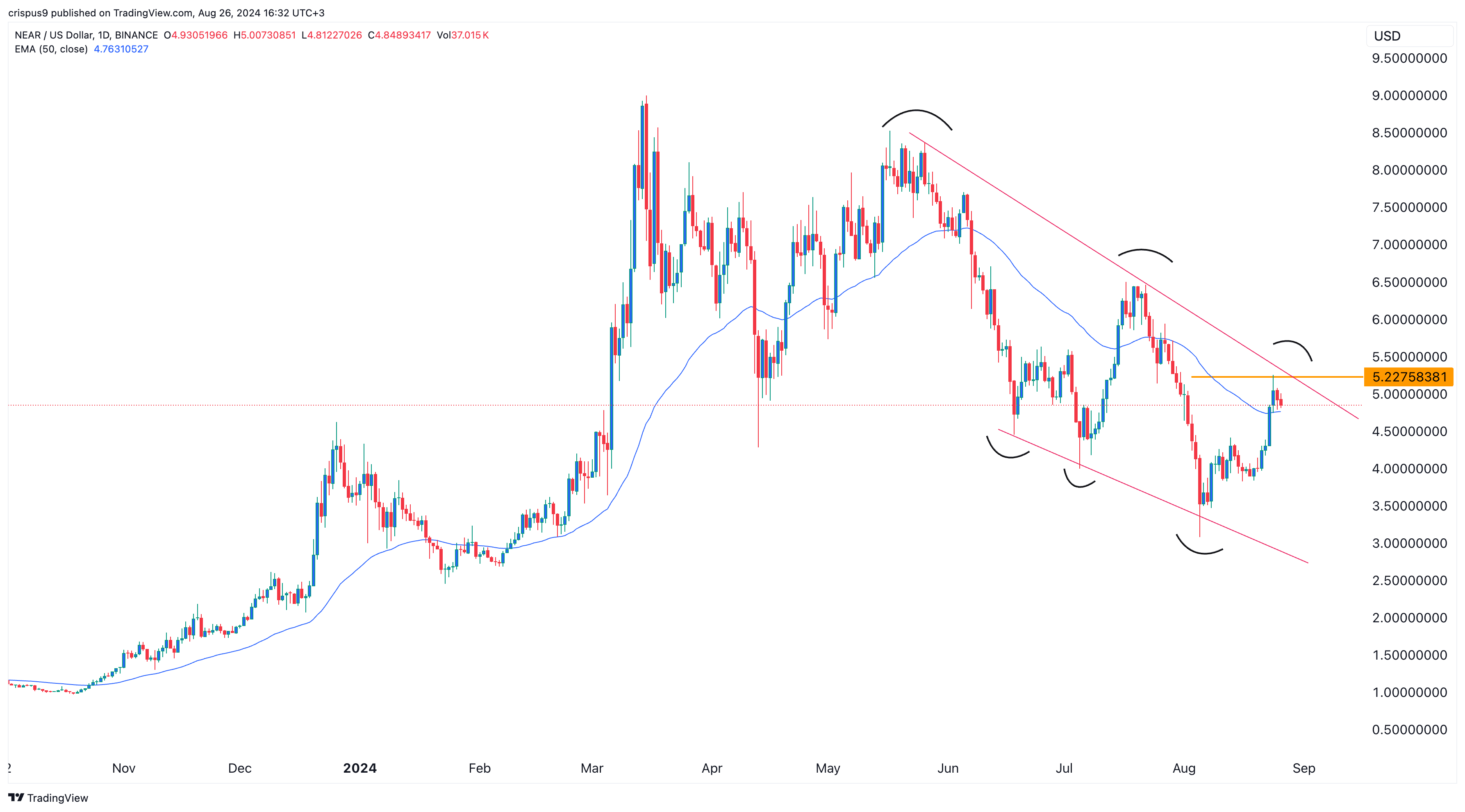

NEAR has dropped to $4.83, a decrease from its peak of $5.22 last week. Despite this, it still hovers slightly above its 50-day moving average and is about 57% higher than its lowest point this month.

Near DeFi inflows jump

Upon scrutiny, it becomes clear that many decentralized applications (dApps) within Near’s DeFi ecosystem have seen significant increases in funding over the last several weeks.

Over the past week, the amount flowing into Burrow, which resembles AAVE, increased by 23%, reaching a total of $160 million.

Correspondingly, deposits into liquid staking platforms such as Linear Protocol, Meta Pool, Here Wallet, and AllStake have risen by more than 25% within the specified time frame.

In summary, the Total Value Locked (TVL) on Near Protocol has reached an all-time high of approximately $654 million since July. Translated into Near Protocol’s native currency, the TVL now amounts to about 47.6 million NEAR tokens.

Question: What caused the significant surge in TVL for Burrow Finance on NEAR Protocol within the last seven days?— The Smart Ape 🔥 (@the_smart_ape) August 26, 2024

It’s probable that this bounce back stems from the latest release of Nightshade 2.0, which incorporates stateless verification (meaning it doesn’t rely on any stored state) and boosted scalability via sophisticated sharding techniques.

Sharding is a method that divides data into smaller segments, or “shards,” which can improve a network’s overall capacity and performance. This process is designed to help manage congestion, ensuring that price fluctuations in gas (the fee paid for transactions) do not affect the entire network uniformly. The team behind Near aims to make it an attractive choice for developers who want to create and launch decentralized applications.

Nvidia earnings ahead

As an analyst, I find myself closely watching the upcoming earnings announcement by Nvidia on August 28th. The reason for this heightened interest is that Nvidia has emerged as a dominant player in the AI sector, propelling its market capitalization beyond the staggering $3 trillion mark.

The upcoming earnings report could shed light on if the artificial intelligence sector continues expanding. Notably, Nvidia’s latest financial figures show a staggering increase of approximately 240%, reaching an impressive $26 billion – surpassing their total earnings from the entire fiscal year 2021.

Experts anticipate that Nvidia’s quarterly earnings will surpass $28.7 billion, exceeding the $26.9 billion they reported last year.

Near Protocol stands out as a leading blockchain platform particularly beneficial for artificial intelligence (AI) creators. It provides agent-based frameworks, financial transactions, computational tools, and decentralized data storage solutions. Notable companies such as Ringfence, Masa, and Cosmose AI have embraced this technology.

Based on data from CoinGecko, Near holds the title as the largest blockchain platform predominantly focused on artificial intelligence, with a market capitalization of approximately $5.3 billion.

Near token is still in a downtrend

Today’s graph indicates that despite increasing more than 57% from its lowest point in August, Near is still experiencing a downward trend. This token continues to stay beneath the upper boundary of the declining channel which links the peak swings seen since May 26.

Recently, the price pattern indicates a potential continuation of the downward trend as it’s showing a progression of lower lows and lower highs. This could mean another test of the support at $4 might occur. However, a bullish reversal will be signaled if Near surpasses its descending trendline.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-26 16:58