As a seasoned analyst with over two decades of market analysis under my belt, I find myself intrigued by the recent developments in the Bitcoin market. Having navigated through various bull and bear markets in traditional finance, I can’t help but see parallels between the current state of Bitcoin and some of the past cycles we’ve witnessed.

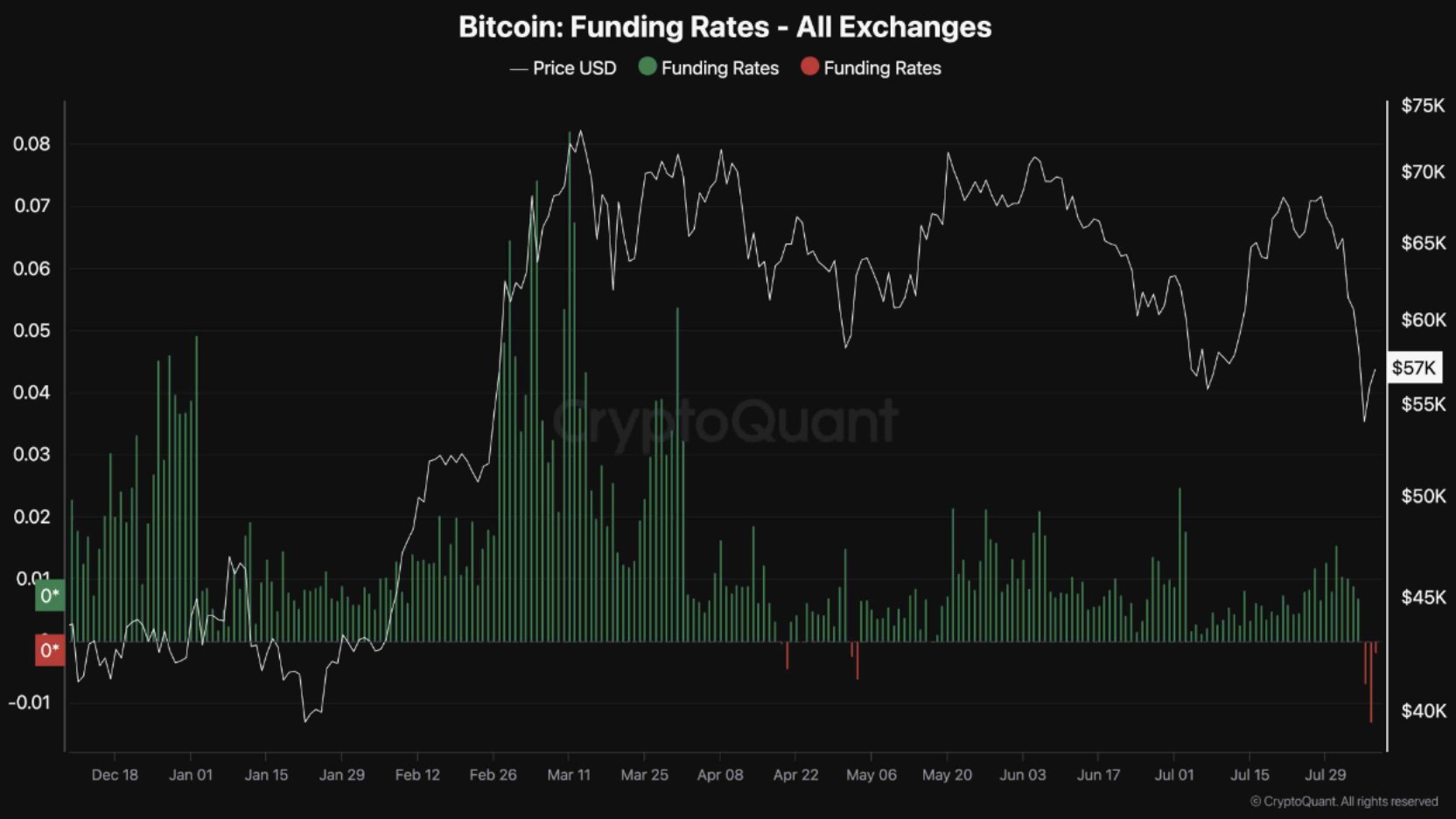

As an analyst, I’ve observed that the significant market drop on August 5th has flipped Bitcoin‘s funding rate for margin trades, possibly paving the way for a bullish final quarter of the year.

Anonymous CryptoQuant expert ShayanBTC predicts that Bitcoin (BTC) could potentially reap benefits following its early-August drop, even before the year ends. The plunge to around $49,000 caused a significant deleveraging event, eliminating approximately $1 billion in BTC long positions. This decline also erased over $1.2 billion in crypto margin loans and readjusted funding rates to negative values.

From my perspective as a crypto investor, I observed that short sellers have been taking advantage of heavily leveraged positions. However, a researcher from CryptoQuant sees this as a potentially good sign for the market. It indicates that the market may be cooling down and becoming less overheated in the future.

In the past 30 days, significant Bitcoin investors, often referred to as “smart money,” have continued to express confidence in the markets by acquiring an additional 404,000 tokens. This move comes after a short-lived surge to $70,000 and a subsequent dip below $50,000 last month. Data from CryptoQuant shows that this accumulation trend occurred alongside multiple liquidation events, such as Germany’s sale of approximately $3 billion worth of Bitcoin and the repayment of over $6 billion to Mt. Gox creditors.

Adding Bitcoin (BTC) to their portfolios typically indicates a positive outlook for the leading cryptocurrency, reflecting optimistic long-term investor sentiment. This is particularly relevant when funding rates decrease, allowing for increased upward price movements.

Bitcoin could range lower before an uptick

As whales increased their Bitcoin (BTC) purchases on August 5, Bitfinex analysts foresaw a potential retesting of the token’s support at approximately $48,900. Subsequently, they anticipated another surge towards record highs.

According to historical records, it’s common for Bitcoin to face challenges in August and September. The advances made in July were erased due to broader market anxiety triggered by external factors, yet there’s a possibility that the last three months of the year could offer some respite for Bitcoin.

Prior to a reversal in global financial markets, there was a widespread belief among investors and financial institutions that the Federal Reserve would lower interest rates in September. If the Federal Open Market Committee meeting next month results in a more accommodative stance, it could potentially inject significant funds into the cryptocurrency market, thereby boosting prices.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- USD CNY PREDICTION

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

2024-08-07 18:26