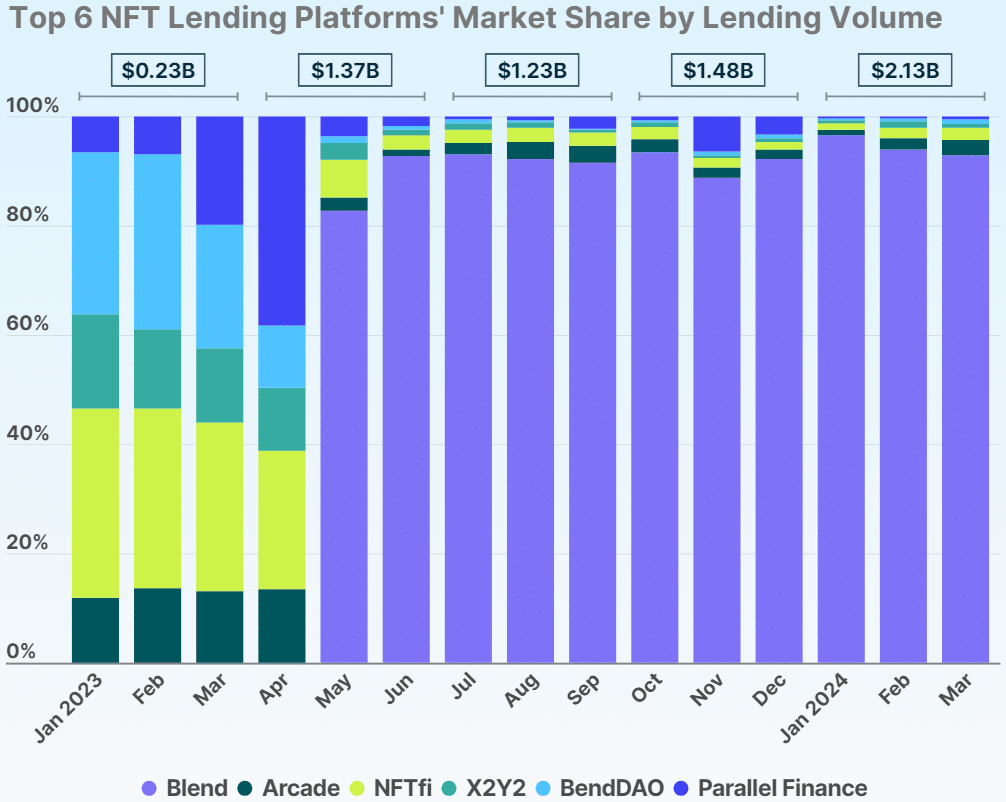

In the first quarter, the NFT lending sector reached an all-time high of $2.13 billion, marking a 43.6% surge compared to the previous quarter. Notably, the volume for five out of the six leading NFT lending platforms grew.

In Q1 2023, the market for lending non-fungible tokens (NFTs) experienced its top players strengthening their hold, as the total value of NFT loans reached a new peak of $2.13 billion. This represented a robust 43.6% increase compared to the previous quarter, based on figures from CoinGecko’s recent report.

In January, there was a remarkable $0.9 billion worth of NFT lending transactions, which shattered the previous record of $0.85 billion set in June 2023. Notably, Blend stood out as the top performer, accounting for an impressive 92.9% market share, with an astonishing $562.33 million in NFT lending volumes during March.

Although NFT loan initiations are currently led by Ethereum collections, the increasing buzz around Bitcoin Ordinals warrants exploration of their potential influence on the NFT lending sector.

CoinGecko

In the world of NFT lending, other platforms besides Nexo, such as Arcade and NFTfi, have experienced expansion. However, their market shares are relatively small, accounting for only 2.8% ($16.94 million in total volume) for Arcade and 2.2% ($13.3 million in total volume) for NFTfi. Even further down the list, X2Y2, BendDAO, and Parallel Finance (previously known as ParaX), manage market shares of 0.8%, 0.8%, and 0.5% respectively.

To increase user participation on NFT lending platforms, incentives are being introduced by rolling out new schemes. For example, in February, Arcade, which is supported by Pantera Capital, announced its “Clash of Clans” airdrop program. Through this, 4,000 wallets will receive 750 ARCD tokens each. Likewise, other marketplaces such as X2Y2 and BendDAO have also launched their own tokens for their members to promote engagement.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-25 11:13