As a seasoned crypto investor, I’ve witnessed firsthand how the performance of traditional tech companies like Nvidia can impact the cryptocurrency market, particularly tokens related to artificial intelligence (AI). The recent earnings report from Nvidia, which showed record-breaking revenue and a planned stock split, sent its shares soaring to new highs. However, contrary to our expectations, AI-focused cryptocurrencies like Render (RNDR), Fetch.ai’s token FET, The Graph (GRT), and SingularityNet (AGIX) saw immediate price drops instead of surging as they did in the past.

Nvidia’s projected quarterly earnings surpassed expectations and the company announced a stock split, resulting in an all-time high for Nvidia’s shares. Concurrently, AI-centric cryptocurrencies experienced a significant impact.

As a researcher investigating recent business news, I’ve come across an intriguing development with Nvidia Corporation, headquartered in Santa Clara, California, and a trailblazer in GPU-accelerated computing. According to a May 25th report, this tech giant will enact a ten-for-one stock split beginning June 7. Additionally, they plan to enhance their quarterly dividend by an impressive 150%, resulting in a post-split payout of 1 cent per share.

One way to rephrase this in clear and conversational language is: A stock split is an action taken by companies to divide their current shares into greater numbers, thereby increasing the number of shares available for trading and enhancing market liquidity. Companies opt for stock splits when their share prices reach exorbitant levels, making it difficult for smaller investors to afford purchasing a single share.

Nvidia’s stock price rose by 5.9% in after-hours trading, reaching $1,005, surpassing the $1,000 threshold for the first time. This increase brought approximately $140 billion to the company’s market capitalization.

As a crypto investor, I’m thrilled to share some exciting news about Nvidia’s recent earnings report and subsequent stock split. The stock price of $NVDA is soaring towards the $1,000 mark.

— The Kobeissi Letter (@KobeissiLetter) May 22, 2024

The primary semiconductor manufacturer projects its fiscal second-quarter earnings to reach around $28 billion, give or take 2%. This prediction surpasses the anticipated revenue of $26.66 billion as reported by LSEG.

In the first quarter, the company experienced a significant increase in revenue, amounting to $26.04 billion, which is 262% more than the same period last year. This figure surpassed the predicted earnings of $24.65 billion. Additionally, net income saw a substantial rise, reaching $14.88 billion, representing a growth of 628% compared to the previous year.

Surprisingly, despite Nvidia’s impressive earnings report, the prices of cryptocurrency tokens related to artificial intelligence didn’t experience an immediate surge as some crypto traders had anticipated.

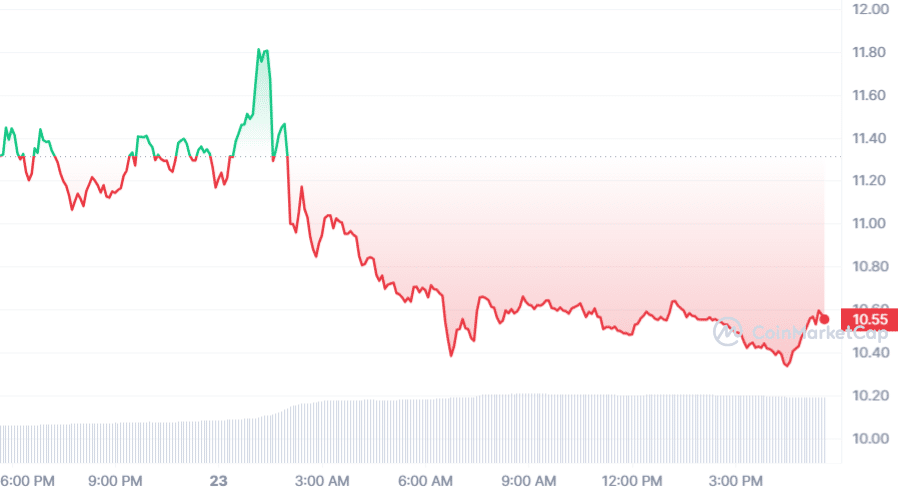

In simple terms, on Ethereum, the decentralized rendering platform RNDR experienced a 12% decrease in value following its earnings report, bringing the price down to $10.48.

When I penned this, the coin had dropped by 6.6% and recorded a trading volume of $827 million during the past 24 hours based on information from CoinMarketCap.

As a researcher examining historical trends, I’ve noticed an intriguing pattern with RNDA (RNDR being the ticker symbol for NVIDIA’s RTX On Demand platform). Although its value experienced an initial decrease, past data indicates a possibility for recovery. This observation is supported by a remarkable surge of 38% that took place within just two days following Nvidia’s Q4 earnings event in February.

According to experienced crypto trader D0C Crypto, there’s a possibility that RNDR‘s price may rise significantly beyond $15 based on past trends.

Further fueling the rumors, a well-recognized cryptocurrency wallet associated with whales transferred around $52.1 million in RNDR tokens to an unidentified wallet. The community is showing signs of expecting a “sell the news” occurrence based on the information from Santiment. This transaction indicates that significant investors are readying themselves in response to Nvidia’s upcoming results and potential market responses.

At the point when Nvidia unveiled its earnings, the price of Fetch.ai’s token FET hovered approximately around $2.65. Following this announcement, the value of FET has experienced a decline of about 2.8%, bringing it down to $2.45.

As a crypto investor, I’ve noticed that some of the other well-known AI tokens like The Graph (GRT) and SingularityNet (AGIX) have experienced declines in their values recently. Specifically, GRT dropped by around 4%, while AGIX saw a decrease of approximately 6%.

Industry leaders weigh in

Despite a widespread price decline for AI crypto tokens, optimistic observers in the cryptocurrency market believe that Nvidia’s robust performance could bring about a favorable impact, similar to what transpired during the previous market cycle.

The announcement of Nvidia’s stock split has the potential to significantly impact the AI crypto token market. Historically, Nvidia’s earnings reports have been a major catalyst for these tokens, frequently leading to price increases. (Tim Zinin, Botanica School founder, shared this insight with crypto.news)

“A stock split may attract more investors due to the reduced share price. This influx could further bolster confidence in technology and artificial intelligence investments. The belief that artificial intelligence is a permanent fixture in our future has been firmly established among investors.”

As a crypto investor, I’ve noticed an intriguing connection between Nvidia stocks and AI tokens this year. The correlation between them has been significantly high, above 0.75. Traditional finance (TradFi) investors have begun to leverage crypto tokens with similar market behavior to gain an edge over stock traders. They appreciate the convenience of accessing these tokens and the reduced competition compared to the heavily traded stocks.

As a researcher studying the impact of tokenization on financial markets, I came across Pagani’s observation that a stock split serves to lower entry barriers for individual investors in the tokenized market. This is indeed one of the advantages of tokenization. However, it is important to note that this strategy primarily benefits existing stockholders, rather than token holders themselves.

As the CEO of Bondex, I, Ignacio Palomera, agree with this observation. Nvidia’s impressive earnings reports have a positive impact on our industry as a whole, raising the overall market tide and benefiting companies like mine.

In the past, there had been tension between the cryptocurrency and machine learning sectors. Miners in crypto were after high-performance GPUs for handling transactions, whereas machine learning experts required those same GPUs for model training. With the growing influence of AI on decentralized networks, however, we’re now witnessing a convergence of these two communities.

Ignacio Palomera, CEO of Bondex

As a crypto investor, I’ve noticed that the traditional financial sector continues to impact the cryptocurrency market in significant ways. Just like in the late 2010s when the market was unsure of how cryptos like Bitcoin and Ethereum would perform, there is still uncertainty regarding the relationship between cryptocurrencies and artificial intelligence (AI). However, once retail investors fully understand this interaction, we can expect to see stronger correlations emerge.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-05-23 15:27