As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I find the recent Polymarket poll suggesting a new Bitcoin high this year to be an intriguing proposition. My personal journey in the cryptosphere has been marked by both exhilarating highs and humbling lows, but I’ve learned to always keep an open mind and a keen eye on market indicators.

It’s predicted by the latest survey on Polymarket that Bitcoin might reach a record-breaking peak this year.

Polymarket users see BTC hitting a new record high

Approximately two out of three people surveyed are optimistic about Bitcoin (BTC), predicting it to keep rising and set a fresh peak. Compared to the lowest prediction of this month, the likelihood of this occurrence has increased by 21 percentage points.

Currently, Bitcoin is valued at approximately $63,840. If it increases by around 15.6%, it could challenge its previous record high of $68,777. Given that it has surpassed a 21% increase since its lowest point in September, reaching this level appears feasible as it seems to be in a technical bull market.

Bitcoin could reach new record levels due to various factors that may spur its growth. On a broader scale, the Federal Reserve has reduced interest rates significantly and indicated they might continue doing so.

This week’s economic data aligns with the proposed reductions, as per S&P Global, the Manufacturing Purchasing Managers’ Index (PMI) stayed below 45 in September, suggesting a contraction. Additionally, data from The Conference Board revealed that consumer confidence dipped this month due to heightened worries about job market conditions.

Consequently, it’s expected that the Federal Reserve will persist in lowering interest rates to avoid a harsh economic landing. Generally, Bitcoin and other high-risk assets thrive when monetary authorities exhibit a more accommodative approach.

Over the past four days, it appears that institutional investors are actively purchasing spot Bitcoin Exchange-Traded Funds (ETFs). As per Sosovalue’s data, these spot ETFs have received inflows of approximately $392 million, pushing the total to an impressive $17.8 billion.

It appears that recent data indicates a decrease in Bitcoin deposits on cryptocurrency exchanges, reaching an all-time low. This suggests that many Bitcoin holders have chosen to take control of their own assets by moving them into personal wallets instead. As of September 25th, the number of coins held on exchanges stood at approximately 2.35 million, marking a significant drop from the peak of 2.7 million observed throughout the year.

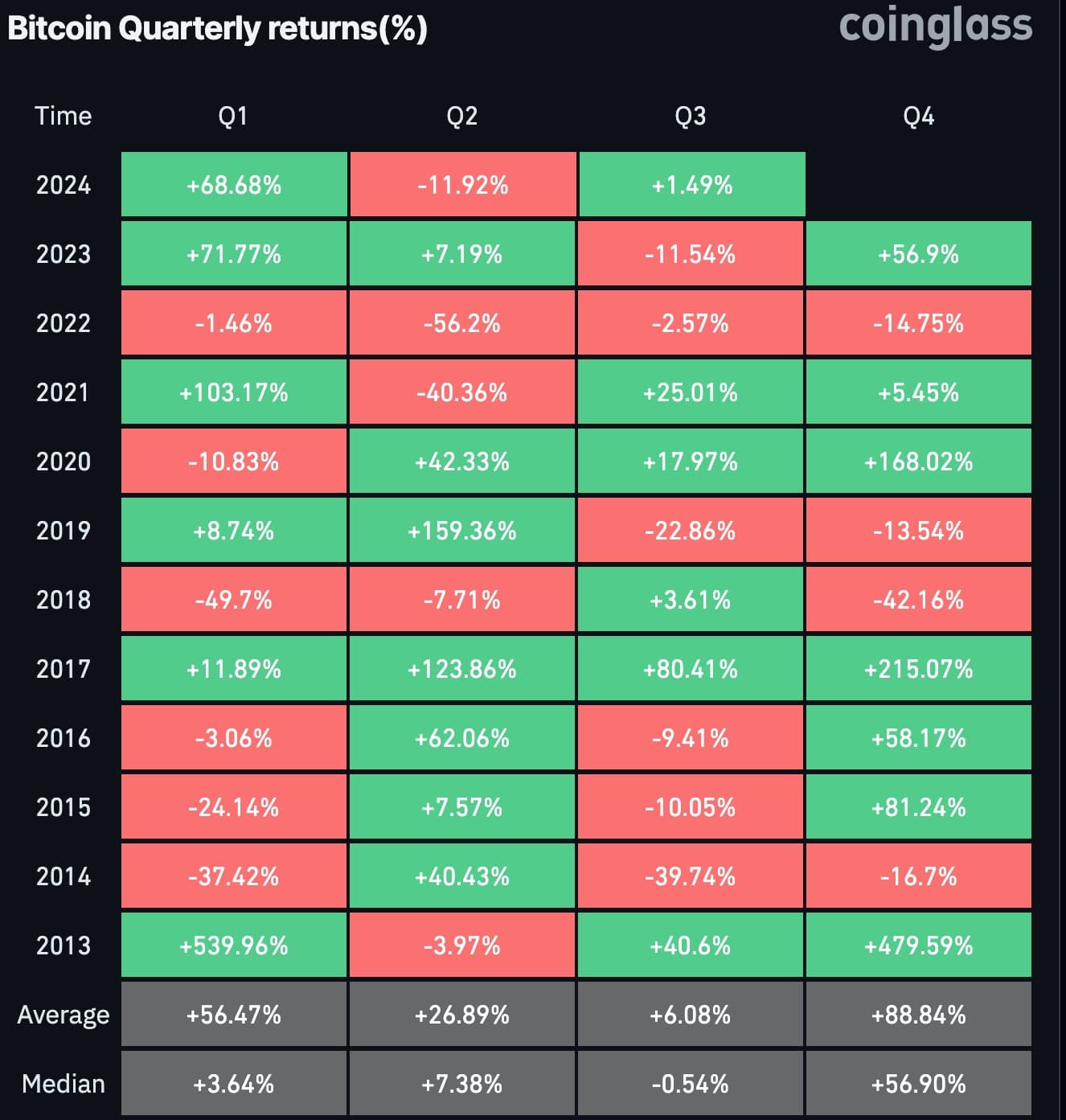

A significant factor that could spur Bitcoin is its seasonal trend. As per CoinGlass, the typical return for Bitcoin in the last quarter (October to December) stands at a remarkable 88%, with the median return being 56.90%. These returns are notably higher compared to those of the first three quarters of the year.

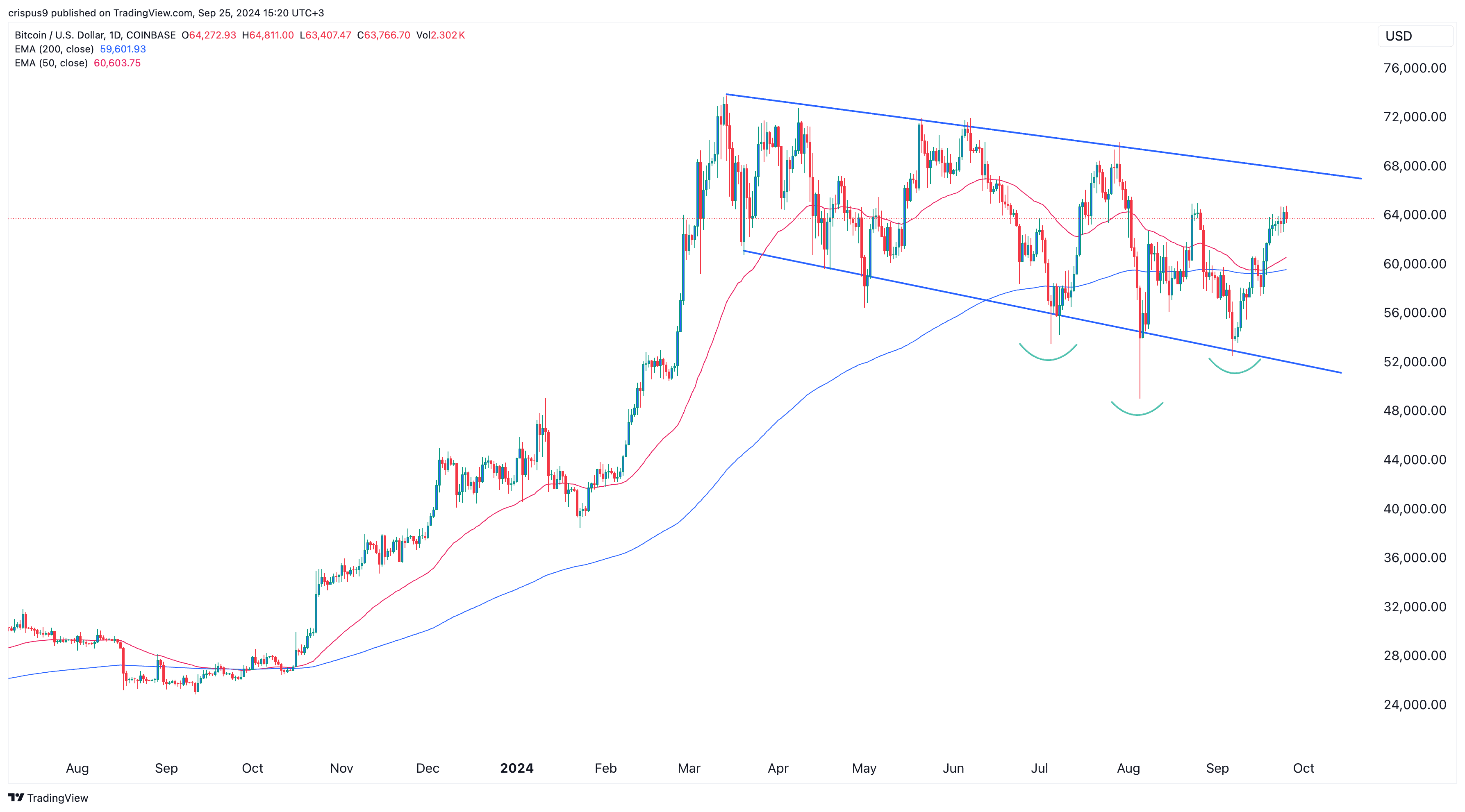

Bitcoin price narrowly avoided a death cross

A factor that might fuel Bitcoin is its ability to dodge the “death cross,” a situation where the 200-day and 50-day moving averages intersect, typically resulting in a substantial decrease in Bitcoin’s value.

Bitcoin has moved above both moving averages, indicating that bulls are currently in control.

Moreover, Bitcoin exhibits not one but two optimistic chart formations: an inverse head and shoulder, and a falling broadening wedge. Typically, such patterns have been followed by additional price increases in the past.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-25 16:09