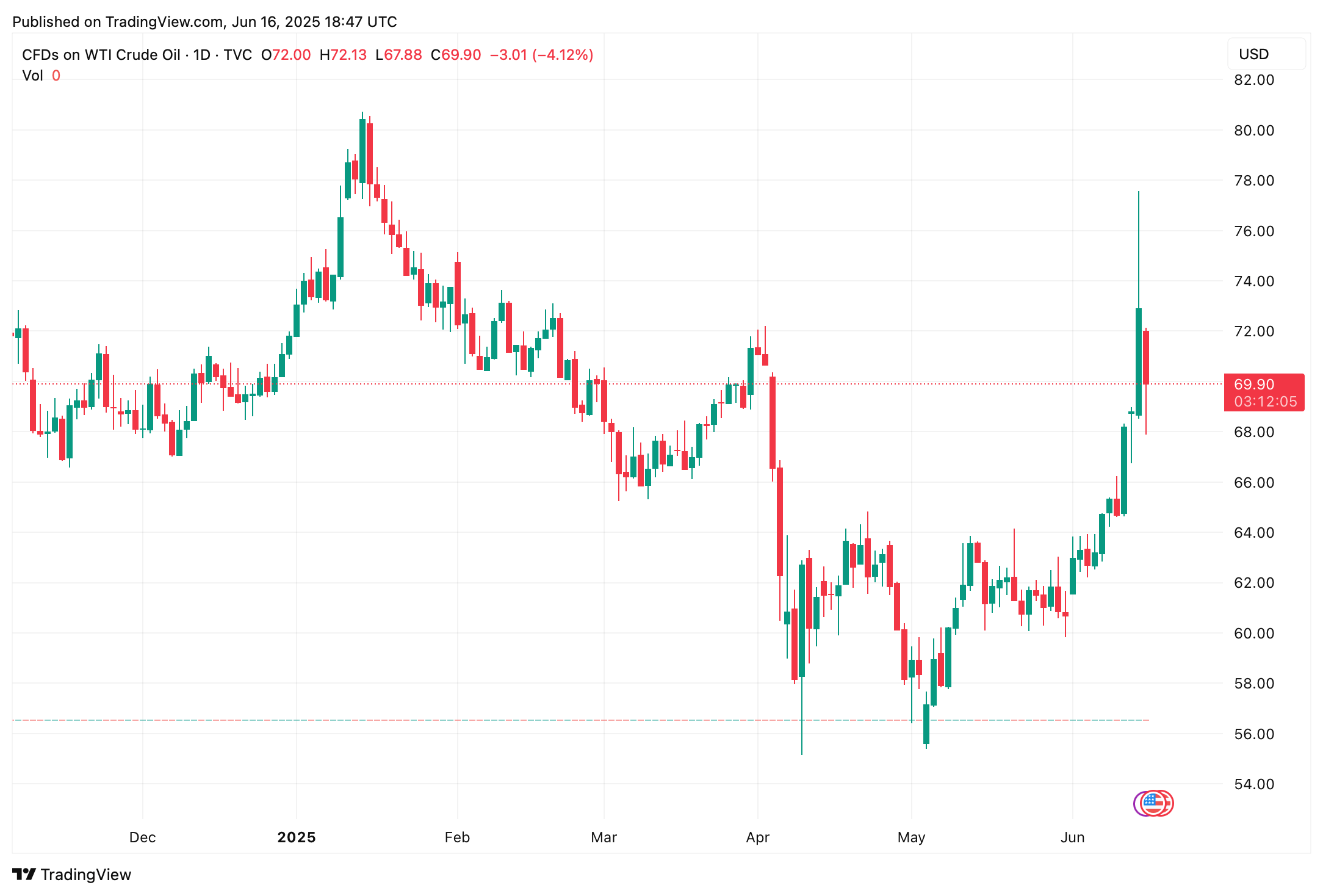

In a most curious turn of events, the stocks of the United States have found themselves in a most agreeable position, as the price of crude oil has taken a rather precipitous plunge of over 4% within the last 24 hours, marking a total descent of 8.74% since the twelfth day of June. The esteemed analysts at Deutsche Bank have observed that the path of oil may very well oscillate with the unpredictability of a wayward kite in a tempest.

$76 to $70: Crude Collapses as Nuclear Talks Stall

//news.bitcoin.com/iran-unleashes-missile-blitz-on-israel-dow-tanks-over-800-points/”>barrage of missiles aimed at the cities of Tel Aviv and Jerusalem. One might say, it was a rather explosive affair! 💥

Now, emerging reports suggest that Iran may be inclined to revive diplomatic discussions regarding its nuclear aspirations. Alas, the recent hostilities have caused earlier negotiations with the United States to be put on hold as of June 15. When the military skirmishes commenced, the price of crude oil soared to a staggering $76.76 per barrel, yet today it finds itself languishing at $70.05, a decline of 8.74%. This drop is particularly noteworthy, given that Israel’s Haifa Oil Refinery has suffered partial damage.

An editorial from the New York Times (NYT) has shed light on the insights of Deutsche Bank analysts, who posit that crude oil prices may continue to fluctuate with the grace of a waltzing couple, ranging from a dizzying $120 per barrel to a rather dismal $50 by the next year. The journalist Stanley Reed, stationed in London, has also conferred with an executive from the commodities research firm Argus Media.

The senior energy markets analyst at Argus Media, the esteemed Bachar El-Halabi, remarked to Reed:

As long as supply has not been disrupted, I don’t think we are going to see huge jumps in oil prices, because the geopolitical risk premium is already factored in.

According to the prediction market Polymarket, the probability of Iran closing the Strait of Hormuz in 2025 stands at a mere 25%, down from the 40% observed last week. A brief closure of this vital strait could send global oil prices soaring, as it is a strategic artery that channels approximately 20% of the world’s seaborne oil—carrying exports from Saudi Arabia, the UAE, Kuwait, and Iraq. Any obstruction would undoubtedly rattle the energy markets, provoking a most frantic scramble as traders and governments prepare for potential shortages and logistical snarls. 🏃♂️💨

//www.tradingview.com/heatmap/stock/#%7B%22dataSource%22%3A%22SPX500%22%2C%22blockColor%22%3A%22change%22%2C%22blockSize%22%3A%22market_cap_basic%22%2C%22grouping%22%3A%22sector%22%7D”>upward drift, whilst the

crypto economy

has advanced by 2.62% over the past 24 hours. Meanwhile, gold has

slipped 1.26%

on Monday, stabilizing around $3,389 per troy ounce. One might say, it is a rather glittering affair!

Longer-term U.S. bond yields remain elevated, a reflection of the persistent economic and fiscal ambiguity that hangs in the air like a rather unwelcome guest. During the session, the yield on the 10-year Treasury note fluctuated between approximately 4.42% and 4.55%. Recent benchmarks for the 30-year yield indicate it has been hovering near 4.90% to 4.93%, with the latest issuance carrying a 4.75% coupon as of June 16.

The financial pulse now hinges not only on the volatility of the oil trade but also on a delicate geopolitical détente that could recalibrate risk sentiment overnight. Investors are navigating a matrix of uncertainty—sensitive to even the faintest whispers of escalation or diplomacy. Whether calm or conflict prevails, the balance of power in energy, equities, and fixed income shall likely reflect every subtle shift upon the global stage. 🎭

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

2025-06-16 22:59