Ah, the ever-so-dramatic dance of the OP token. It’s like a waltz at a gala—elegant, yet utterly devoid of direction. The poor thing can’t seem to regain its footing above those pesky resistance levels, and if we’re being honest, the sellers have taken over the dance floor. As of July 5, 2025, OP is languishing around $0.535, after a rather sharp multi-day tumble. Truly, a sight to behold! 🎭

Daily Price Action: Oh, the Drama of a Persistent Downtrend

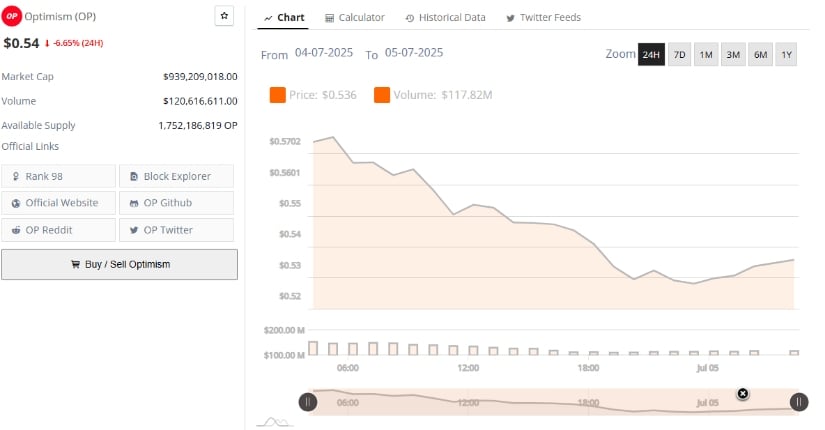

Let’s take a peek at the 24-hour chart from Brave New Coin, shall we? The token’s value dropped from $0.5702 to $0.536, a swift 6.65% plunge—how delightful. Hardly a whimper of resistance from buyers, which can only mean one thing: bearish control reigns supreme. Hold onto your monocles, folks!

As trading closed, OP huddled in a tight range between $0.52 and $0.54—quite the cozy consolidation, like a cup of tea on a rainy day. In fact, it’s almost as if the market participants are waiting for something, but goodness knows, no one’s in a hurry. 🍵

Trading volume during this fiasco stood at a modest $117.82 million. While the occasional flicker of hope appeared, the lack of follow-through suggests that buyers are about as confident as a cat in a dog park. The market cap has tumbled to a modest $939.2 million, and OP simply can’t seem to rise above the $0.56–$0.57 zone, let alone flirt with the psychological resistance at $0.60. How utterly tragic. 😓

Price Structure: A Weakling, Really

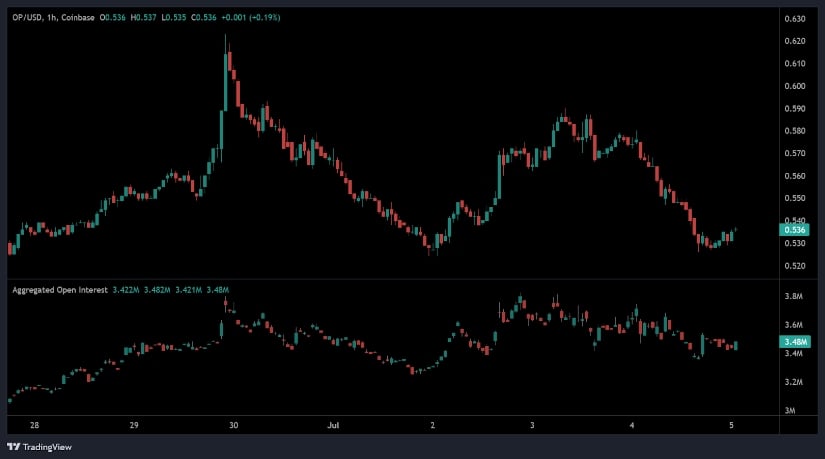

Now, let’s get into the real meat of the matter—the OP/USDT chart on TradingView. The poor dear has been posting lower highs and lower lows for months. It’s almost as if it’s trying to audition for a role in a soap opera—too much drama, not enough action. Despite its best efforts to stabilize near $0.535, the broader structure remains ominously downward. And those candles? A tight, uninspiring range between $0.52 and $0.54. A perfect example of market indecision. 🎬

Momentum indicators, however, hint at the faintest possibility of a recovery—faint being the operative word. The RSI sits at 44.12, just below the neutral 50, suggesting that bearish sentiment is still in the driver’s seat. But wait! It has just crossed above its moving average (43.39)—could this be the beginnings of a faintly bullish divergence? A short-term rally, perhaps? But for that, OP would need to break $0.55—good luck with that! 🤞

Volume, Open Interest, and Technical Indicators: Uncertainty Everywhere

Over on the OP/USD hourly chart, the volatility has been nothing short of spectacular. After hitting a high of $0.62 on June 30, the token swiftly retraced and landed at the $0.525 support. It’s like watching a roller coaster with no safety bars. The price bounced off support and formed a descending pattern before a minor recovery to $0.536. But, alas, it met resistance below $0.56—no breakout, no party. 😅

Open interest tells a similar tale of woe. As the token rallied to $0.62, open interest surged to 3.48 million—only to plummet when the sell-off began. Such dramatic flair! A lack of recovery in OI highlights a general lack of enthusiasm. If open interest were to rise alongside a price break above $0.58, we might entertain thoughts of a bullish trend. But until then, OP remains in the same dreary range-bound limbo, hoping for a bit of luck—or perhaps just a better plot. 🤷♂️

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-07-05 23:05