As a seasoned crypto investor with a keen eye for market trends and a deep understanding of the regulatory landscape, I’m thrilled to see Ondo Finance’s ONDO token surge nearly 20% following the U.S. Securities and Exchange Commission (SEC) approval of spot Ethereum exchange-traded funds (ETFs). This news is a game-changer for the crypto industry, as it paves the way for more institutional investment in digital assets.

The value of Ondo Finance’s ONDO token surged by almost 20% following the announcement that the United States securities regulatory body gave its approval for Ethereum spot exchange-traded funds.

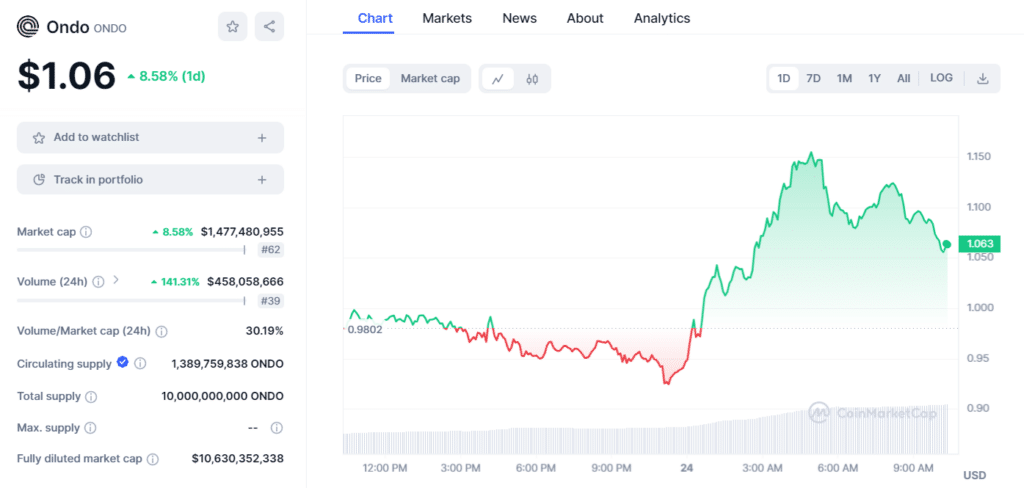

As an analyst, I’ve noticed an impressive jump in the value of Ondo Finance’s ONDO token. The token surged by almost 20%, reaching a new peak at $1.16. This significant rise occurred following the SEC’s approval of spot Ethereum ETFs in the United States. With this decision, market sentiment has shifted towards optimism for potential future price rallies.

As an analyst, I’ve been following ONDO’s impressive growth closely, and while it’s clear that something significant is driving this surge, the exact reason remains elusive. However, based on available information, it seems that ONDO’s strategic partnerships with industry giants like BlackRock could be influencing investor sentiment. These partnerships lend credibility to ONDO and may signal to investors that the platform has the backing of established financial institutions. This perception alone could be fueling investor confidence and driving up the value of ONDO’s stock.

As a researcher studying the cryptocurrency market, I came across an interesting development in late March. Ondo Finance, a prominent player in the industry, transferred $95 million of its assets to BlackRock’s tokenized fund, BUIDL. This move aimed to enable instant settlements for Ondo Finance’s U.S. Treasury-backed token, OUSG.

BlackRock, the leading player in the crypto ETF market, has amassed the largest portion of Bitcoin ETFs through its iShares Bitcoin ETF (IBIT), outpacing MicroStrategy’s Bitcoin holdings in a short period. Moreover, the U.S. financial regulatory body has approved BlackRock’s application for a Spot Ethereum ETF.

The Securities and Exchange Commission (SEC) giving its nod to Ethereum ETFs has sparked anticipation among crypto enthusiasts regarding the possibility of similar products for other altcoins, particularly those associated with BlackRock. Yet, no signs have emerged from the SEC hinting at the approval of any spot altcoin ETFs as of now.

Despite Bloomberg analyst James Seyffart’s proposition that tokens like Solana could eventually merit their own exchange-traded funds (ETFs), he indicates that the choice of altcoins for ETFs hinges on investor interest. However, Seyffart anticipates that a Solana ETF may not emerge in the near future due to the Securities and Exchange Commission’s (SEC) hesitance regarding its classification of SOL compared to Ethereum (ETH).

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gods & Demons codes (January 2025)

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-05-24 11:02