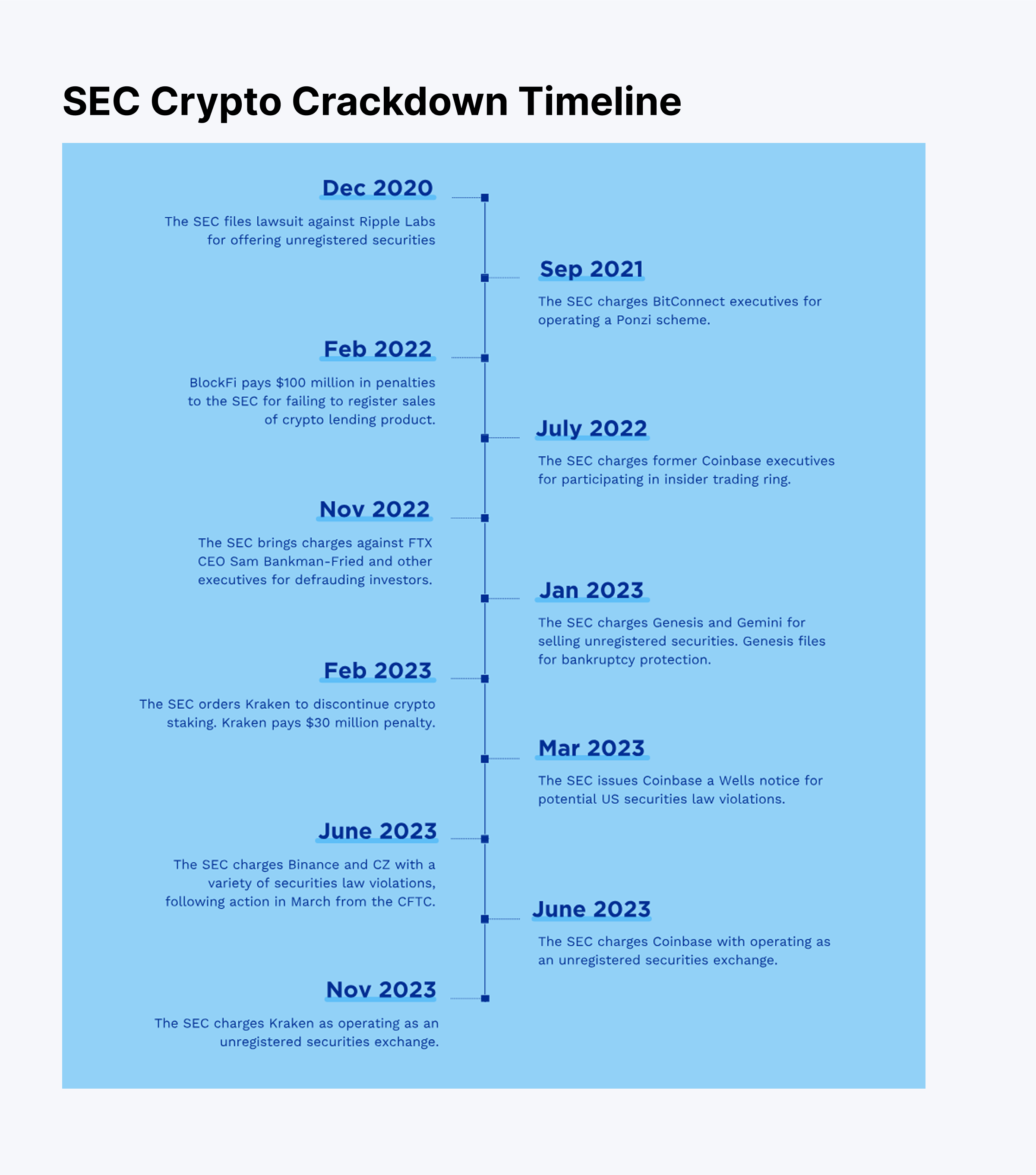

America’s financial world has always worn a stiff collar, but in recent years—especially under Gary Gensler—the regulator’s fist grew particularly iron-clad, the nails chewed from sleepless worry about digital coins. Crypto exchanges shriveled beneath government scrutiny, their operators squinting into the bureaucratic dusk, wondering if tomorrow’s sunrise would even dawn on their business.

In Gensler’s time, the SEC regarded cryptocurrencies as a poisonous mushroom, sprouting overnight and devouring the careful garden beds of honest capital. Each new token was a warning; each wallet, a rumor of the next dot-com collapse. America, the land of opportunity, grew suspicious of coins that glimmered brighter than the moon on the Hudson.

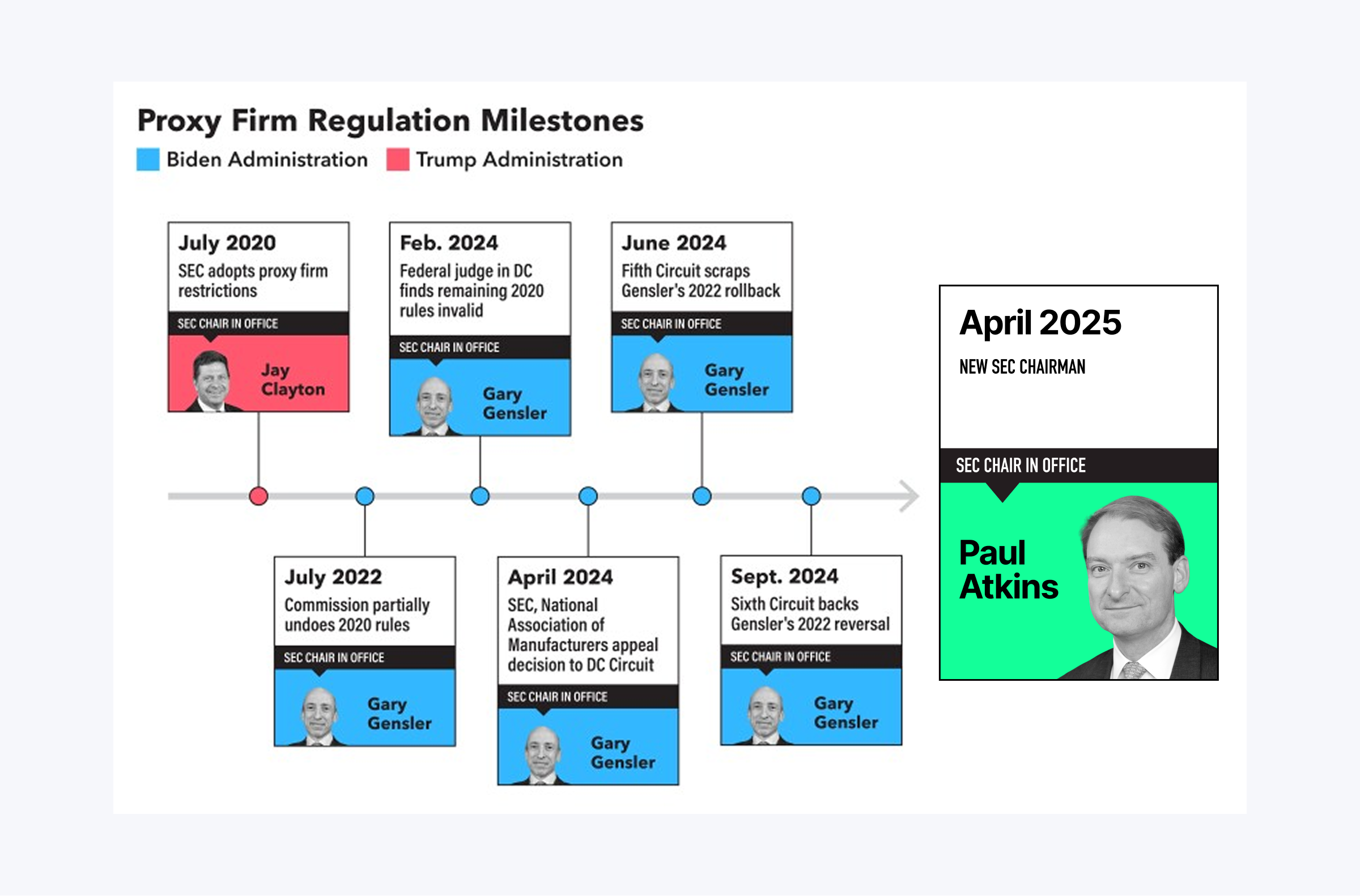

Then Washington yawned, turned over, and coughed up a new regime. Trump, ever the casino card dealer, appointed a new SEC boss—Paul Atkins. The financial press, always eager for the next messiah or scapegoat, greeted him with applause (and a hint of nervous snickering).

Who is this Atkins? What does this silver-haired regulator intend? Come, let us peer beneath his sensible haircut.

Key Takeaways:

- Trump’s team drags Paul Atkins onto the SEC stage, Senate’s rubber stamp still drying—April 9th, if you’re collecting autographs.

- The mood has shifted! Crypto-brokers, once livestock for the regulatory butcher, can now hope for kinder handling—perhaps carrots instead of sticks.

- To sit on the throne, Atkins burned the paraphernalia of past allegiances, selling off his holdings to avoid “conflicts of interest” (translation: no one wanted tomorrow’s headlines reading “Chairman Atkins Invested in UnicornCoin”).

- Crypto-fans cheer, skeptics groan—the casino opens its doors wider, but who’s watching the high rollers?

Paul Atkins: From Law Clerk to The Regulator Who Would Be King

Young Atkins, not yet burdened by Senate hearings, learned law in ancient Carolina, then Vanderbilt—a southern son, weaponized with degrees. New York claimed him, at Davis Polk, where he advised bankers on which legal line not to cross (and how close they could toe the others).

The government came calling, as it does for those not quite corrupt enough for Wall Street nor honest enough for the priesthood. Chief of Staff at the SEC, then a return to private work, then back again—a revolving door, spinning so fast you could generate enough wattage to light up a congressional hearing.

Bush Jr. anointed him Commissioner in 2002. Atkins then made a name not as a strict enforcer (why kick over the applecart when you can sell cider?) but as a skeptical guardian of the free market. Regulation, he argued, should come with as much humility as possible (or, failing that, plausible deniability).

The man doesn’t lack for hustle, either—after clocking out at the SEC, Atkins co-founded and invested in enough financial outfits to give any accountant indigestion. He played both sides so adroitly, children should study his life instead of chess.

SEC: Where Bureaucracy Goes to Reproduce

Atkins’s time in the SEC trenches made him a tireless critic of red tape. If he ever wielded a rubber stamp, it was upside down. He became famous for rolling his eyes during enforcement crackdowns, muttering about “cost-benefit,” and championing rules with enough loopholes to crochet a sweater.

He helped piece together post-Enron rules—arguably so they’d never quite fit—and emerged from the mess as a “principle-based” regulator, whatever that means (most likely: fewer memos, more loopholes).

When Gensler finally vacated the SEC chair, Atkins was ready. Like a patient uncle at Thanksgiving, he waited for the turkey to leave before reaching for the drumstick.

The Appointment: Atkins, Meet Political Theater

Trump rolled in, tossed out a few acting chairs, and when the dust settled—there was Paul in the glow of April’s Senate confirmation, a market-friendly candidate with crypto-sized ambitions. Wall Street swapped fear for optimism; crypto CEOs high-fived; somewhere in a windowless basement, a lawyer began preparing the first lawsuit anyway.

Atkins, philosopher of deregulation, was here to “innovate.” Now, that means something different depending on who’s paying your retainer. Still, many say his appointment offers the industry a chance to change its suit—from orange jumpsuit to pinstripe.

Paul Atkins: Portfolio, Side Hustles & Spectacles

Suffice it to say, Atkins never sat still. If there’s a boardroom, he’s probably spilled coffee on its table at least once.

- Patomak Global Partners: Atkins founded this consultancy—helping financial firms dodge (excuse me, “navigate”) US regulatory shark-infested waters.

- BATS Global Markets (Board Member): Kept the seat warm, whispered advice into Board meetings, possibly sent around memes about “market structure”.

- National Association of Corporate Directors: Where directors go to remind themselves they exist for something other than perks.

- American Enterprise Institute: Providing bold new ideas, like “what if the free market solved everything?”

- Private Clients: If you’re a hedge fund, Atkins advised you—for the right price. If you’re a crypto startup, maybe he winked.

Critics eyed his revolving door with skepticism. Conflict of interest? Atkins said he’d sell everything that might invite nerve-wracking headlines. Transparency for all! (But especially for me, after divestment.)

Even his detractors (and they are legion) admit: nobody knows the warren of financial regulations—and the bodies buried within—better than old Paul. Want someone who understands both the rules and the escape routes? There he is, waving from the command chair.

Regulatory “Repentance”

No one becomes SEC Chair without ritual cleansing. So Atkins put his wealth in the market’s porcelain bowl and flushed—err, ‘divested’—his positions, memberships, and paper trails. Skeptics still see shadows, but show trials are for the history books, not Senate confirmations (most of the time).

A Regulator Who Sends Emojis to Bitcoin

Atkins’s crypto stance? As friendly as you can get without actually sending Satoshi a Christmas card. He once said, “Not all crypto projects are a scam.” A revolutionary statement, at least at the SEC. His preference: clarify, don’t crucify. Let’s not swing the hammer when a pencil will do.

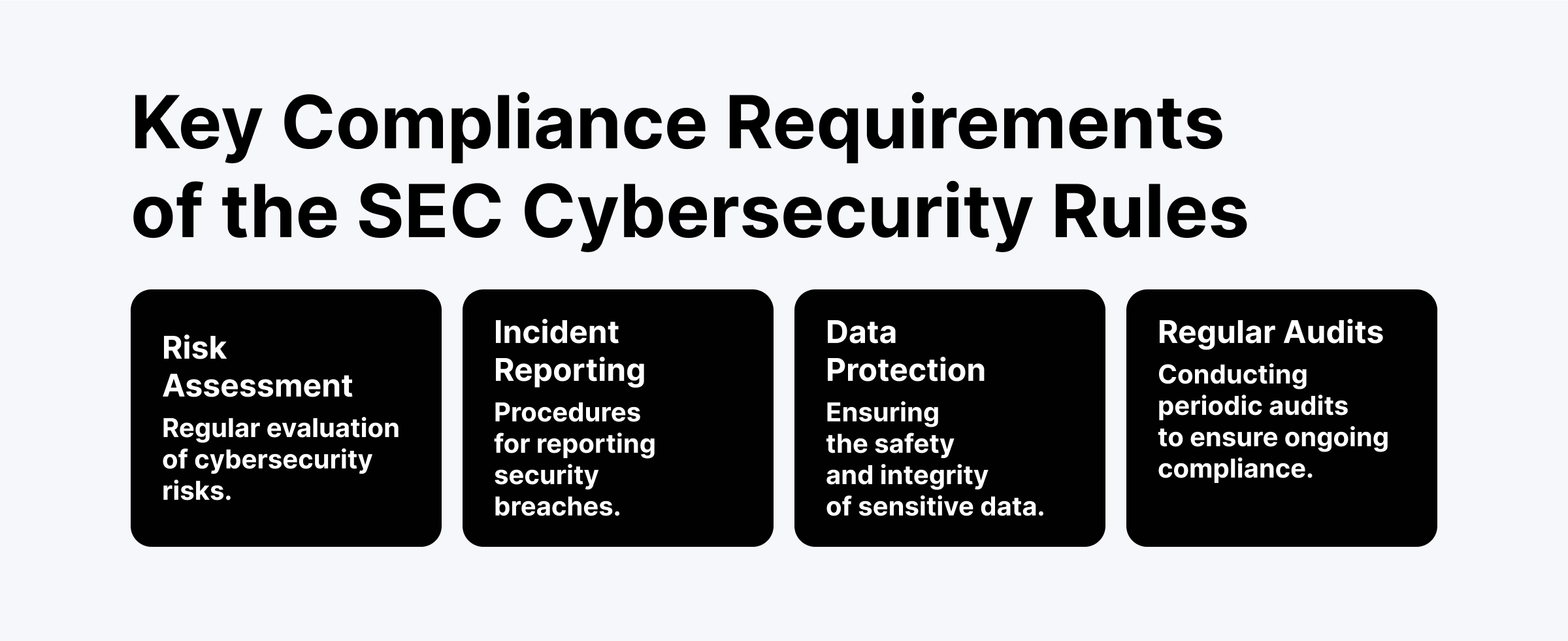

He supports modernizing the laws (imagine—trying to regulate fintech with rules written when the telegraph was new). Sandbox programs? Developers, bring your toys—just don’t break the sandbox.

Predictions: The SEC Goes Jazz

The market now expects Atkins to swap the Enforcement Department’s chainsaw for a paintbrush. Less punishment, more “gentle guidance.” Instead of raids, perhaps coffee seminars and polite emails. Crypto firms cross their fingers—and their lawyers’ fingers, too.

Policy Reform or Policy Circus?

Optimists say the SEC will overhaul confusing tests and offer actual definitions of what constitutes a “security.” Pessimists clutch their pearls—what if the wild west comes back, and all the gunslingers have algorithms?

Enforcement: From Bullwhip to Velvet Glove

Where Gensler saw a whip, Atkins sees a handshake and a LinkedIn connection request. Punishment, he figures, is for the slow-witted; smart regulation should mean guidance, not guillotine.

Everything For the Startup—And Maybe the Big Banks 😏

If Atkins gets his way, bootstrappers and whales alike may finally catch a break. The US might even reverse its talent exodus, bringing DeFi stars home. Just, you know, don’t look too closely at whose pockets end up bulging most.

New Toys for the Regulators

Expect the Chairman to rush in with pilot projects, sandboxes, and more buzzwords—an SEC that tries “engagement” as often as “enforcement,” and sent a “friend request” to blockchain developers.

Gensler vs Atkins: When Bureaucrats Collide

Gensler, the professor, brought the SEC a syllabus. Every exam, an enforcement action. Every answer, more red tape.

Atkins, the deregulator, arrives with wire-cutters and a big grin. “Can we maybe teach these firms instead of handcuffing them?” He wonders aloud, while lawyers on both sides prepare very different press releases.

The contrast should keep media pundits and day-traders entertained. Critics say the fox is now in charge of the henhouse, but the hens are learning to code.

Paul Atkins: Pros, Cons, and Corporate Gymnastics

Let us be honest: if you seek a savior, move along. If you want a bureaucrat who moonlights as a contortionist, you are in luck. Here are the market’s complaints and cheers:

Cheers

- Crypto and FinTech might finally have a seat at the table (but bring your own coffee.)

- Guidelines that are at least legible without a law degree (maybe.)

- Startups might breathe easier and bring jobs back—unless eaten by VC wolves first.

- He’s actually worked *outside* government, which is rarer than an honest expense report.

- Talks to entrepreneurs instead of just subpoenaing them.

Boo Hiss

- Some say “free market” is just code for “let the sharks circle.”

- The old “conflict of interest” meme will never die.

- Deregulation often attracts the sketchy and the sketchier.

- One eye remains on the big banks; don’t expect Robin Hood—think more “well-dressed Sheriff.”

The Future: Crypto’s Big Gamble

The Atkins era could see the US reclaim its spot as the world’s wildest, weirdest, and most lucrative crypto playground. Or maybe, like in all good Russian stories, hope and doom swirl together, and only the shrewd survive.

Obstacles remain. Atkins must persuade Congress, outwit his own reputation, and build the rarest of American dreams: a regulator the industry doesn’t hate and the public doesn’t fear.

- Convince the naysayers he’s not just here for his portfolio.

- Draw a line, finally, around what makes a decentralized project “legit.”

- Balance the art of reform with the science of enforcement, without falling asleep in committee hearings.

If Atkins can pull it off, the result could be innovation on a grand scale—or headlines that would make even Gorky sigh.

FAQ: Because Questions Never Die

Is Paul Atkins pro-crypto?

If Bitcoin could vote, he’d have its block. He wants the SEC to use rulers, not hammers, on blockchain ventures.

Who’s running the SEC now?

Paul Atkins—lawyer, consultant, ex-Commissioner, and proud survivor of Senate confirmation hearings.

Is Atkins better than Gensler?

Do you prefer tight shoes to loose slippers? Same office, different philosophies. Atkins will hand out more slippers, fewer blisters.

What’s Atkins’ plan for crypto?

Clear skies, gentle winds, and a rulebook that looks less like an IRS manual. But don’t mistake it for paradise—every paradise has mosquitoes.

There you have it—Paul Atkins, the man who would turn the SEC into a place where crypto comes to talk, not to stand trial. Or so the story goes. 🥃

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

2025-04-30 13:18