As a seasoned crypto investor with over a decade of experience navigating the volatile world of digital assets, I must admit that PayPal’s achievement with PYUSD is nothing short of impressive. Having witnessed the rise and fall of numerous stablecoins, it’s refreshing to see a player as established as PayPal entering the fray.

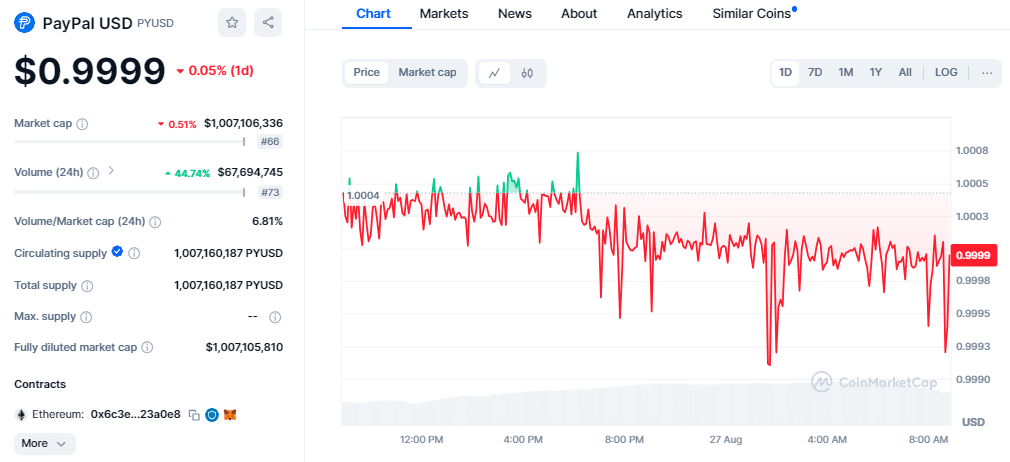

The US dollar-linked digital coin by PayPal, called PayPal USD (PYUSD), has reached an impressive achievement, exceeding $1 billion in total market value as reported by CoinMarketCap. Introduced in the year 2023, PYUSD maintains a 1:1 equivalence with US dollars and is issued by the Paxos Trust Company, a trusted American cryptocurrency custodian overseen by U.S. regulations.

Dan Schulman, the President and CEO of PayPal, emphasized the necessity of digital currencies, pointing out that they should be a reliable, digitally-advanced tool that can seamlessly connect with traditional currencies such as the U.S. dollar.

PYUSD functions like any other ERC-20 token within the Ethereum network, ensuring compatibility. Notably, this digital currency is endorsed solely on PayPal’s payment infrastructure. It has been specifically engineered to work effortlessly with numerous external developers, digital wallets, and Web3 applications.

As a data analyst, I’m excited to share that PayPal has been expanding its reach by collaborating with multiple partners. Recently, in the month of May, we introduced PYUSD on the Solana blockchain, which was a joint effort with Crypto.com, Phantom, and Paxos. This collaboration not only enhances PayPal’s accessibility but also positions us at the forefront of blockchain technology integration.

This move aims to attract more users to the blockchain network. Additionally, PayPal joined forces with Web3 infrastructure provider MoonPay to enable cryptocurrency purchases directly through PayPal accounts, further expanding its reach.

Although PYUSD is expanding its influence, it lags behind well-established dollar-linked stablecoins such as Tether and USD Coin (USDC) in terms of market dominance. Tether currently holds the lead with a market capitalization close to $118 billion, while USDC comes second with approximately $35 billion.

In its ongoing development, PYUSD signifies an increasing fusion of digital currencies with conventional banking structures, providing a reliable and forward-thinking approach within the rapidly changing world of cryptocurrency.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-27 08:21