As a seasoned crypto investor with battle-tested nerves and a knack for reading market trends, I find myself intrigued by the recent surge of Pepe (PEPE) during the Santa Claus rally. The coin’s 24-hour volume of $2.2 billion and the rising futures open interest certainly caught my attention.

As a crypto investor, I witnessed a surge in the price of my Pepe coins over Christmas Eve, joining other meme coins in a rebound, much like the traditional stock market’s Santa Claus rally.

In a bustling market setting, Pepe (PEPE), the third-largest meme token, experienced a surge in value following investors’ purchases during a price drop. This upward trend coincided with Bitcoin (BTC) reaching $98,500 and the Crypto Fear and Greed Index edging towards the ‘greed’ zone.

nearly all cryptocurrencies surged, causing the total market capitalization of coins monitored by CoinGecko to reach an unprecedented peak of $3.60 trillion dollars.

Yesterday, Pepe recorded a daily trading volume of approximately $2.2 billion. Moreover, the futures open interest saw an increase for the third day in a row, peaking at $151 million. This is the highest it’s been since December 30th.

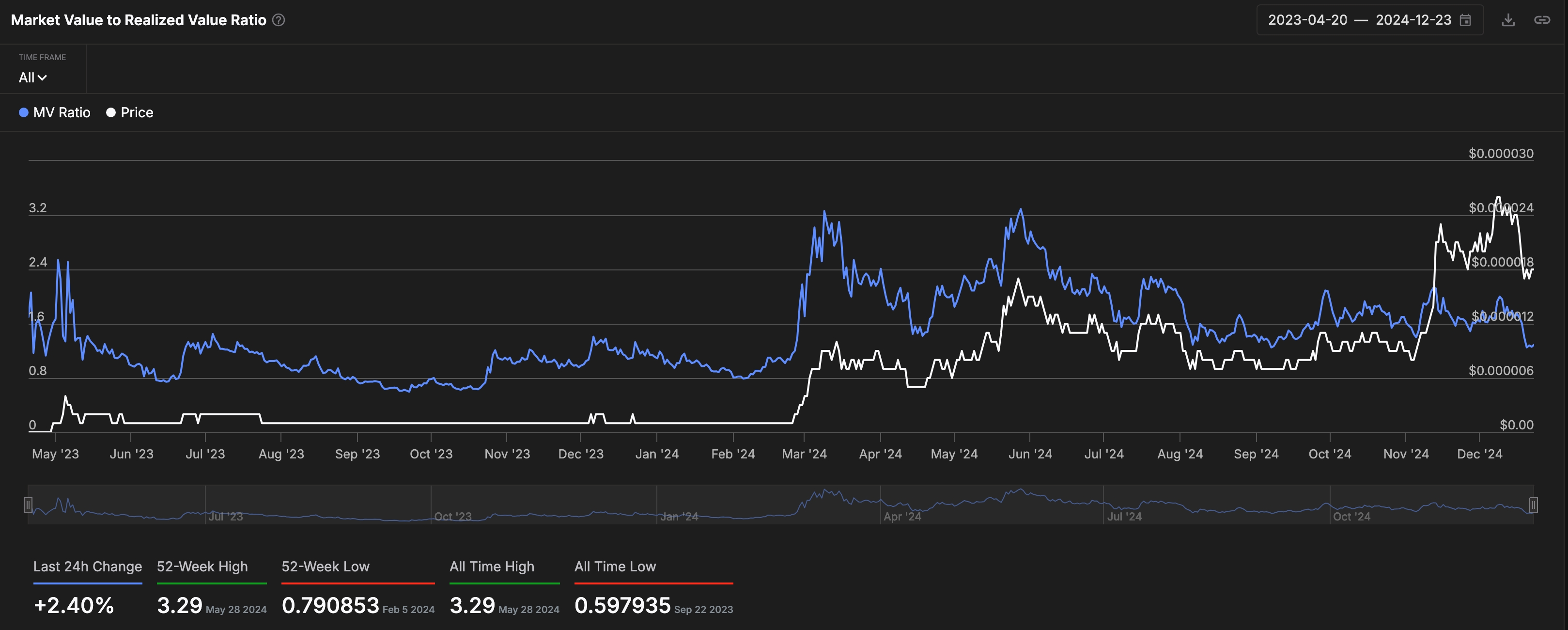

Additionally, the coin leaped due to signs indicating that Pepe had reached its lowest point since November 5, according to the Market Value to Realized Value (MVRV) ratio. This MVRV-Z score is renowned for being one of the most reliable indicators in predicting market peaks and troughs.

As a researcher studying cryptocurrency trends, I’ve been analyzing the Market Value to Realized Value (MVRV) indicator for Pepe. This metric is derived by comparing the current market price with the realized value, which represents the total amount investors originally paid for their coins. The latest MVRV reading has dropped to 1.28, suggesting a significant oversold condition similar to what we observed in November. At that point in time, Pepe experienced a powerful rally that culminated in an all-time high of $0.00002830. Keeping this pattern in mind, it might be worthwhile to monitor the coin’s future performance closely.

The other contrarian case for Pepe is that there are signs that speculators capitulated and exited their trades. Data shows that the number of active, new, and zero balance addresses dropped by over 20% in the last seven days.

According to the data presented, the active addresses ratio has decreased to 1.34%, marking a low not seen in over a month. Typically, significant changes in the price of Pepe occur when this ratio is on a downward trend.

Pepe coin price analysis

Each day’s graph reveals that the Pepe coin reached its highest point at approximately $0.00002830 during this month, followed by a significant price drop.

As a researcher, I’ve noticed a significant development in the price trend. We’ve dipped below the crucial support level at $0.00001713, which marks the upper boundary of the cup and handle pattern that emerged between May and November. Typically, a break and retest pattern indicates a potential continuation of the existing trend. Currently, Pepe is maintaining its position above the 100-day moving average, hinting at an attempt to flip the 50-day moving average.

It seems that the drop in Pepe’s price hasn’t ended just yet. The recent increase could potentially be a “dead cat bounce,” which is a temporary recovery before a further decline. Moreover, it might also be contributing to the formation of a bearish flag chart pattern, a common downward trend indicator.

Consequently, it’s possible that the coin may continue to decrease in value once the Santa Claus rally concludes. The bullish trend would be officially confirmed if the coin surpasses the significant level of $0.000025.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-12-24 20:30