As a crypto investor with some experience under my belt, I’m always keeping an eye on market trends and news that could potentially impact the price action of various tokens. The recent US CPI data release has been a significant catalyst for the crypto market, including meme coins like Pepe (PEPE).

On Wednesday, the price of PEPE (Pepe) rebounded significantly due to favorable US Consumer Price Index (CPI) figures. The cryptocurrency reached a peak of $0.00014 in a bustling trading session. Over the past few days, PEPE has experienced a remarkable increase of more than 23% from its lowest price point.

Buying the dip after the CPI data

The Bureau of Labor Statistics recently released data indicating a decrease in inflation rates. Specifically, the Consumer Price Index (CPI) went from a 0.3% increase to no change at all for the month, falling short of the projected 0.1% rise. This marks the second consecutive monthly decline on an annualized basis. The overall CPI rate dropped from 3.4% to 3.3%. Adjusting for food and energy prices, inflation decreased by 0.2% for the month and remained at a yearly rate of 3.4%.

The inflation figures were released before the Federal Reserve made its interest rate announcement. Experts believe that Fed officials will be pleased with these numbers and may consider reducing interest rates in the near future. A reduction in interest rates signifies a favorable condition for investors as it decreases the cost of borrowing, making speculative investments, including meme coins, more enticing.

The annual increase in the US Core Consumer Price Index came in at 3.4%, falling short of the predicted figure (3.5%) and registering a decrease from the previous reading (3.6%). In response, the value of Bitcoin soared by 2.4% following the announcement of the CPI data.

— Lookonchain (@lookonchain) June 12, 2024

As an analyst, I’ve observed that Pepe’s price rebound was not only driven by its own market dynamics but also by the broader uptrend in the cryptocurrency market. Investors who had been holding back were enticed to buy as they saw Bitcoin soaring to $69,600 and Ethereum hitting $3,645. Likewise, meme coins such as Bonk, Dogwifhat, and Book of Meme experienced a resurgence. However, it’s important to note that these tokens could face a significant correction if the Federal Reserve adopts a more hawkish stance in its upcoming decision.

As a researcher studying the cryptocurrency market, I’ve come across an intriguing observation regarding Pepe’s recent price surge. This uptick may be attributed to a common investing strategy known as “buying the dip.” In this case, the coin had plummeted approximately 35% from its peak value this week. The rebound took place in a bustling trading environment with increased transaction activity. According to CoinGecko’s data, Pepe’s daily trading volume skyrocketed to over $1.28 billion, marking a significant leap from the previous day’s $714 million.

Pepe price prediction

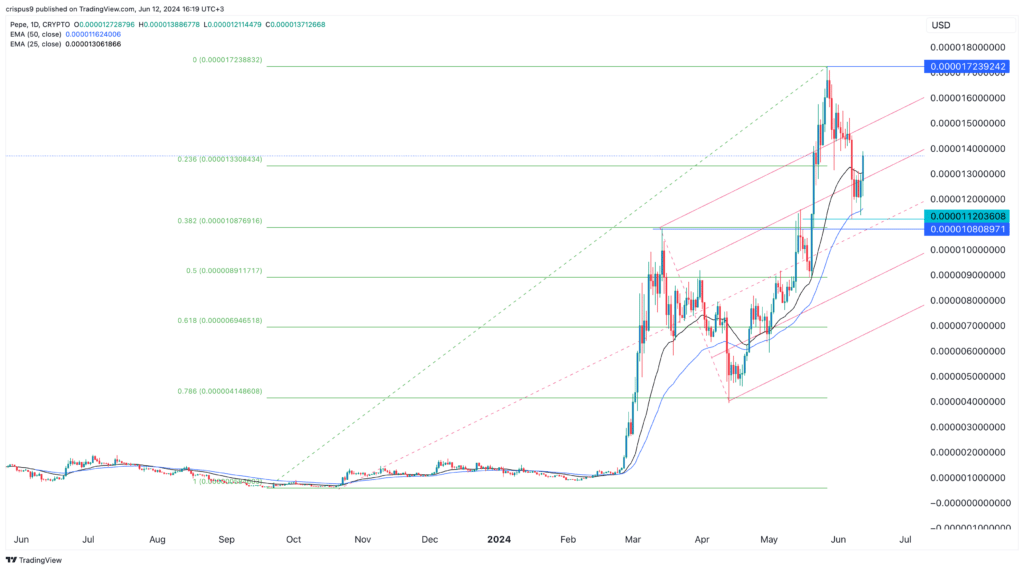

The price of Pepe recovered following the disappointing US inflation report, as indicated by the daily graph. It bounced back from a low of $0.00001120, which marked its lowest point this week. This price was slightly above the significant support level at $0.00001080, which represented Pepe’s highest swing on March 14th.

As an analyst, I’ve noticed that Pepe has recently surpassed the 23.6% Fibonacci Retracement level, which is a favorable development. Additionally, it has managed to climb above its 50-day and 25-day moving averages, as well as the initial resistance level of the Andrew’s pitchfork tool.

As an analyst, I would interpret this as follows: The token’s price is expected to keep climbing based on buying pressure. The next significant resistance level lies at $0.00015, which represents a 10% increase from the current price. A successful breach above this threshold could propel the token up to its highest point in 2021, reaching $0.0000172.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-06-12 16:48