As a seasoned analyst with over two decades of market experience under my belt, I’ve seen enough bull runs and bear markets to know that every coin has its own unique story. Pepe (PEPE), the third-largest meme coin, is currently experiencing a recovery after two consecutive days of price increases in a high-volume environment.

In the past two days, the price of Pepe tokens has increased significantly within a busy trading market, as investors seized the opportunity to purchase the tokens at a lower price.

Pepe price is recovering

On Wednesday, Pepe (PEPE), the third-largest meme coin, was priced at approximately 0.0000081 USD. This represents an increase of more than 38% from its lowest point on Monday, a day when both stocks and many cryptocurrencies experienced significant declines of over ten percent.

The way its price movements are happening is similar to other cryptocurrencies such as Stacks (STX), Bonk, and Solana (SOL). Notably, these tokens have all developed what’s known as a “hammer pattern,” which is a common indicator of potential market reversals.

Among all meme-based cryptocurrencies, Pepe recorded the largest trading volume, surpassing the $1.43 billion mark, which is more than Dogecoin‘s ($1.03 billion) and Shiba Inu‘s ($356 million).

Nonetheless, Pepe’s recuperation encounters some significant risks. Initially, the process occurs within a market with relatively low futures open interest. The open interest currently stands at around $71 million, significantly lower than its peak in July at over $141 million.

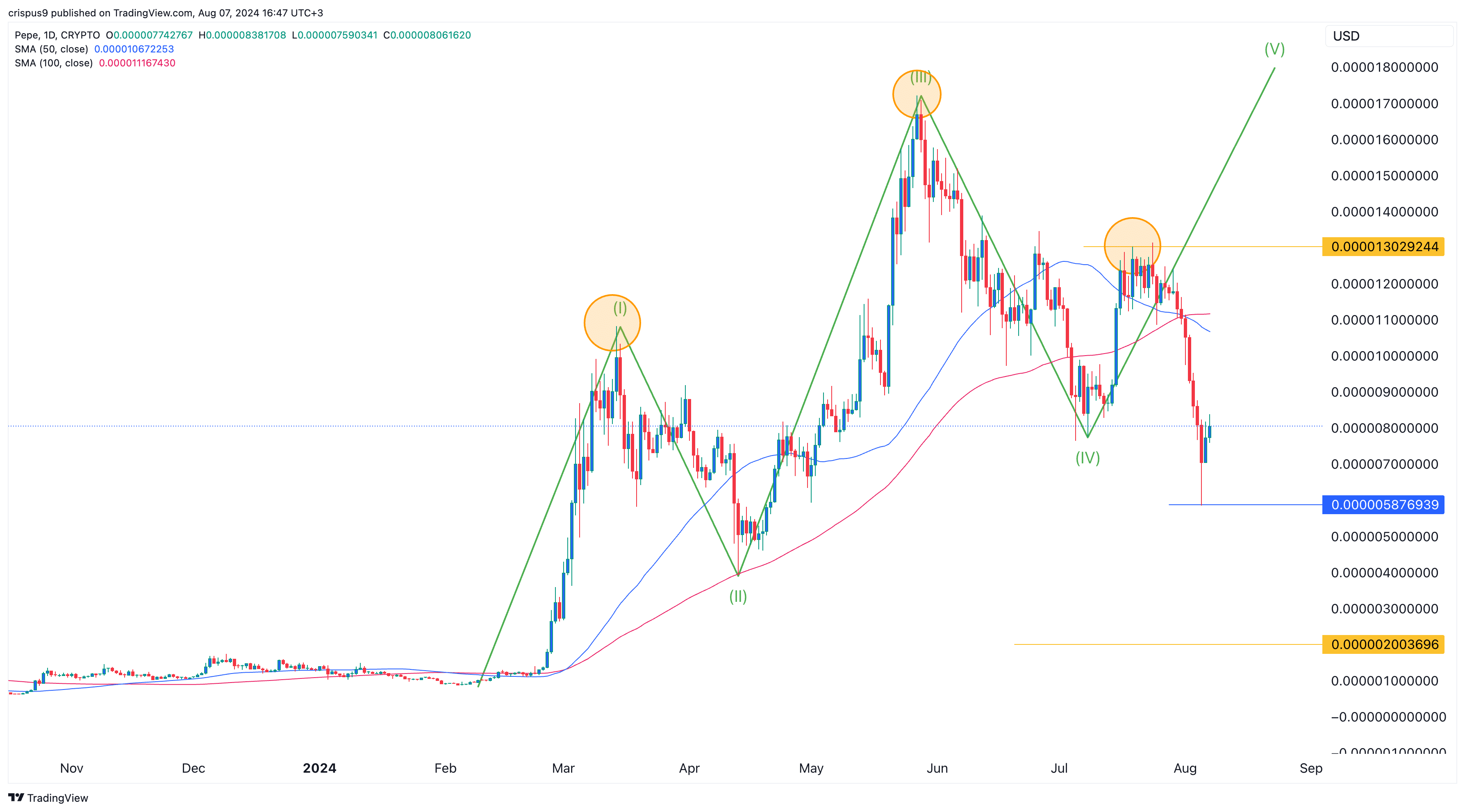

2nd, the token has developed several potential bearish chart formations that might slow its upward movement. The most significant one is the head and shoulders pattern. It recently fell from the level of the right shoulder ($0.000013) and broke through the sloping neckline at $0.0000066.

If the ongoing recovery proves temporary or just a short-term surge (similar to a ‘dead cat bounce’), there’s a potential risk that the price of Pepe could plummet as low as $0.0000020, which represents a significant drop of approximately 75% from its current levels. This level was determined by measuring the gap between the peak (the head) and the support line (the neckline).

Pepe token invalidated 5th Elliot Wave phase

In the meantime, it appears that Pepe might have disrupted the Elliot Wave pattern’s bullish phase because he didn’t finish the expected upward fifth part.

Another possible issue, as we’ve mentioned earlier regarding Bitcoin, is the potential formation of a ‘death cross’ pattern, an ominous indication suggesting a downtrend may be imminent.

In simpler terms, Pepe’s price is currently lower than both its 50-day and 100-day averages, which have recently crossed paths in a way that suggests a potential decline. This could mean the token might continue falling and even touch this week’s low of $0.0000058 again. If it breaks below this level, it could indicate further decreases.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-07 17:30