Experienced cryptocurrency investor, Peter Brandt, has expressed his opinions about the potential for Bitcoin‘s market value to plummet.

In a recent post on X, Brandt cautioned that altcoins could plummet by 90% and the vast majority of memecoins would become worthless. This warning sparked anxiety among traders, particularly those who had forecasted bitcoin reaching $200k in 2021.

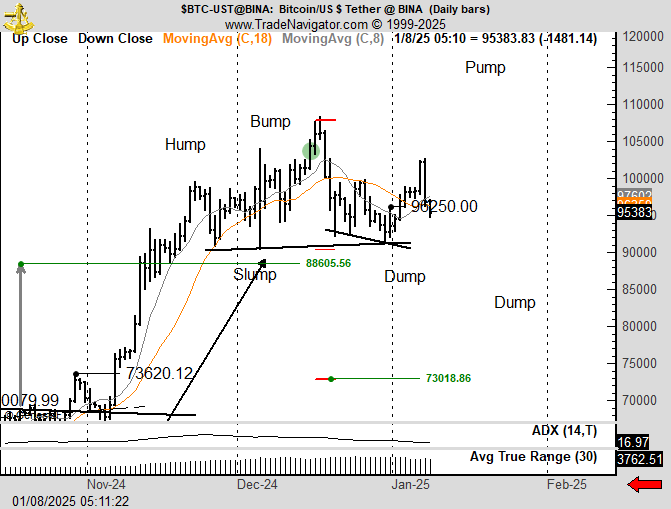

In a more recent tweet today, he contradicted the notion that Bitcoin’s (BTC) value could experience a significant plunge. Contrary to what some chart trends seem to indicate, predicting a possible decline to $73,000.

As per Brandt’s perspective, the value of cryptocurrency tends to fluctuate significantly, meaning that the patterns on its charts constantly change, and it can be challenging to precisely predict the trend of Bitcoin.

He pointed out, “It’s essential not to blindly rely on any specific pattern. What starts as an intra-day chart can transform into a daily one, then a weekly one, and eventually a monthly trend – until we find a pattern that proves effective.

Brandt’s comment emerged following Bitcoin’s drop to $95,328.48 from its peak of $108,000 on December 17, leading some to speculate about a potential dip or crack in the market.

Yet, it’s important to understand that the volatility of Bitcoin isn’t solely tied to chart patterns; it’s also significantly influenced by broader economic factors like changes in the U.S. labor market. This adds an extra layer of complexity to its dynamics.

As a data analyst, I’ve been analyzing the most recent employment trends in the U.S., and here’s what I found: There seems to be a decrease in the number of employees voluntarily leaving their jobs, with an accompanying increase in job openings. In simpler terms, it appears that there are fewer people choosing to switch jobs.

As per Brandt’s analysis, a potential deceleration in consumer spending due to economic trends might indirectly influence the cryptocurrency market.

Simultaneously, international issues, such as potential trade tariffs from the previous Trump administration, could further strain an already vulnerable economy. A decrease in global trade may lead to increased costs for imports, which could impact American consumers. In turn, these consumers might reconsider investing in risky assets like cryptocurrencies due to economic uncertainties. If people become more cautious about their spending, this could exacerbate declines in the crypto market if conditions worsen.

As the cost of Bitcoin fluctuates and the broader market remains volatile, investors are focusing on the forthcoming Federal Reserve meeting (FOMC). Analysts predict that there will be fewer interest rate reductions in 2025 than initially thought. Despite worries, many market observers remain hopeful.

He referenced the 2008 financial crisis as an example, where bankers received bonuses despite many people losing their houses and jobs. Kiyosaki anticipates that sectors such as automobiles, real estate, dining, and even luxury items like wine will experience downturns by the year 2025.

Even so, he considers digital currencies like Bitcoin, physical gold, and silver as viable methods for safeguarding assets from inflation. He advises individuals to remain composed, use their intelligence wisely, and capitalize on the reduced costs in the market.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2025-01-08 20:36