As a seasoned analyst with over two decades of experience in the crypto market, I find myself constantly intrigued by the dynamics of new projects like Pi Network and their counterparts, such as Bitcoin.

Anticipated progress continues with the Pi Network’s mainnet debut, as Bitcoin exhibits an infrequent “death cross” formation.

As a seasoned blockchain enthusiast with years of experience under my belt, I have followed Pi Network closely since its inception and witnessed its steady growth over time. This year, I’ve been particularly impressed by the unwavering dedication of the Pi Network developers as they work tirelessly to transition the blockchain from the closed mainnet phase to the public mainnet. In a recent update, they highlighted their progress with the Know Your Customer (KYC) verification process for users. With over 13 million pioneers successfully completing the KYC, and 6 million already migrated to the mainnet, it’s clear that Pi Network is making significant strides towards mainstream adoption. As a long-term holder of Pi coins, I eagerly anticipate the public mainnet launch and look forward to witnessing the continued growth and success of this innovative project.

As a researcher involved in this project, I am thrilled to announce that our network has successfully onboarded over 13 million verified participants who have completed Know Your Customer (KYC) processes. Moreover, we have assisted more than 6 million of these individuals in transitioning to our Mainnet! This significant achievement is a testament to the collective efforts we’ve made together, bringing us closer to realizing our vision of an Open Network.

— Pi Network (@PiCoreTeam) August 8, 2024

Moreover, pioneers are given a six-month leeway to finish the verification process, which is an essential part of Pi Network’s transition to mainnet. This Know Your Customer (KYC) procedure helps in eliminating possible bots from the network.

As an analyst, I’m highlighting one of the crucial steps necessary for the mainnet launch of Pi Network. This significant achievement will empower users to trade their Pi tokens in open markets.

In addition to the other key achievements, the Pi Network team is striving for two significant milestones: fostering a vibrant ecosystem and a favorable market setting. For the ecosystem, the target is to have at least 100 decentralized applications (dApps) designed to enhance the token’s practicality.

The exact count of Pi Network decentralized applications (dApps) developed so far is uncertain. However, a repository indicates approximately 27 dApps across sectors such as commerce, gaming, NFTs, and utilities in the ecosystem. This suggests that it may take some time before reaching the 100-mark.

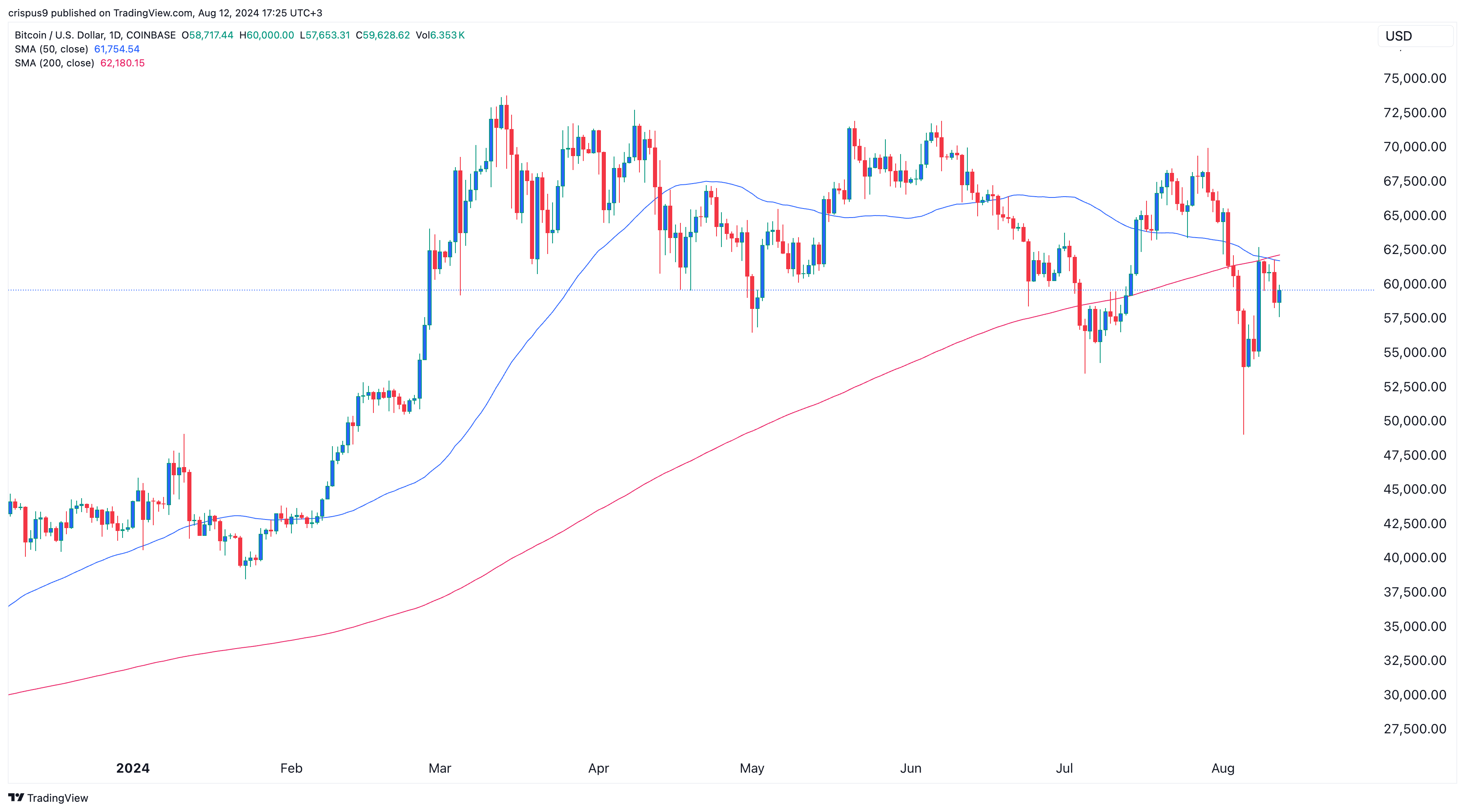

Bitcoin has formed a death cross

As a crypto investor, I’m eagerly anticipating the token listing, hoping for an auspicious market climate. This year, Bitcoin (BTC) and numerous other digital currencies touched new peaks, but subsequently witnessed a downturn.

Recently, Bitcoin exhibited a “death cross” formation, where its 50-day and 200-day moving averages intersected in a downward direction. Historically, this chart pattern has often preceded a substantial drop. For instance, in the year 2022, Bitcoin experienced a decline of more than 60% following this formation.

Investing in listing a cryptocurrency during a bear market can be quite risky, as demonstrated by the recent performance of newly launched tokens such as Notcoin (NOT), Pixelverse (PIXFI), Wormhole (W), and zkSync. These tokens have seen significant declines from their peak values.

Previously mentioned, the fluctuations in Pi Coin’s value might resemble those of other ‘tap-to-earn’ cryptocurrencies due to their shared business structure.

Shares of “tap-to-earn” tokens such as Notcoin and PIXFI are currently in decline, while the future values of Hamster Kombat have reached record lows. This trend might continue with Pi coin after its listing, as early investors sell off their long-held tokens. This is due to the fact that many have been holding onto these tokens for a number of years.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-08-12 22:20