As an experienced analyst, I believe the recent downtrend in Polygon’s price and loss of market share in the layer-2 industry can be attributed to the intense competition it faces. With the rise of competitors like Arbitrum, Base, Blast, and Optimism, Polygon has seen a significant drop in TVL from its record high, resulting in a 82% decline from its all-time high for MATIC.

The cost of Polygon has been decreasing noticeably over the last several months due to its shrinking dominance within the layer-2 sector’s market.

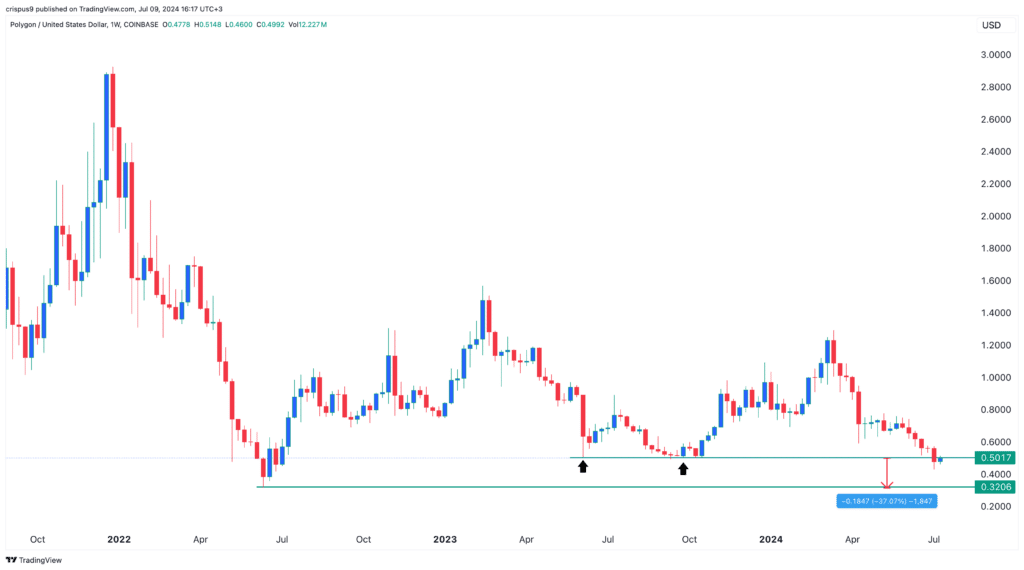

I analyzed the price movement of MATIC and noticed it hit a significant support level at $0.4343 on Friday. Since then, it has recouped some losses but remains approximately 60% down from its peak this year and an impressive 82% below its all-time high.

Competition in the layer-2 industry

In recent years, Polygon, a trailblazer in the field of layer-2 technology, has faced increased competition, resulting in added pressure for the company.

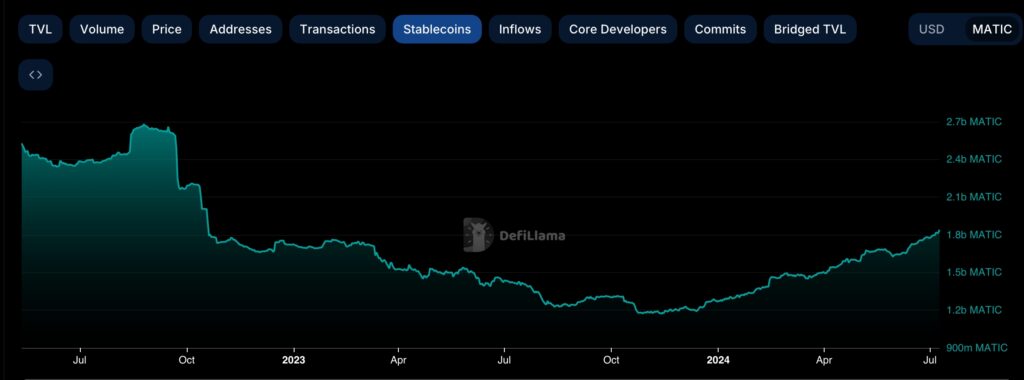

The DeFi industry’s total value locked (TVL) currently stands at $872 million, a significant decrease from its all-time high of around $10 billion. In Matic terms, this represents a drop from a previous peak of 5.7 billion to the current TVL of 1.78 billion.

Approximately 661 developers have joined the team at Arbitrum, a prominent layer-2 networking solution. The total value secured in this network exceeds $3 billion.

Polygon has been surpassed in terms of assets by both Base and Blast, with respective totals of $1.4 billion and $1.2 billion. Additionally, Optimism has claimed a portion of the market previously held by Polygon.

This competition partially explains why the MATIC price has dropped by 82% from its all-time high.

In spite of facing certain obstacles, Polygon boasts some noteworthy on-chain statistics. For instance, there are approximately 1.09 million unique addresses on its network, positioning it as the second largest behind Tron with its 2.09 million addresses.

As a crypto investor, I’ve found it reassuring to notice that the network has maintained a consistent transaction volume. Specifically, there have been over 3.8 million daily transactions since March 11th of this year.

Additionally, the amount of stablecoins has been surging significantly since October of the previous year. As depicted in the graph below, this increase translates from approximately 1.17 billion MATIC to more than 1.8 billion as of Tuesday. Stablecoins play a crucial role in blockchain systems, facilitating most transactions.

Stablecoins in Polygon

Polygon offers a more attractive staking reward than many other cryptocurrencies, with a rate of 5.67%, whereas Ethereum and Cardano offer staking yields of 3.29% and 2.9% respectively.

Polygon price has lost a key support

Polygon price chart

Although the Polygon token boasts notable advantages, its value has significantly declined over the past couple of weeks. Moreover, it has dipped beneath a crucial resistance line, which could undermine the emerging double-bottom trend.

As a researcher studying the price movements of Polygon, I’ve observed that it dipped beneath the crucial support level at $0.50 for the first time since June and October 2023. If this dip represents a genuine breakdown rather than a temporary setback, then there is a strong possibility that Polygon’s price will continue to slide and eventually touch the next support level at $0.3206, which was its lowest point in June 2022 and approximately 37% lower than its current value.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-07-09 20:30