As a seasoned researcher with over a decade of experience in the dynamic world of blockchain and cryptocurrencies, I find myself intrigued by Polygon’s recent developments. On one hand, we see encouraging metrics in its NFT and DeFi ecosystem, with surging volumes, sales, and active participants. Yet, on the other, we observe a 10-day streak of price retreat – a curious paradox that piques my interest.

For the initial time in a span of ten days, Polygon stepped back, despite positive statistics regarding its non-fungible token (NFT) and decentralized finance (DeFi) system showing promising progress.

DEX volume and NFT sales rise

1. The price of Polygon (MATIC) dropped to a low of $0.53, falling from its peak of $0.582 last week. Despite this, it’s still 60% above its lowest point for the month as we approach the transition to POL on September 4th.

After the developers successfully secured their X account following a recent hack, Polygon experienced a withdrawal or reversal of its position.

Independent data sources indicate that Polygon’s ecosystem is thriving. As reported by CryptoSlam, weekly NFT sales surged by a staggering 111%, reaching approximately $12.7 million. Additionally, the number of buyers increased by 35% to around 88,000, and the number of sellers grew to roughly 25,000.

356,700 transactions were managed by Polygon, but the wash trading volume saw a drop of 12%, reaching $9.2 million. Ranking fourth, Polygon follows Ethereum (ETH), Solana (SOL), and Bitcoin (BTC) in the NFT market’s hierarchy.

Polygon has shown strong performance within the Decentralized Exchange (DEX) sector, with its trading volume increasing by 7.32% to reach a significant $770 million. In this competitive market, it ranks among the top seven players, following notable names such as Ethereum, Solana, and Tron. Key active DEX networks within the ecosystem include Uniswap, Quickswap, Woofi, Dodo, and Retro.

Over the past week, I’ve observed a significant growth of approximately 10% in the Total Value Locked within the DeFi ecosystem for Polygon, now standing at a staggering $951 million.

Still, the network is seeing substantial competition in the layer-2 industry from the likes of Arbitrum (ARB) and Base, which have accumulated over $2.82 billion and $1.6 billion in assets. Arbitrum has also become one of the most active DEX networks, handling over $3.7 billion in the last seven days.

In the near future, Polygon’s ecosystem will undergo a transformation, moving from MATIC to POL. This transition will bring about enhanced functionalities within the network. The new POL token will be utilized to offer services across all chains in the Polygon network, including AggLayer.

Additionally, Polygon’s proof-of-stake system will utilize both its indigenous gas (transaction fee) and the POL token as its native staking currency. The introduction of POL may lead to increased volatility in Polygon’s market.

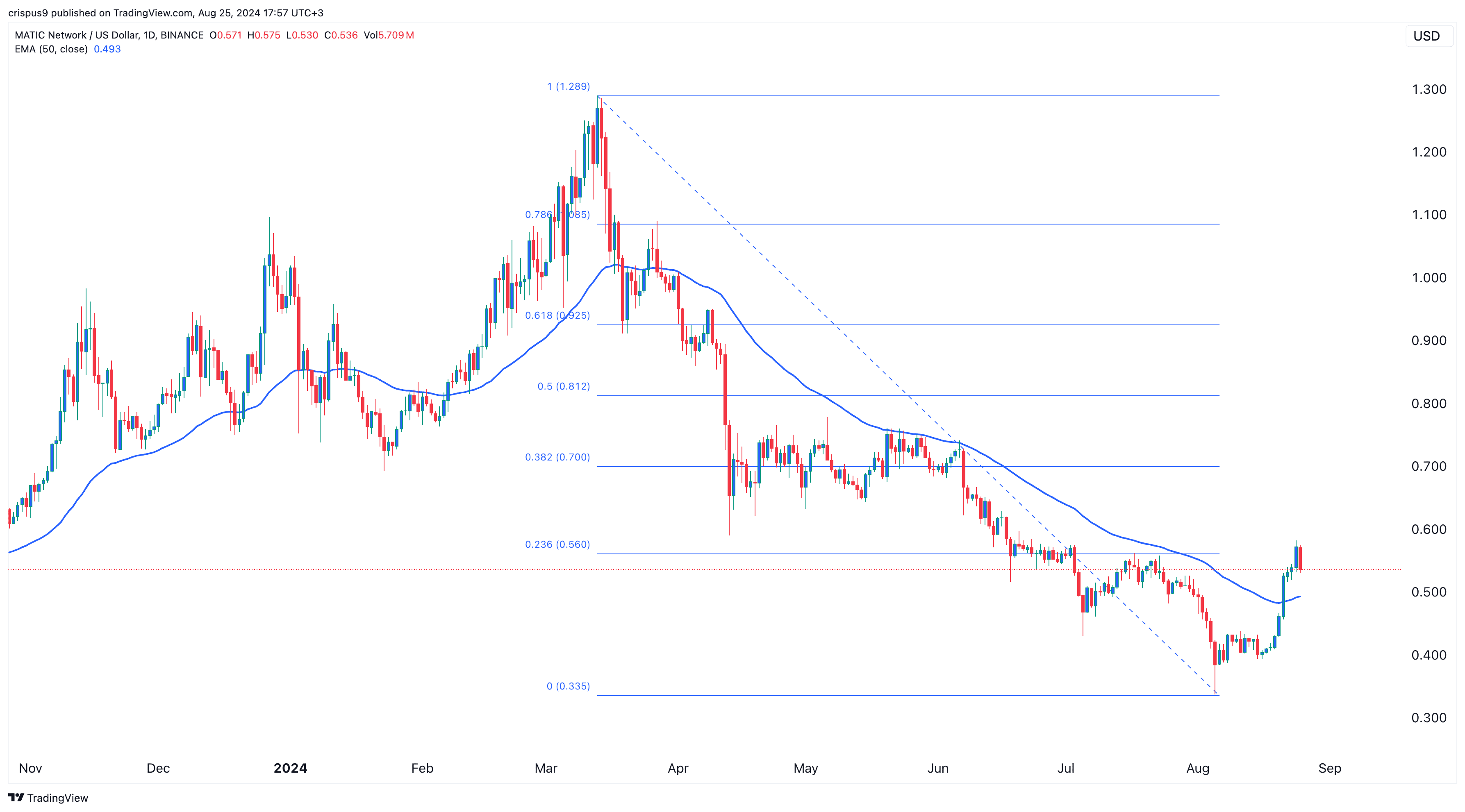

Polygon remains above the 50EMA

Currently, Polygon is above its 50-day moving average and sitting near the 23.6% Fibonacci retracement level.

Previously, it failed to move above that retracement point in July this year.

After its formation, the token appears to have developed a bearish engulfing candlestick structure, suggesting a potential reversal or correction might occur. This could potentially lead the price back towards the 50 Exponential Moving Average (EMA) at around $0.493.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-25 21:22