As a seasoned researcher with over a decade of experience in the dynamic world of cryptocurrencies, I’ve seen my fair share of market fluctuations. The recent prediction by Polymarket suggesting that Ethereum might drop to $2,000 before potentially jumping to $4,000 has caught my attention.

According to Polymarket, a widely used prediction platform, it’s expected that the price of Ethereum might initially fall to around $2,000, followed by an increase towards $4,000.

Since August 25th, it’s been more likely than not (a 60% chance as of August 27th) that Ethereum (ETH) will decrease in value and potentially fall below $2,000 by December 31st. This prediction has become increasingly likely as the coin’s value dropped from this week’s high of $2,818 to around $2,600 on August 27th.

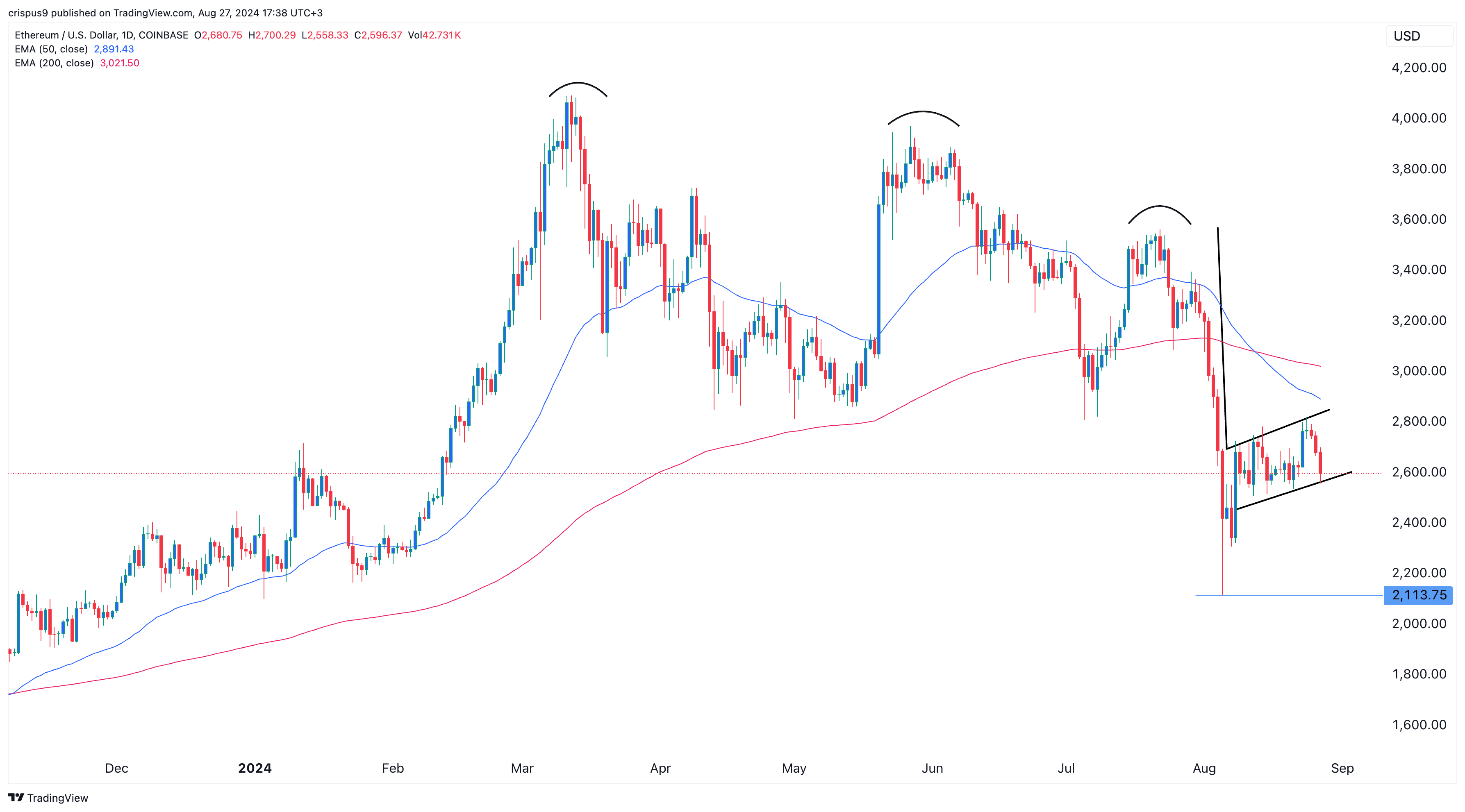

Since March, Ethereum, similar to many other alternative coins, has been following a significant downward trajectory, reaching an all-time high of $4,085. This trend has increased the likelihood that its value could dip to approximately $2,000, as it would need to decrease by around 23%. Conversely, for Ethereum to return to its previous high, it must surge by nearly 54% instead.

According to a Polymarket survey involving $231,000 in assets, there’s approximately an 8% likelihood that Ether will reach $3,000 before September. In another poll with $1.1 million, the majority of traders are not anticipating it to set a new record high this year.

2019 has presented Ethereum with a series of hurdles. Particularly in the realm of stablecoins, it’s facing stiff competition. For instance, Tron (TRX) processes billions of dollars worth of transactions daily.

In addition to its challenges, Solana is also experiencing competition within the Decentralized Finance sector. During July, Solana witnessed a significant increase in demand for its meme coins, leading it to handle the highest DEX (Decentralized Exchange) volume among all platforms. Specifically, Solana’s DEX volume reached an impressive $57 billion during this month, surpassing Ethereum’s $54.5 billion.

This month, Ethereum is significantly dominating with transactions worth approximately $50 billion, while Solana trails behind at around $33 billion.

“Ether is grappling with the issue that its exchange-traded funds are not gaining popularity among investors. According to SoSoValue’s data, these funds have experienced a total withdrawal of approximately $477 million since they were launched. Moreover, there has been a continuous withdrawal for the past eight days.”

Ethereum formed a death cross

Furthermore, Ether has created a pattern of successive lower peaks and troughs, which is quite significant. What’s more, it has also experienced a death cross, meaning that its 200-day and 50-day Exponential Moving Averages have intersected each other.

The chart has developed a bearish flag formation as well, indicating potential further price decreases. If this occurs, it’s crucial to keep an eye on this month’s low at $2,113. A drop below that level could increase the likelihood of the coin reaching $2,000.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-27 17:56