As a seasoned crypto investor with a keen eye on political events and market trends, I can’t help but notice the intriguing confluence of recent developments that could potentially impact both the US presidential race and the crypto space.

As aanalyst, I’ve observed that a botched assassination attempt against Donald Trump in Pennsylvania has seemingly enhanced his prospects of securing victory in the upcoming winter elections, according to betting markets.

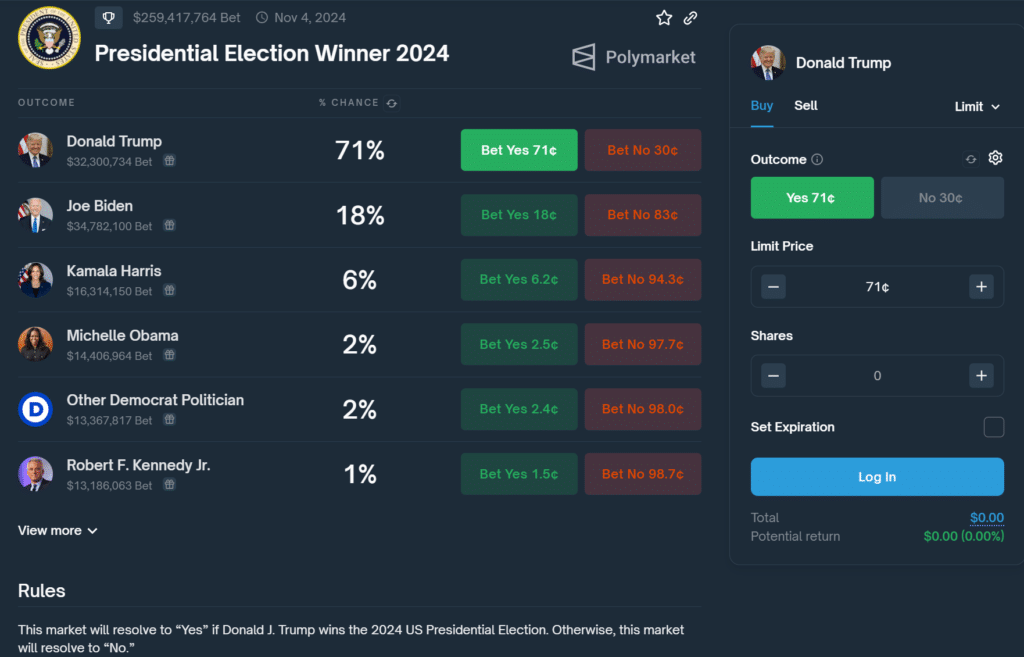

Betting enthusiasts on Polymarket predict that Donald Trump, the Republican nominee, has a 71% probability of triumphing in the upcoming 2022 US presidential election against Joe Biden. As of Monday, the chances of Biden being re-elected stood at approximately 18%. Over $259 million have been wagered on Polymarket’s prediction platform in a pool named “Presidential Election Winner 2024.”

As a crypto investor, I’ve been closely monitoring the political landscape and the associated market movements. Prior to last weekend’s shooting incident at a Pennsylvania rally, Trump’s chances of winning, according to crypto.news, stood at approximately 60%. However, this near miss might have significantly influenced things beyond just Polymarket bets. The crypto markets also experienced a noticeable surge following the unfortunate event.

Among the top 10 cryptocurrencies, excluding Ripple‘s XRP token and stablecoins, every other token experienced a rise of at least 7% within the past 24 hours.

Are the stars aligning for crypto?

Alongside Trump’s victory in Pennsylvania, former President Trump revealed his choice for a pro-cryptocurrency running mate: JD Vance. Vance was presented as Trump’s vice presidential nominee during the cryptocurrency market recovery on Monday.

The connection between the two individuals might spark curiosity about the possibility of pro-crypto administrators in the White House, given Trump’s team’s recent shift towards a more cryptocurrency-friendly stance. An Ohio senator named Vance gained recognition for his proposed legislation aimed at revising US crypto regulations.

At a higher level of perspective, Jerome Powell, the Federal Reserve chairman, indicated that the central bank could be on the brink of implementing interest rate reductions. Powell expressed his viewpoint that the Fed should not postpone employing accommodative monetary strategies until inflation aligns with its desired 2% threshold.

POWELL: LATEST DATA ‘ADD SOMEWHAT TO CONFIDENCE’ INFLATION IS RETURNING TO 2%

— *Walter Bloomberg (@DeItaone) July 15, 2024

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- USD CNY PREDICTION

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-07-15 22:48