As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of bull runs and bear markets. The current crypto bull run has been no exception, with some coins skyrocketing while others have lagged behind. In the case of Popcat (POPCAT), it seems to be one of those coins that has not kept pace with its peers.

In simpler terms, amidst the current cryptocurrency market surge, Popcat – one of the top meme coins on the Solana platform – appears to be lagging, potentially indicating a possible downturn or bearish trend.

Popcat (POPCAT) retreated to $1.43 on Tuesday, Nov. 12, down 18% from its highest level this year.

Over the past seven days, Popcat saw a modest increase of only 14%, whereas Dogecoin (DOGE) experienced a significant surge of 128%. Additionally, other tokens such as Shiba Inu, Pepe, Dogwifhat, and Bonk have all soared more than 40%. These digital assets gained momentum after Donald Trump’s election victory, sparking optimism about more favorable regulations in the United States.

One explanation for Popcat’s less-than-optimal performance might be investors shifting their focus to other digital currencies. Nevertheless, it’s worth noting that even with this rotation, Popcat still stands as one of the top-performing cryptocurrencies this year. In fact, its growth has been remarkable, soaring more than 250,000% from its lowest point.

According to certain experts, Popcat might experience growth in the short run. On platform X, renowned analyst Professor Astrones, with a following of more than 187,000 people, proposed that the value of the coin could range from $10 to $20.

$POPCAT

This one will still pump

The $POPCAT top will be between 10$ – 20$

— ProfessorAstrones (@Astrones2) November 12, 2024

Popcat price may be at risk of a big dive

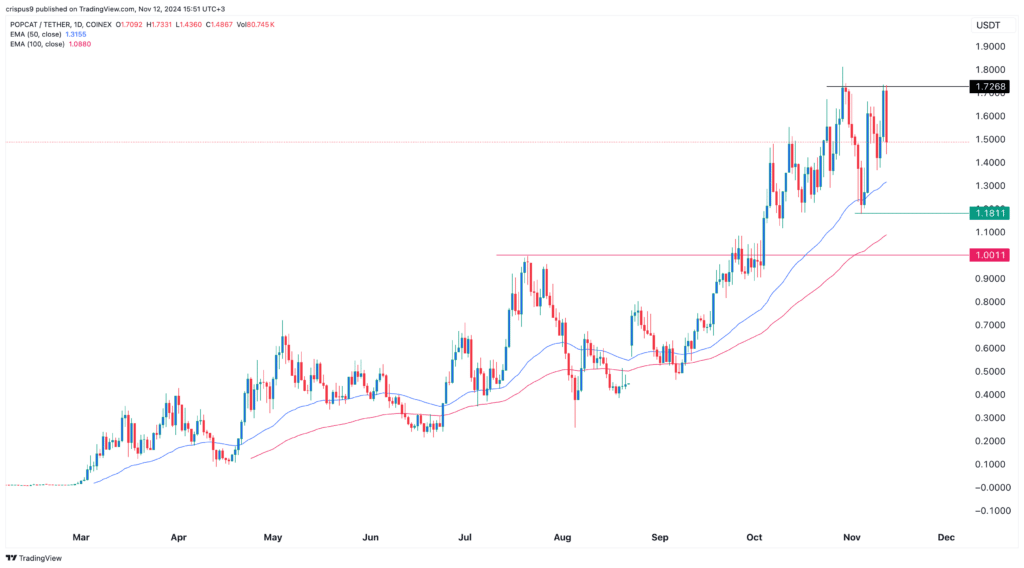

This year, the value of Popcat’s tokens has shown impressive growth, hitting an all-time peak of $1.8132. On October 4th, it surpassed a significant resistance level at $1, indicating a dominant bullish trend.

Popcat continues to hover over its 50-day and 100-day Exponential Moving Averages, which is usually an optimistic indicator. Yet, it has developed a double-top structure at $1.7268, a pattern often associated with potential bearish reversals in the market, with a neckline situated at $1.1810.

Furthermore, it appears that a bearish candlestick pattern is developing, suggesting a possible decline in price for Popcat. If this trend continues, the support level at around $1.18 (approximately 21% lower than current prices) could be tested. A break below this level might lead to additional drops, potentially reaching $1.

Conversely, a leap beyond the resistance level of $1.7270 could hint at possible profits, potentially reaching as high as the resistance point at $2.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- The 15 Highest-Grossing Movies Of 2024

2024-11-12 17:00