As a seasoned analyst with over two decades of experience navigating the volatile crypto market, I find myself intrigued by Popcat’s (POPCAT) recent surge and bullish sentiment. The 22% rise within 24 hours, following the U.S. Federal Reserve’s rate cut, indicates a savvy team capitalizing on favorable market conditions.

In simpler terms, the digital currency known as Popcat, which operates on the Solana network, experienced a significant surge, placing it at the forefront of daily gains among the top 100 cryptocurrencies currently in circulation.

The recent 50-basis-point rate cut by the U.S. Federal Reserve has triggered bullish sentiment across the crypto market, which Popcat (POPCAT) has leveraged, recording a 22% rise in price in the past 24 hours.

At this moment, Popcat is being traded at $0.8738, marking a 39.03% increase over the past week. This growth has boosted its market capitalization to an impressive $856.4 million. Moreover, a high daily-hour trading volume of $135 million indicates a surge in investor attention towards Popcat.

A pattern contributing to the surge was the rounded bottom formation on the daily chart, which often indicates a potential bullish reversal. Most of the rally occurred in the last trading session, with Popcat gaining nearly 19% yesterday, its largest intraday gain in a month.

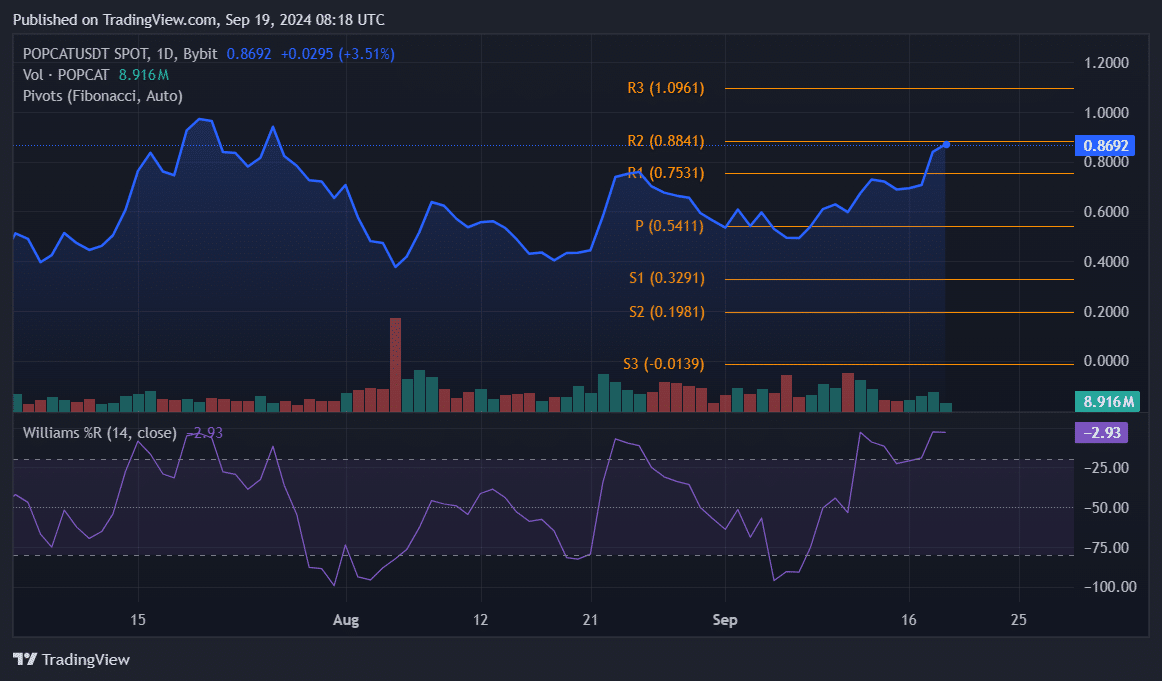

The Fibonacci pivot points indicate potential obstacles for advancement, beginning at approximately $0.88 and progressing upward to the record high of around $1.09. As investors aim to surpass the $1 mark once more, the $0.88 level stands as a significant hurdle.

On the negative side, significant support can be found around $0.75, with further supports at $0.54 and $0.32. However, the price has just broken through the important $0.46 barrier, a point emphasized by analysts as a crucial sign of a bullish surge.

Based on a recent post from the anonymous analyst known as Impulsive Dom, this security breakthrough suggests a strong upward trend could be ongoing. If the momentum persists, it’s possible that Popcat might aim for prices within the $2 to $3 range during its third Elliott Wave surge.

Is it likely that the price of Popcat will surge soon? 🚀

— impulsive dom (@impulsivedom) September 19, 2024

Furthermore, the Williams %R indicator, presently at -2.93, suggests an overbought state. Values nearer to zero may signal that the asset might be approaching a short-term peak, and the market could encounter selling pressure imminently. It’s plausible that a correction from this level will occur, considering the recent steep increase.

If Popcat continues at its current pace, it’s possible that the price could reach $1. But remember, it’s crucial to exercise caution since dropping below $0.75 might trigger a reevaluation of lower resistance points around $0.54 and $0.32.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-09-19 12:53