In a move indicating growing regulatory attention towards digital assets in Portugal, Portugal’s leading bank, Banco de Investimento Global (BiG), has temporarily halted fiat-to-cryptocurrency transactions with cryptocurrency platforms.

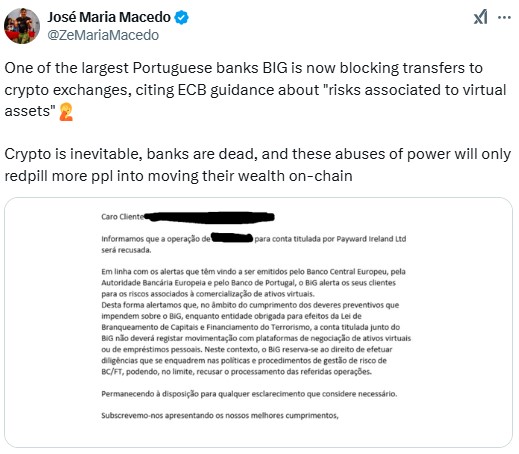

Delphi Labs’ co-founder, José Maria Macedo, shared on Twitter that BiG, a company handling assets worth nearly €7 billion, has made an announcement. Macedo voiced his disapproval of this decision, implying it might encourage more individuals to shift their funds towards blockchain services.

As an analyst, I find myself expressing the viewpoint that cryptocurrencies are destined to become widespread, traditional banks may lose their dominance, and instances of misuse of power will continue to push people towards managing their assets on blockchain platforms. Interestingly, it seems that such sentiments are not universally applicable to all entities (in this case, BiG).

Many significant Portuguese banks, like Caixa Geral de Depósitos, are reportedly continuing to accept traditional money transactions for cryptocurrency platforms. This decision is being made as Portugal adapts its strategy regarding the regulation of cryptocurrencies.

Initially recognized for being welcoming towards cryptocurrencies, the nation even allowed tax-exempt crypto trading as recently as 2019. However, a fresh tax policy enacted in 2023 mandates a 28% capital gains tax on brief crypto holdings, exempting long-term investments from this levy.

BiG’s move is aligned with a wider European shift towards tighter controls over cryptocurrencies. The goal of the European Union’s Markets in Crypto-Assets Regulation is to establish a uniform system for digital assets, which will influence how financial institutions interact with crypto exchanges.

In light of the changing international regulatory terrain surrounding cryptocurrencies, nations such as El Salvador are modifying their regulations, demonstrating that striking a balance between fostering innovation and ensuring security remains an ongoing dilemma for governing bodies.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2025-01-08 12:07