As a seasoned researcher who has witnessed the crypto market’s rollercoaster ride over the years, I can confidently say that yesterday’s events were as thrilling as they were unpredictable. The Bitcoin surge following Trump’s election victory was a stark reminder of how politics and finance intertwine in unexpected ways.

Yesterday, due to Bitcoin‘s price soaring to a record peak following Donald Trump’s election win, there was a significant rush of sell-offs or “liquidations” in the cryptocurrency market.

In the presidential race, Donald Trump emerged as the leading Republican contender, and this development was followed by an extraordinary surge in the value of Bitcoin (BTC), pushing its price to a record-breaking peak of $76,480.

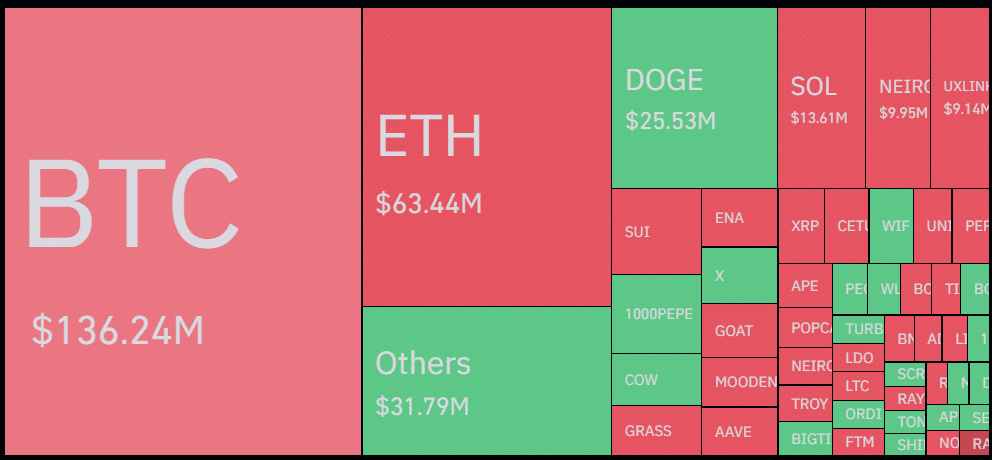

On November 6th, a strong upward trend in market value resulted in substantial sell-offs amounting to approximately $611.5 million, as reported by data from Coinglass. This was the highest one-day liquidation event since August.

Most of the liquidations stemmed from traders holding short positions who had bet against Bitcoin’s upward momentum. Approximately 70% of the liquidations, or $426.891 million, were from shorts. Conversely, long positions also took a hit amid the high volatility, with $183.46 million in liquidations.

The burden continues for those holding short positions, as a total of $107.69 million worth of these positions has been closed. Meanwhile, long positions experienced a loss of approximately $63.86 million today, although the volume of liquidation was less compared to shorts.

As new information emerges, it appears that open interest continues to be high, indicating that trading activity is still robust and investor confidence remains strong.

As a crypto investor, I noticed a significant increase of approximately 7.39% in the total open interest over the last 24 hours, pushing it up to an impressive $83.14 billion. On the flip side, the futures volume seems to have taken a dip, decreasing by 20.69%, now standing at $235 billion. This could be due to the initial buzz from Bitcoin’s surge starting to settle down and investors adopting a more measured approach.

In addition, it’s worth noting that the Bitcoin long position to short position ratio has experienced a minor decrease, falling by approximately 0.5 percentage points to stand at 1.01 at present. This figure suggests a slight inclination towards long positions among investors, indicating a relatively even mindset overall.

Significantly, Bitcoin reached a new record high on Tuesday, surpassing its previous peak from March at $73,679. However, after hitting this all-time high (ATH), the price showed a minor decrease. Still, this decline followed an impressive intraday increase of 9.01%, which is the largest since August.

Yesterday, a significant surge in the rally drove up the overall market, taking the total value of the global cryptocurrency market to a five-month high of $2.52 trillion. This strong upward momentum resulted in substantial liquidations due to its intense impact on the market.

bitcoin experienced a 2.41% increase over the past day and is currently valued at approximately $75,091. The trading volume has decreased by almost 21%, amounting to around $76.55 billion. This decrease in trading activity has led to less market volatility. Despite this decrease, bitcoin aims to conclude the week above $76,000 to preserve its positive trend.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-11-07 20:34