As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I must admit that Reef’s recent surge has caught my attention. After being delisted by Binance, a move that usually signals a downturn, the token’s resilience and subsequent rally have been quite unexpected.

For five straight days, the price of the Reef token climbed higher due to increased demand in both the immediate trading market and future contracts, following its removal from Binance‘s platform.

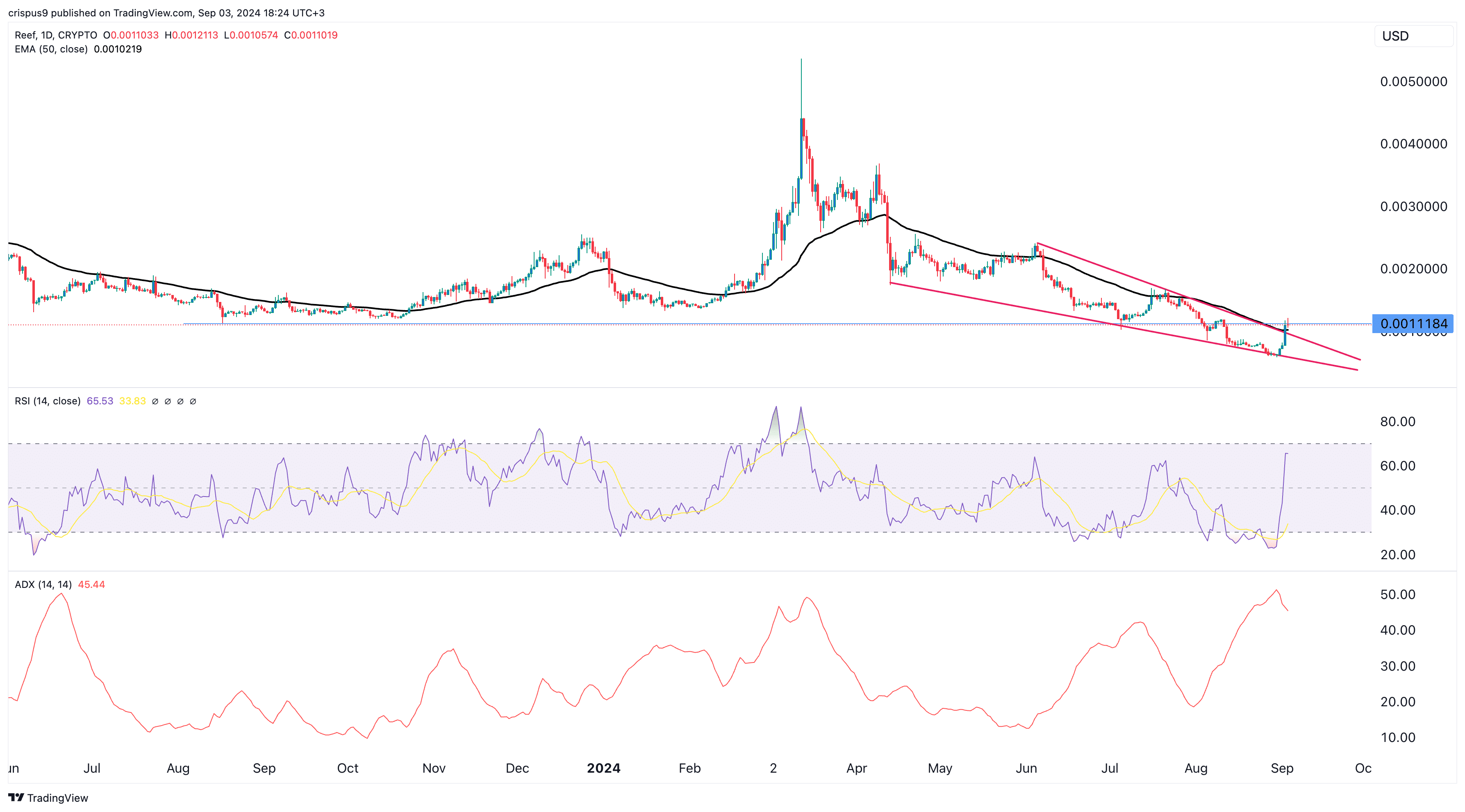

On September 3rd, the price of Reef (REEF) peaked at $0.0012, which was its highest level in a month. Remarkably, this is a surge of 106% from its lowest point last month. This impressive recovery has pushed its market capitalization above $25 million.

The healing process of the Reef took place after its creators introduced a fresh community development fund. This fund was designed to foster initiatives in areas such as lending systems, secure digital wallets, frameworks for decentralized autonomous organizations (DAOs), and interoperability bridges.

Last Friday, our Community Development Fund 🛠️ was launched, and the positive reaction has been simply incredible! 🚀

— 🐠 Reef (@Reef_Chain) August 28, 2024

Due to Reef’s rally, there was a significant surge in investor interest, as indicated by data from CoinGecko. This surge resulted in a massive increase of the 24-hour trading volume to $45 million on Tuesday, which was up from $23 million on September 1st. This marked the highest point for the trading volume in almost a month.

Furthermore, Reef’s involvement in the futures market reached an all-time high of $60 million over the past two years, marking a substantial increase compared to the $3 million recorded in August.

Remarkably, I found that my project, Reef, experienced a resurgence post its delisting from Binance, the leading crypto exchange. Generally speaking, it’s common for cryptocurrencies to experience a decline following their removal from top-tier platforms like Binance.

The data shows that the majority of trades are taking place on Gate.io, with HTX, KuCoin, and Bitget being the next most active platforms in terms of trading activity.

Reef price crosses key resistance

The price of Reef peaked at $0.0013, surpassing the significant barrier at $0.0011, which was its lowest dip from the previous year in August.

Previously, Reef exhibited a falling wedge shape, which is often seen as a bullish reversal signal. Now, it has surged past its 50-day moving average, and the Relative Strength Index (RSI) is approaching the overbought threshold of 70. The RSI is a tool that gauges an asset’s speed of change.

In simpler terms, the Average Directional Index (ADI), a tool that gauges the intensity of a market trend, stands at 50 and is heading south. This suggests that the token might temporarily reverse its course due direction, causing traders to retreat briefly as the token could retreat slightly as retreat

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-03 18:52