As a crypto investor with a few years of experience under my belt, I’ve seen my fair share of market shifts and competitive dynamics. The recent news that Coinbase has lost significant ground in global trading volume to up-and-coming exchanges like Bybit is a cause for concern.

The global trading volume on American cryptocurrency exchange, Coinbase, seems to be decreasing noticeably due to intense competition following the debut of Bitcoin SPOT ETFs in the United States markets.

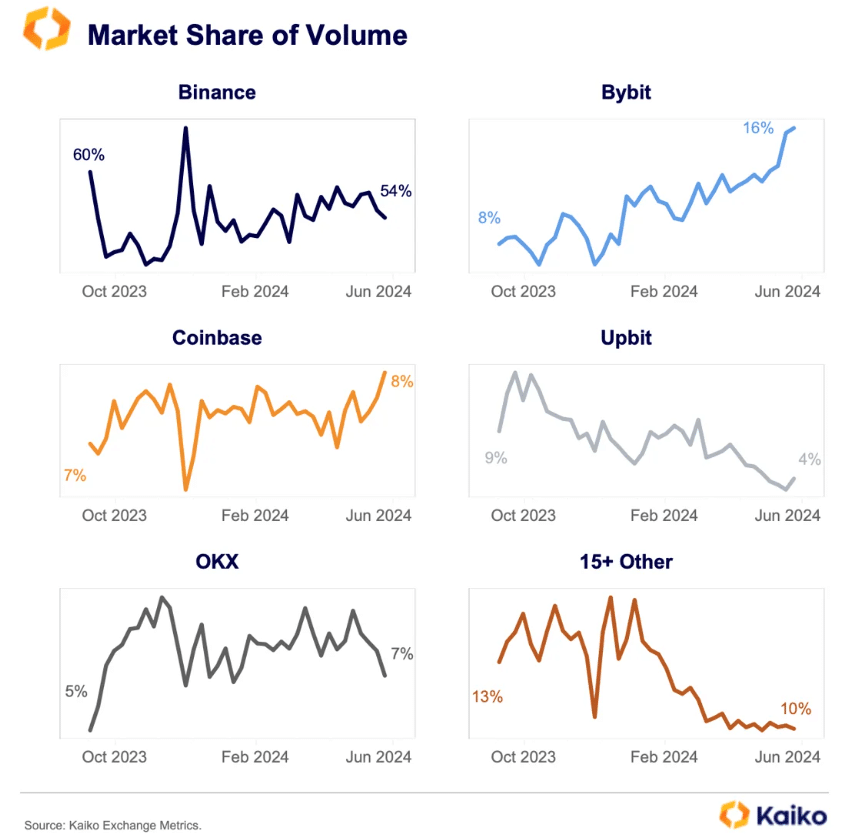

According to data from blockchain analysis firm Kaiko, Coinbase, a well-known cryptocurrency exchange, has experienced a significant decrease in market share since October 2023. Its share used to be as large as 11%, but it has now dropped to approximately 8%. In contrast, Bybit, another major player in the crypto exchange industry, has grown its market share to roughly 16% of the global trading volume.

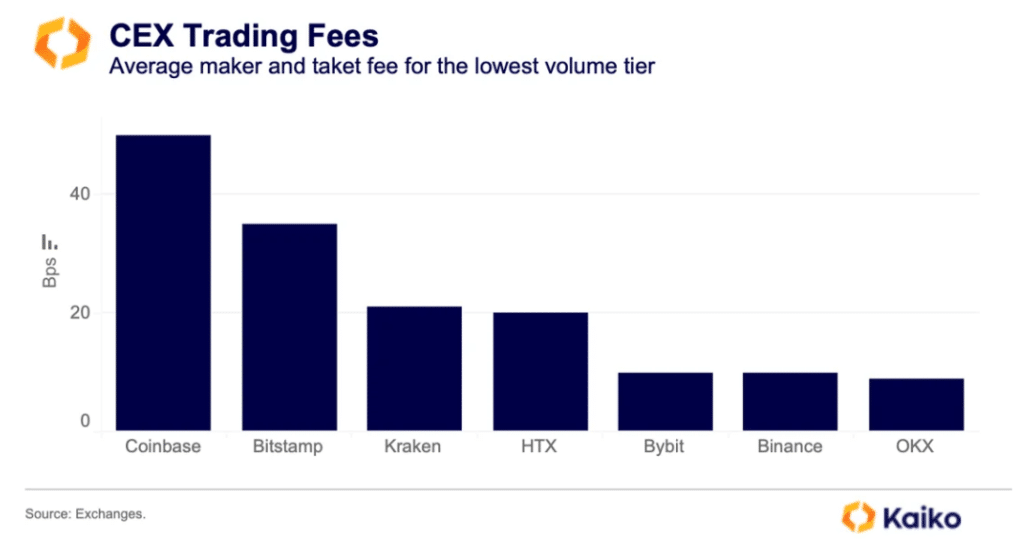

As a crypto investor, I’ve noticed that Bybit’s strategic move to reduce trading fees has significantly contributed to an increase in market share, according to data from Kaiko. However, it’s important to note that lower costs weren’t the sole factor behind its success. Kaiko points out that Bybit also benefited from Binance‘s regulatory issues at the time.

According to Kaiko’s analysis of trading data, the surge in spot trade volumes on Bybit is attributable to both Bitcoin and Ethereum. The market shares of these two assets have significantly grown from a 17% share last year to a 53% share presently.

Binance has experienced a more pronounced rise in trading volume for altcoins, according to the firm. Despite maintaining the leading market share (54%), Binance’s portion of Bitcoin and Ethereum trading volume has decreased to 43% in 2021 from 59% in 2020. Kaiko hypothesizes that this shift could be attributed to fluctuations in investor risk appetite, with a tendency for volumes to decrease during market downturns.

Although Bybit has made strides forward, it appears that Wall Street is pulling back from engaging with the exchange. In late May, news surfaced that Hidden Road, a prime brokerage firm backed by Citadel Securities, had ceased providing its clients access to Bybit. This decision reportedly stemmed from disagreements concerning Bybit’s KYC/AML (know your customer/anti-money laundering) procedures. Bybit has yet to publicly comment on the situation, but a representative for the exchange assured that they remain dedicated to transparency and will keep the public informed as the review continues.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-06-25 16:18