As a seasoned crypto investor with a decade-long journey under my belt, witnessing this global surge towards Central Bank Digital Currencies (CBDCs) feels like standing at the precipice of a new era. The pace at which nations are adopting and exploring CBDCs is nothing short of astounding.

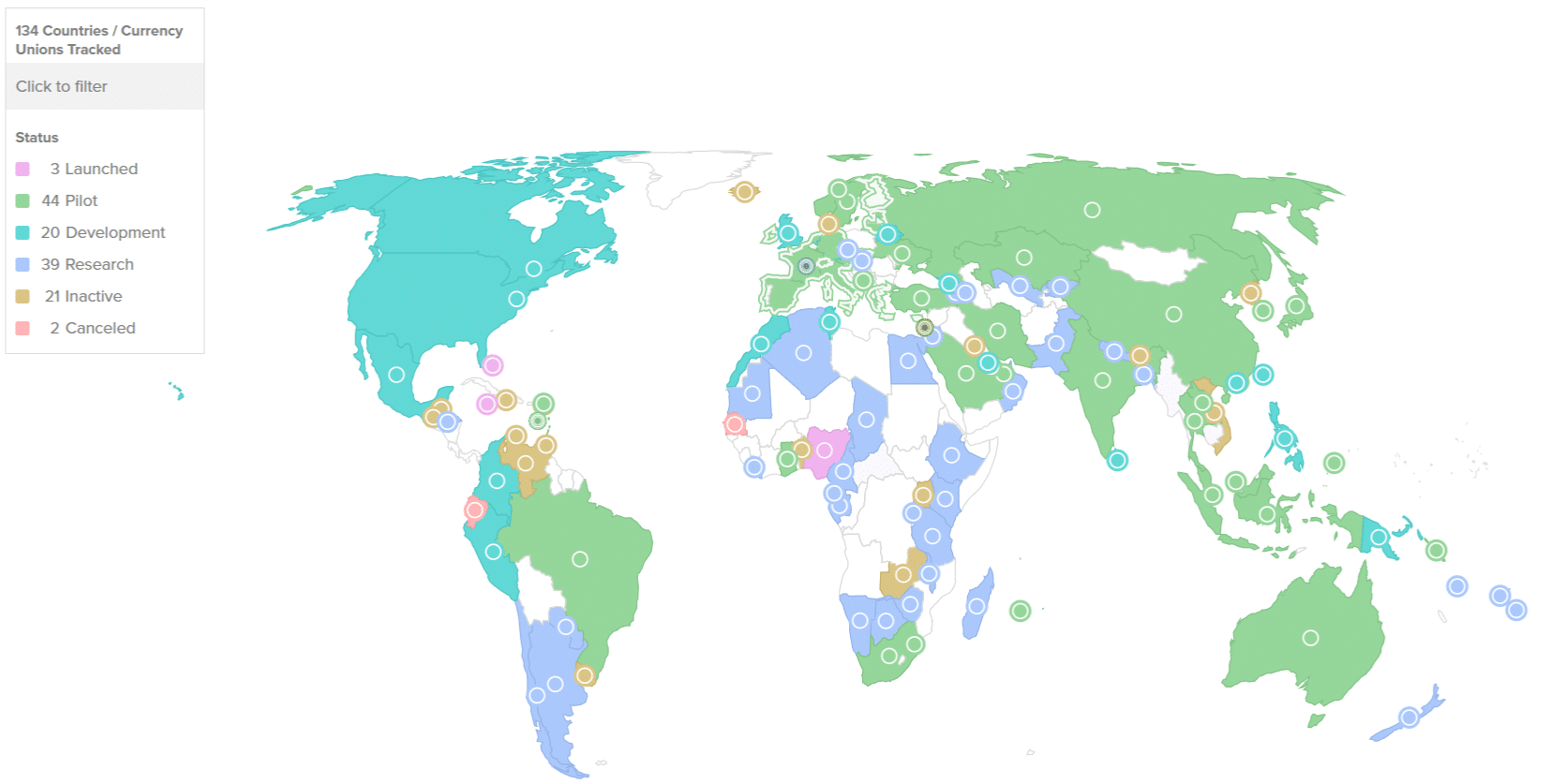

It has come to light that a staggering 134 nations, accounting for approximately 98% of the world’s economic activity, are actively investigating the adoption of digital currencies. Among these, an impressive 44 countries have already embarked on trials involving Central Bank Digital Currencies (CBDCs).

99% of the global economy is currently giving close attention to Central Bank Digital Currencies (CBDC), as per data from the U.S.-based Atlantic Council think tank. As of September 2021, a total of 134 countries worldwide are either actively exploring or considering CBDCs, which is a significant increase from the 35 countries that were looking into it in May 2020.

It appears that more than 65 nations, such as India, Australia, and Brazil, are actively pursuing Central Bank Digital Currencies (CBDCs), either through development, testing, or launch phases. In fact, every member of the G20 group is currently examining the possibility of their own CBDC, with 19 countries already in advanced stages of exploration, according to a research organization’s findings.

Although there’s significant global curiosity, just three nations – The Bahamas, Jamaica, and Nigeria – have successfully rolled out Central Bank Digital Currencies (CBDCs), with each aiming to broaden their national scope. Interestingly, the study suggests that digitization could be more than just a financial endeavor; it seems to be a geopolitical objective as well. All of the initial BRICS members – Brazil, Russia, India, China, and South Africa – are experimenting with CBDCs as an “alternative payment system to the dollar.

The Atlantic Council notes that following Russia’s invasion of Ukraine and the imposition of G7 sanctions, there has been a significant increase in cross-border wholesale Central Bank Digital Currency (CBDC) initiatives. Currently, over a dozen projects are underway to link banks in China, Thailand, and the United Arab Emirates.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-17 13:29