In a move that could only be described as audacious, Ripple has acquired Hidden Road for a staggering $1.25 billion, cementing its place as the first crypto-native firm to operate a global, multi-asset prime brokerage platform. This acquisition, the largest in Ripple’s history, could herald a new chapter for XRP and the broader Ripple ecosystem. 🚀

A Major Leap into Institutional Finance

Announced on April 8, the deal marks one of the largest mergers in the digital asset industry. Hidden Road, known for its extensive clearing and financing services across foreign exchange (FX), fixed income, swaps, and digital assets, currently serves more than 300 institutional clients and clears over $3 trillion annually. 💼

“With new resources, licenses, and added risk capital, this deal will unlock significant growth in Hidden Road’s business,” said Marc Asch, CEO of Hidden Road. He added that the partnership with Ripple would allow the firm to increase capacity, expand into new product lines, and service more markets with institutional-grade reliability. Brad Garlinghouse, Ripple CEO, called the acquisition a “once-in-a-lifetime opportunity” and emphasized that the deal gives crypto “access to the largest and most trusted traditional markets—and vice versa.” He noted that Hidden Road, a long-time Ripple partner, would integrate XRP and the XRP Ledger (XRPL) to expedite trade settlement and enhance operational efficiency. 🤝

XRP Ledger at the Core of Integration

The acquisition also brings a significant boost to Ripple’s technological infrastructure. Hidden Road plans to migrate its post-trade processes onto the XRP Ledger, demonstrating the blockchain’s potential as a cost-efficient, decentralized solution for institutional finance. This move could validate XRPL’s capacity to handle large-scale clearing operations while maintaining transparency and speed. ⚙️

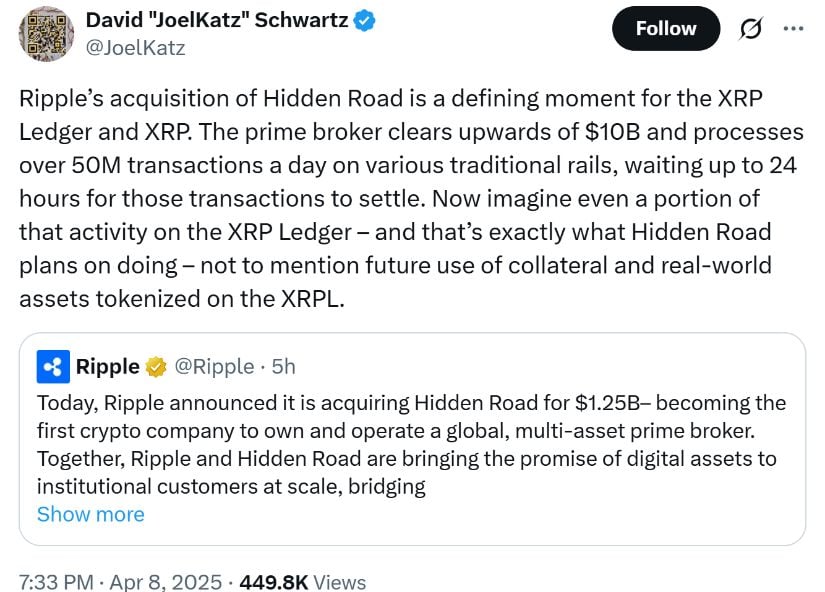

In addition, Hidden Road will adopt Ripple’s enterprise-grade stablecoin, Ripple USD (RLUSD), as collateral across its prime brokerage services. This positions RLUSD as the first stablecoin to enable efficient cross-margining between digital and traditional financial markets. Ripple CTO David Schwartz called the acquisition a “defining moment for XRP,” citing the potential to settle portions of the firm’s $10 billion in daily transactions using XRPL instead of relying solely on fiat rails that take up to 24 hours. He also hinted at future adoption of real-world assets tokenized on the XRP Ledger as collateral within prime brokerage platforms. 💡

Strengthening Ripple’s Strategic Position

The acquisition comes amid broader shifts in the U.S. regulatory landscape. With the former regulatory overhang from the U.S. Securities and Exchange Commission (SEC) receding, Ripple sees a more favorable environment for digital assets and the XRP market. Garlinghouse acknowledged this timing, stating, “We are at an inflection point for the next phase of digital asset adoption.” 🕰️

Despite long-running legal tension surrounding the XRP lawsuit, Ripple remains focused on growth through strategic mergers and acquisitions rather than an IPO. Monica Long, Ripple’s president, confirmed this during a panel at Paris Blockchain Week 2025, saying the firm prefers organic expansion over public listing. “We’re definitely a player in M&A right now,” Long stated. “An IPO makes sense for companies that need liquidity. That’s not our constraint.” This emphasis on long-term value building also underlines Ripple’s confidence in the evolving Ripple market and its vision of making Ripple exchange services a key bridge between crypto and traditional finance. 🌉

Implications for Ripple and the XRP Ecosystem

With this deal, Ripple positions itself as a serious contender in reshaping global finance. The integration of XRPL into Hidden Road’s infrastructure could drive broader institutional adoption, benefiting not only Ripple price prospects but also long-term XRP price predictions. 📈

The partnership is also likely to spur interest in Ripple’s other enterprise services, including Ripple Payments and custody solutions tailored for institutional clients. By enhancing liquidity access and lowering operational costs, Ripple is sending a strong signal that its focus lies on building scalable, bank-grade solutions for the digital economy. 💼

Final Thoughts

As Ripple XRP news continues to evolve, the firm’s strategic focus on infrastructure and institutional relationships, including past collaborations with Ripple Bank of America, suggests that Ripple’s ambitions are far from capped. The Hidden Road acquisition is not just a financial milestone—it is a foundational moment for what Ripple and XRP could become in the next wave of digital finance. 🌊

With regulatory clarity improving, technological groundwork solidifying, and major acquisitions underway, Ripple appears poised to not only lead but to define the next era of institutional crypto adoption. 🚀

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Maiden Academy tier list

2025-04-08 21:38