As a seasoned crypto investor who witnessed the 2017 bull run and subsequent bear market, I can confidently say that the current surge of Ripple (XRP) is reminiscent of those exhilarating times. The market cap leapfrogging Binance’s BNB Coin is a significant milestone, indicating a strong industry sentiment towards XRP.

For the very first time, Ripple‘s own digital currency, XRP, climbed into the group of the top five largest cryptocurrencies in terms of market capitalization, boosted by optimistic trends within the crypto sector.

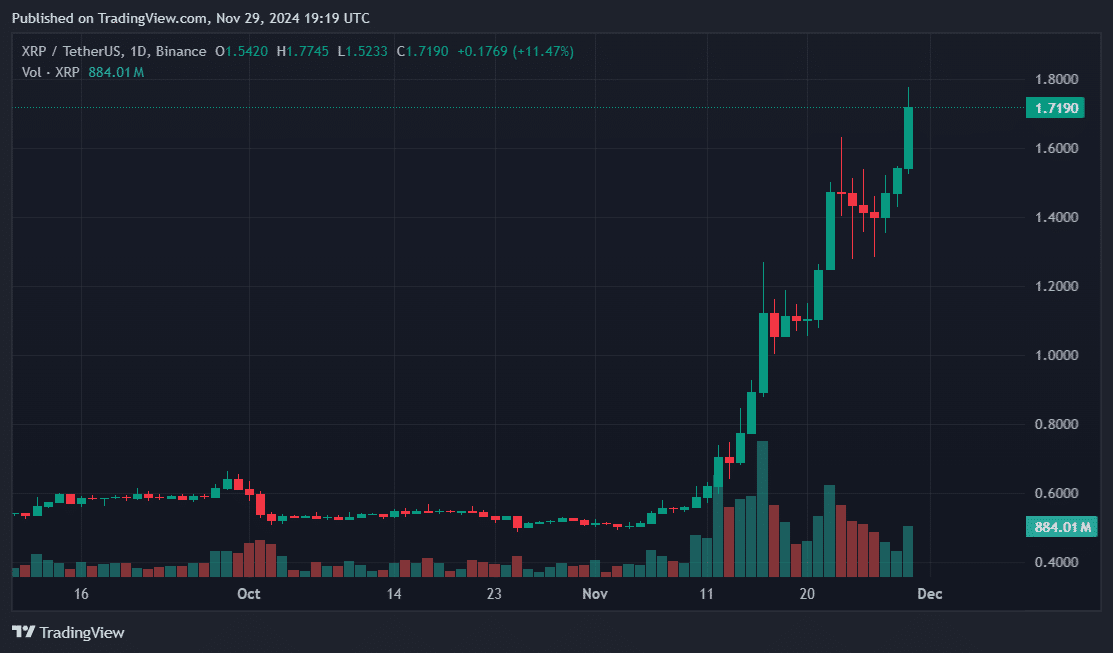

On Friday, November 29th, during a surge in the cryptocurrency market, Ripple (XRP) surpassed Binance‘s BNB Coin (BNB), with Ripple’s market capitalization reaching $97 billion compared to BNB’s $95 billion. This growth was fueled by the overall rise in the value of digital assets, which reached a record high of $3.5 trillion for Ripple.

Over the past day, XRP’s price has climbed significantly due to a combination of growing market sentiment, Ripple’s expanding business operations, and favorable regulatory conditions. This surge propelled XRP by 15.8% within the last 24 hours and an impressive 226% over the past month. At the time of reporting, the token was trading at $1.70. The highest it ever reached was $3.40 back in January 2018.

Ripple catalysts

Leading organizations such as Bitwise, Canary Funds, Grayscale, and WisdomTree spearheaded the push for an XRP-based exchange-traded fund (ETF), following staff shifts within the Securities and Exchange Commission.

Previously serving SEC commissioner and advocate for cryptocurrency regulation, Paul Atkins, emerged as a leading contender for the position left vacant by departing crypto-critic chair Gary Gensler. Following Donald Trump’s victory in the presidential election, Gensler announced his resignation to take effect on January 20th.

To add to that, Ripple emerged as one of the latest players in the stablecoin market. This fintech company launched its RLUSD on both its own XRP Ledger and the Ethereum network, which is currently the biggest decentralized finance platform in terms of user deposits.

The victory in court over the SEC and upcoming crypto-friendly legislation in the U.S. solidifies Ripple’s position as a dominant player in the digital asset sector. In a ruling by the Southern District Court of New York, the SEC’s claim that retail sales of XRP violated securities laws was rejected. Additionally, the judge allowed a $250 million fine related to institutional XRP sales.

Nevertheless, there’s a possibility that the SEC might choose to lodge an appeal. If new leadership such as Atkins takes over at the SEC, they could potentially adopt a distinct regulatory strategy for the agency.

There’s been a lot of uninvited suggestions about who should or shouldn’t be the next SEC Chair. I have faith that the transition team will make the appropriate decision, taking into account these essential considerations for cryptocurrency:

— Stuart Alderoty (@s_alderoty) November 21, 2024

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-11-29 22:28