If there is one thing more delightful than a man in pursuit of pleasure, it is surely a billionaire in pursuit of Bitcoin. Thus, Michael Saylor and the delightfully named Strategy—whose strategic thinking seems to consist of hoarding Bitcoins like a Victorian miser with sugar cubes—have once again announced a fresh acquisition, doubtless whilst sipping absinthe and crafting witty epigrams on volatility. 🍸💰

Strategy Acquires 1,895 BTC: Because Moderation Is for Amateurs

On the modern-day oracle known as X (formerly Twitter, previously sense, now mostly chaos), Mr. Saylor—chairman, co-founder, and probable collector of rare peacocks—declared the latest Bitcoin haul. The numbers: 1,895 BTC, acquired at an average price of $95,167, between April 28th and May 4th. I do hope his abacus is insured.

With a sprightly expenditure of $180.3 million—enough to keep Oscar Wilde in velvet jackets until the sun exploded—the company’s grand total now rests at 555,450 BTC. One has visions of a great Scrooge McDuck vault, only with less diving and more existential dread.

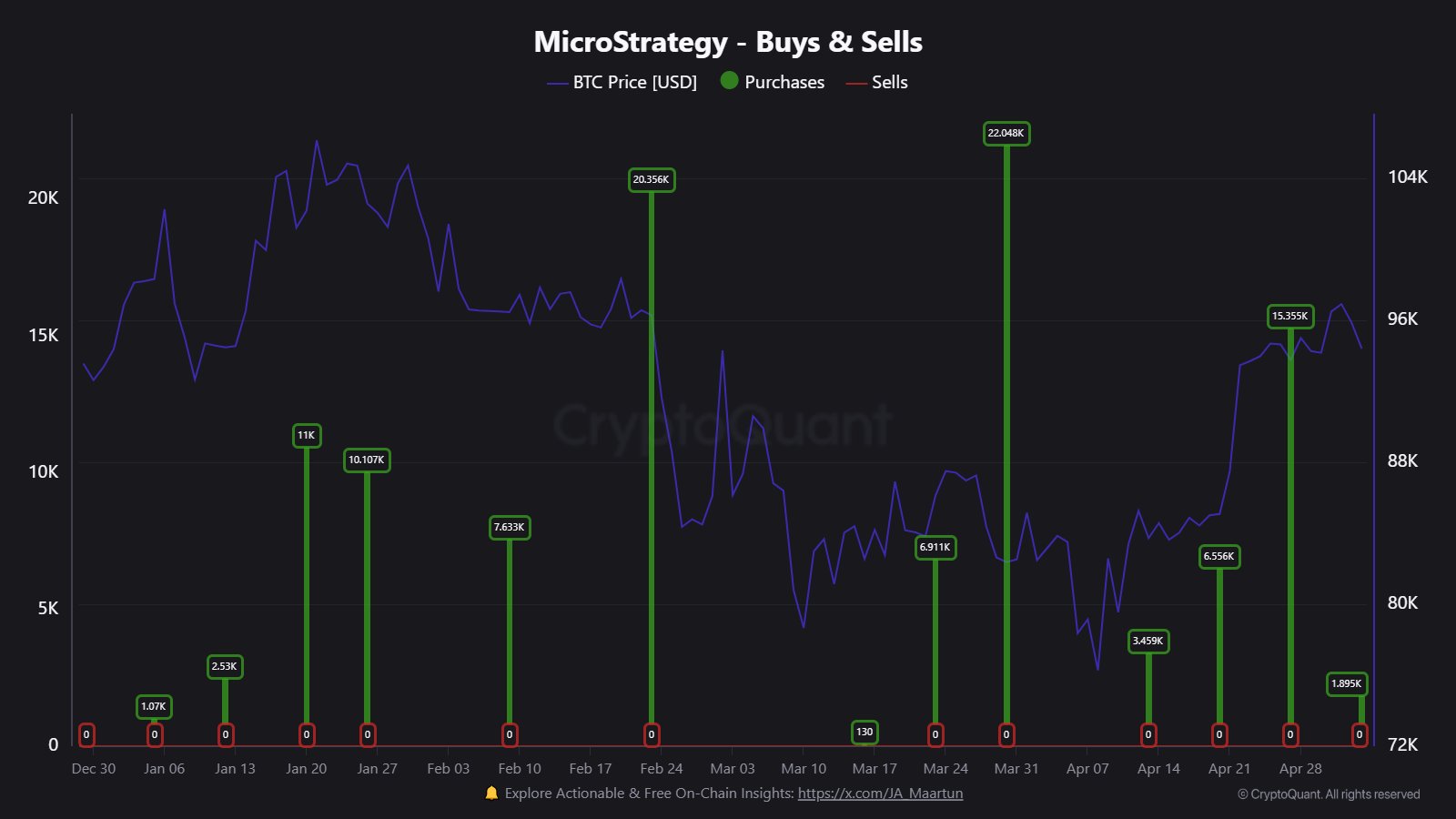

Over the last months, Strategy has been positively rampant. The analyst Maartunn (whose parents kindly combined the words ‘martini’ and ‘fortune’) has observed a peculiar ritual: the initial Bitcoin gobble each month is the lightest. One wonders, is this restraint or simple foreplay? Here’s the chart, with all the suspense of a Victorian melodrama:

Maartunn notes, with the clarity of a man who has stared too long into the crypto abyss, “The first MicroStrategy purchase of the month is always the smallest. It builds up as the month progresses.” How titillating. The latest 1,895 BTC is but the amuse-bouche. Should the pattern persist, we may soon see Saylor swoop in with an even grander flourish—assuming he doesn’t run out of pocket squares first.

The ever-expanding Bitcoin mound cost about $68,550 per BTC. At the current market rate, Strategy sits astride a princely profit—about 38%. For now, Mr. Saylor remains the hero of his own economic operetta. 🎩

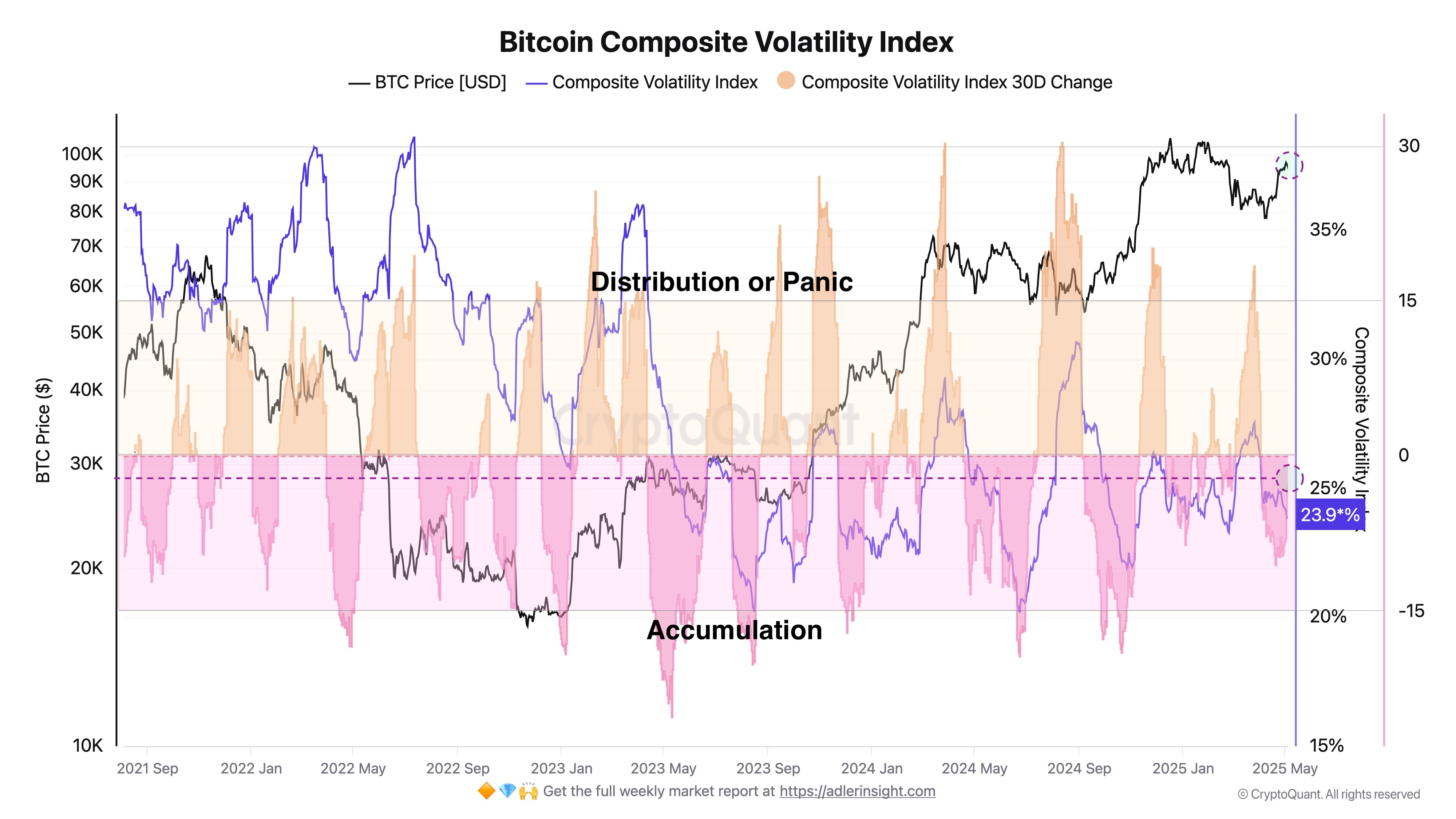

Meanwhile, on the other side of this digital cabaret, CryptoQuant’s Axel Adler Jr, whose name is more mysterious than Wilde’s opinion of American plumbing, offers insights on Bitcoin’s temperamental soul using the cryptic Composite Volatility Index. “Analysis of Bitcoin address activity, which underpins the Composite Volatility Index and its 30-day change, allows us to identify market macro phases,” he intones, as if reading fortunes in tea leaves or thinly sliced truffles.

The chart, equal parts beauty and confusion, unfolds thus:

Adler Jr observes that a 30-day change below 0% means investors are accumulating. Above 15%? Prepare for a stampede—either out the door or towards the nearest chaise lounge. At present: -3.5%. Accumulation is the word of the day, darling. The market is tucking Bitcoin away like a society hostess hoardes sherry biscuits before a party.

BTC Price (Because Drama Requires Numbers)

Bitcoin, not to be outdone by mere mortals, fell below $94,000 earlier—perhaps in a fit of pique—only to prance back to $94,800. The grand spectacle continues, and the audience is invited to gasp: will it faint? Will it soar? Or will it, like Wilde after several gins, simply declare, “To lose one coin may be regarded as a misfortune; to lose two looks like carelessness.”

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Gold Rate Forecast

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

2025-05-06 13:23