As a seasoned analyst with over two decades of experience in the financial markets, I must admit that Michael Saylor’s aggressive Bitcoin acquisition strategy for MicroStrategy is nothing short of extraordinary. The company’s latest $2 billion investment in Bitcoin, at an average price of $74,463 per token, underscores its commitment to digital gold and its belief in the long-term potential of this asset class.

As an analyst, I find myself reporting that I’ve personally witnessed MicroStrategy, under Michael Saylor’s leadership, injecting a staggering $2 billion into the ever-rising Bitcoin market. This digital gold continues to set fresh records daily.

On Twitter, Saylor announced that MicroStrategy invested another $2.03 billion to acquire around 27,200 more Bitcoins (BTC). This purchase brings their total holdings to approximately 279,420 Bitcoin tokens, a significant increase since their aggressive buying strategy began in 2020.

As reported by the firm, MicroStrategy recently purchased their newest Bitcoin holdings at an average cost of approximately $74,463 per Bitcoin. To date, this software company has invested nearly $12 billion in Bitcoin, with intentions to secure additional funds to acquire even more. Saylor announced that they aim to raise a total of $42 billion through debt and equity sales to fund their continued Bitcoin accumulation.

MicroStrategy purchased approximately 27,200 Bitcoins for roughly $2.03 billion each costing around $74,463 per Bitcoin. This move has delivered a quarter-to-date yield of 7.3% and a year-to-date yield of 26.4%. As of October 11, 2024, we hold a total of 279,420 Bitcoins, acquired for approximately $11.9 billion each costing around $42,692 per Bitcoin. ($MSTR)

— Michael Saylor⚡️ (@saylor) November 11, 2024

Bitcoin’s post-election bull run

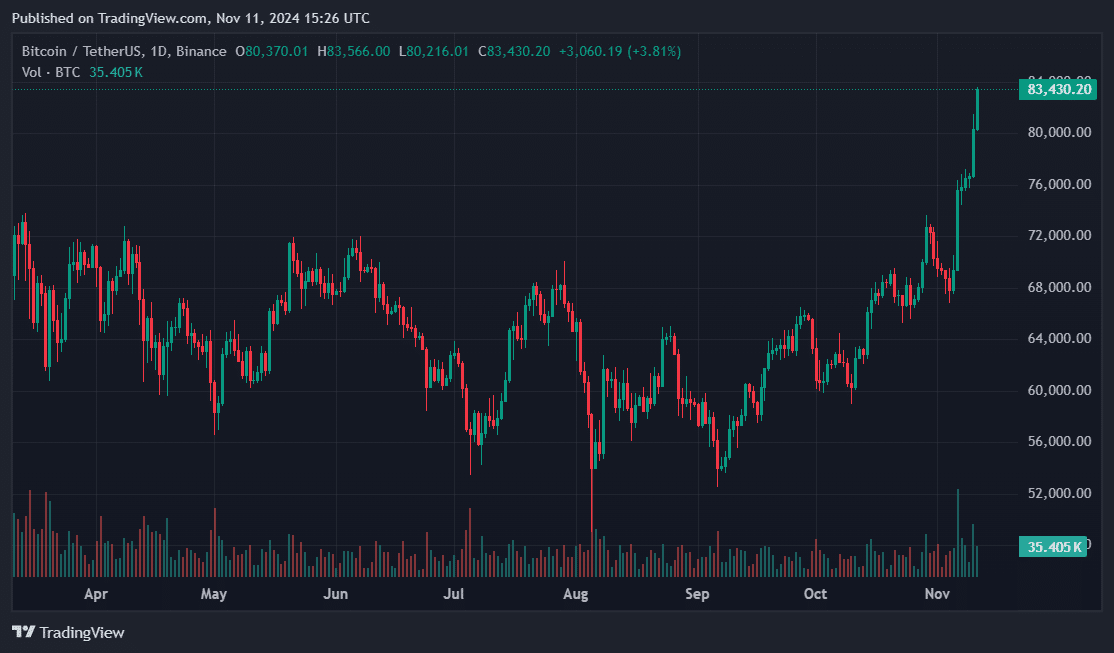

On November 11th, it was announced that MicroStrategy had made a purchase, coinciding with Bitcoin hitting a record peak in its surge post Donald Trump’s election victory the previous week.

After the American media announced Trump as the winner, investors poured more than half a trillion dollars into the cryptocurrency market. Bitcoin, in particular, has been significantly impacted by this increased demand. Its market value surpassed all other digital currencies, currently standing at an impressive $1.6 trillion and continuing to grow.

Last week, investments in digital asset products approached $2 billion following the elections. The election of pro-cryptocurrency candidates has pushed this year’s inflows to an unprecedented high of $31.3 billion.

As it stood at the point of release, Bitcoin was approximately exchanging hands at a record-breaking $83,400, having established successive maximums during the weekend. Nevertheless, analysts urged caution regarding any overexcited market sentiments.

According to an email sent to crypto.news, Bitget Research’s top analyst, Ryan Lee, predicts that volatility might temporarily halt progress and influence the derivative markets.

One important aspect to consider is the comparison between Bitcoin (BTC) and other cryptocurrencies, or altcoins. In the last 24 hours, BTC has surpassed the $80,000 mark, but there hasn’t been a noticeable recovery in exchange rates for Ethereum (ETH), Solana (SOL), and other digital tokens. This suggests that Bitcoin is taking up market liquidity, which could imply that the overall market funds are becoming more scarce. This situation might result in significant fluctuations in derivative markets as a result of liquidity restrictions.

Ryan Lee, Bitget Research

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

2024-11-11 18:50